Shares of Alibaba (NASDAQ: BABA) are being weighed down by a number of risks that are impacting the stock’s investment case. The stock is currently hovering at the same levels from when it went public back in 2014 and at the low end of its five-year trading range, reflecting investors’ elevated concerns regarding Alibaba’s future prospects.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While nobody can deny that the risks attached to Alibaba’s investment case are valid, there are more aspects investors should consider before passing judgment. In particular, BABA’s financials are quite healthy. At the same time, management’s commitment to returning cash to shareholders should encourage investors to take a second look at the stock — especially at its current depressed valuation. Accordingly, I am bullish on the stock.

What are the Risks Attached to Alibaba Stock?

There are multiple risks attached to Alibaba stock, but they can all essentially be boiled down to one major factor: geopolitics. For starters, in recent years, there has been growing concern over the Chinese government’s economic and political influence in the corporate world, leading to increased scrutiny of Chinese companies operating overseas.

This has resulted in a number of regulatory and legal challenges for Chinese companies, including Alibaba. If you have been following the market over the past couple of years, you likely remember that back in November 2020, Chinese regulators suspended the IPO of Alibaba’s financial affiliate Ant Group, citing concerns over regulatory compliance.

This move came just days after Alibaba founder Jack Ma made a critical speech about China’s regulatory system, leading to speculation that the move was politically motivated. And by the way, Jack Ma ended up disappearing for months later.

However, the geopolitical risks have not improved since. The tension between the United States and China has only been worsening lately. The Chinese spy balloon is one example. Further, the U.S. has told China to avoid supplying Russia with arms. If China is to do so, the relationship between the two countries could worsen dramatically.

Thus, you can see why growing tensions could escalate to the point where American investors could find themselves in a tough spot, especially given the dangers related to Alibaba’s variable interest entity (VIE) listing (the shares do not actually represent ownership of the underlying Chinese company.)

The Potential Rewards are Too Good to Ignore

While there are several risks associated with investing in Alibaba, the potential rewards at this point are likely to be outweighing them. Basically, the company continues to demonstrate robust financials and promising growth prospects. Coupled with the stock’s depressed valuation and management’s ongoing share repurchases, Alibaba’s upside potential is hard to ignore. Let’s examine!

In its Q4 results, Alibaba posted revenues of $35.9 billion, up just 2% compared to last year. While some may view this as a lackluster growth rate, it’s important to note the various obstacles Alibaba faced, such as reduced demand and supply-chain disruptions due to COVID-19 measures in China. Despite these challenges, it’s commendable that Alibaba was able to achieve higher revenues than the previous year.

Regarding its profitability, Alibaba posted an adjusted net income of $7.2 billion, up 12% year-over-year. The higher increase compared to revenues hints toward higher margins, which I found admirable given that most companies in the space (e-commerce, cloud) have seen their margins getting compressed due to intense inflationary pressures.

Indeed, Alibaba’s adjusted EBITDA margin expanded from 18% to 21% year-over-year, showcasing the company’s massive economies of scale and ability to achieve efficiencies even under an unfavorable trading environment.

On a per-ADS (one American Depository Receipt equals eight shares) basis, adjusted net income grew by an even larger 14% to $2.79, aided by a lower ADS count due to Alibaba’s ongoing repurchases. Alibaba’s management is well-aware that its stock is undervalued. Thus, they have started buying back stock in bulk to balance its price and reward current shareholders.

Repurchases amounted to a substantial $9.9 billion last year, resulting in the company reducing its share count by a notable 4.5%. With the stock currently trading at a forward P/E of around 11.5, investing in buybacks seems to be the most accretive use of Alibaba’s cash. It’s also worth noting that Alibaba’s net cash position stands at $12.7 billion, which should allow the company to comfortably allocate capital toward repurchases while still maintaining a healthy balance sheet.

Is BABA Stock a Buy, According to Analysts?

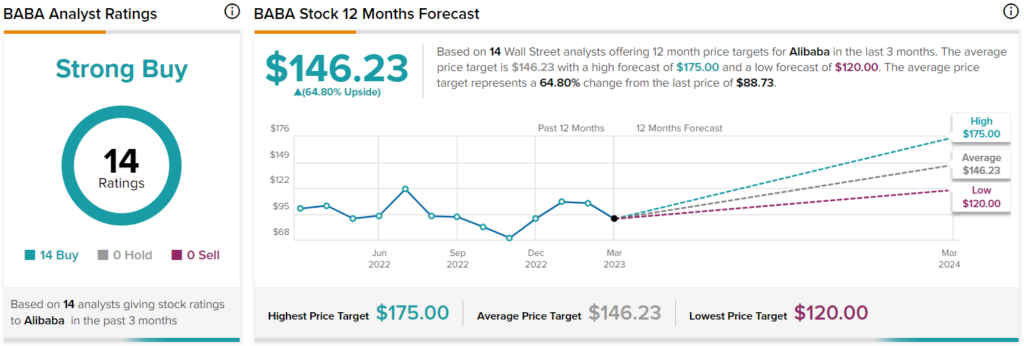

Regarding Wall Street’s view of Alibaba, it’s quite striking to see that despite the well-known risks attached to the company, analysts do recognize that the stock is quite undervalued.

In fact, Alibaba has a Strong Buy consensus rating based on the 14 unanimous Buys assigned in the past three months. At $146.23, the average Alibaba stock price target implies a substantial 64.8% upside potential.

The Takeaway

Nobody can deny that Aibaba’s investment case is bound to several geopolitical risks which could have unforeseen consequences for North American investors. That said, the company has successfully demonstrated that it can post resilient results in a shaky environment while expanding its margins and returning cash to shareholders.

At its current valuation, it appears that much of BABA’s downside has been priced in, which could allow the stock to undergo a significant valuation expansion to more reasonable levels. Management’s underlying buybacks should help with that as well.

Overall, the potential rewards at the stock’s current price are quite likely to be outweighing the underlying risks attached — hence my bullish view on Alibaba.