The past couple of years have provided little comfort for Alibaba (NYSE:BABA) investors. Throughout 2021/22, the stock had been in constant decline, pushed down by a host of factors; a weakening Chinese economy, regulatory tussles, Covid, a heavy investment cycle, and fears of U.S. delisting, have all played their part in depressing sentiment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But 2023 so far has been a completely different story. A little more than half a month into the new year, the stock has already delivered returns of 31% as investors eye a turnaround story.

That is no hope in vain, says Deutsche Bank’s Leo Chiang, who sees plenty of reasons to be optimistic on the company’s prospects.

“We see turnaround opportunities across BABA’s various business lines (e.g., China ecommerce, cloud, and international commerce) and are becoming increasingly optimistic about a solid recovery in 2023,” Chiang opined.

For China commerce, Chiang sees the company as more likely to “enjoy a stronger rebound than peers,” in anticipation of discretionary products such as apparel and cosmetics – its “major” sellers – performing better than staples in the “post reopening” environment.

For the cloud business, boosted by an improved macro environment on top of the waning effect from the loss of a “top overseas customer,” Chiang anticipates this year to generate “revenue reacceleration.”

And taking into account foreign currencies stabilizing and the European and ASEAN markets gradually improving, Chiang also sees growth recovery at play for international commerce.

At the same time, ongoing cost optimization and operating leverage should result in “margin upside.” Add into the mix the improving regulatory environment and Chiang sees enough reasons to raise his FY23/24/25 revenue forecasts by 0.3%/1%/1% and adjusted net income by 1%/3%/3%.

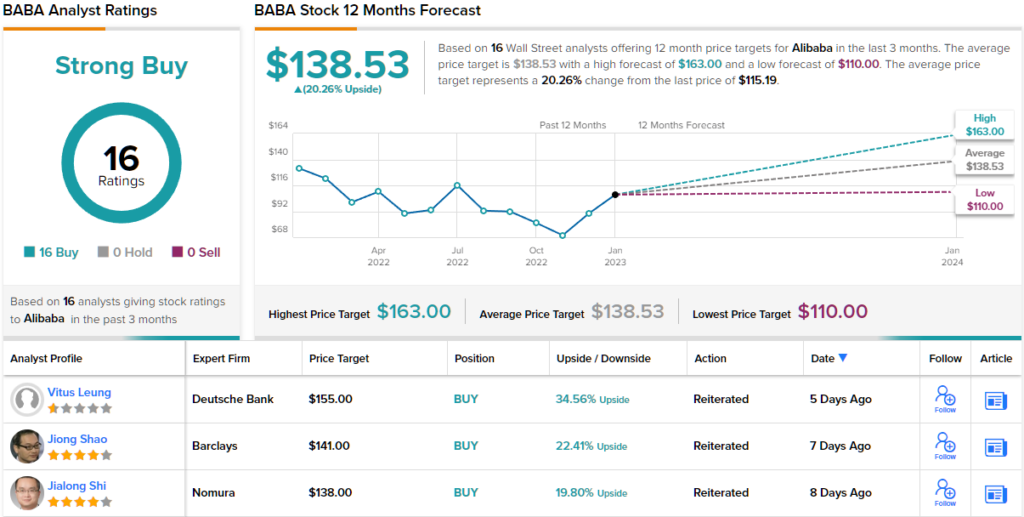

So, how does this all translate to investors? Chiang rates Alibaba shares a Buy along with a $155 price target, suggesting the shares have room for ~35% growth over the coming months. (To watch Chiang’s track record, click here)

Alibaba is that rare beast – a stock with plenty of coverage where everyone is in agreement. It has garnered 16 analyst reviews over the past 3 months – all Buys – naturally making the consensus view here a Strong Buy. The average target currently stands at $138.53, implying the shares will deliver returns of 20% over the one-year timeframe. (See Alibaba stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.