Despite dialing in a better-than-expected quarterly earnings report, Alibaba (NYSE:BABA) shares did not reap the benefits of the beats in the subsequent session. Blame it on concerns over growth prospects amidst growing competition as China moves on from its Covid-19 lockdowns or simply general market weakness, investors did not think the results merited a post-earnings surge.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nevertheless, there was enough to like about the Chinese e-commerce giant’s fiscal third-quarter results (December quarter). Revenue rose by 2% from the same period last year to reach $35.92 billion, while beating the Street’s call by $40 million. At the other end of the scale, adjusted net income increased by 12% year-over-year to $7.24 billion. That resulted in adj. EPS of $2.79, which came in 14% above the same period a year ago and some distance ahead of the $2.4 anticipated on Wall Street.

The company faced major headwinds in the quarter as the government brought to an end its zero-Covid policy which resulted in an uptick of cases that led to supply chain and logistics disruptions whilst rising competition and soft demand trends also played their part. Nevertheless, the company sees these issues abating.

So does Baird analyst Colin Sebastian, who following the earnings call wrote: “While it’s still very early in the post-Covid recovery in China, we are encouraged by recent improvements in e-commerce and retail segment volumes, positive momentum in local services, and what we expect to be improving growth in Cloud. On the call, management acknowledged ongoing competitive pressures, with potentially higher platform investments over the next year, which could limit margin expansion in FY24. Nonetheless, we expect Alibaba to continue benefiting from improvements in demand and supply chain, and we remain constructive on the stock as a China recovery play.”

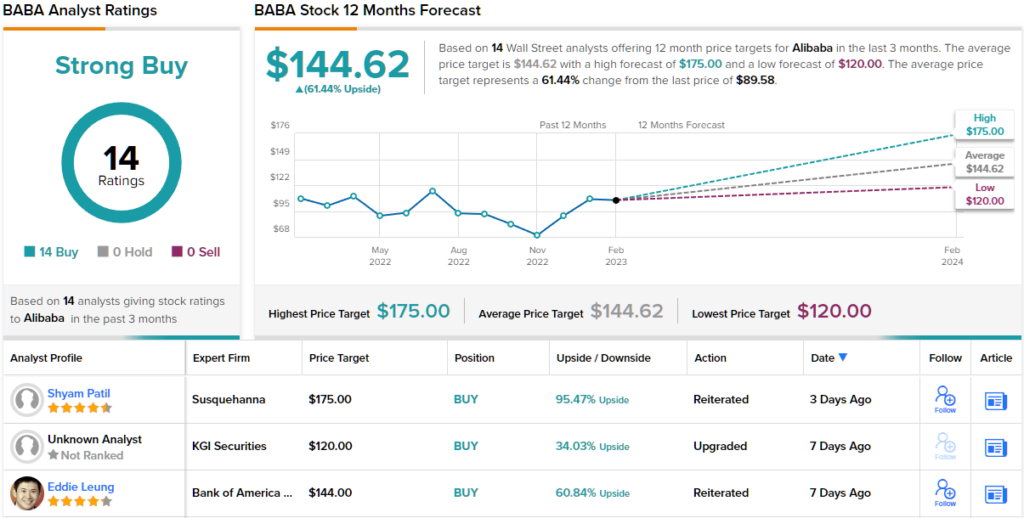

All told, Sebastian rates BABA shares an Outperform (i.e., Buy), along with a $120 price target, which suggests the shares have room for 34% growth over the coming months. (To watch Sebastian’s track record, click here)

Overall, BABA stock gets the Street’s full support; with Buy ratings only – 14, in total – the stock naturally claims a Strong Buy consensus rating. Moreover, the average target is an upbeat one; at $144.62, the figure makes room for 12-month gains of 61%. (See Alibaba stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.