Alibaba Group (NYSE:BABA) is slated to release its third quarter Fiscal 2023 results on February 23, before the market opens. The Chinese e-commerce giant’s performance is likely to have been impacted by the lockdown in China and a slowing economy, partially offset by strong momentum in international commerce business.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Street expects BABA to post an adjusted profit of $2.42 per ADS in Q3, compared with the year-ago quarter figure of $2.46 per ADS. Meanwhile, revenue is pegged at $35.83 billion, lower than last year’s revenue of $37.94 billion.

Factors Affecting Q3 Performance

As per data provided by the National Bureau of Statistics of China, total retail sales declined 1.8% year-over-year in December. This marked the third straight month of a fall in sales. It is likely that the regional lockdowns due to China’s strict COVID-19 policy played a role in the decline.

Nevertheless, Alibaba’s international commerce business might have provided some respite. The segment has been witnessing growth in the number of users across its platforms.

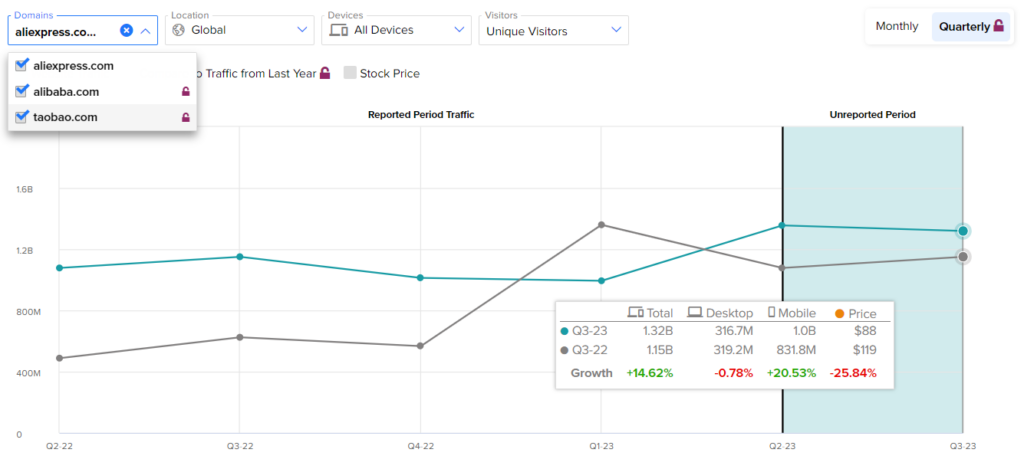

The TipRanks’ Website Traffic Tool suggests that things are improving for Alibaba. Our website traffic screener shows that the number of visits to Alibaba’s websites — aliexpress.com, alibaba.com, and taobao.com increased by 14.6% (year-over-year) for the quarter ending in December.

Moving on to Alibaba’s cloud business, strong domestic demand for its products is expected to have supported Alibaba’s fiscal Q3 performance. Further, the company’s focus on diversifying its other businesses, such as digital media & entertainment and its logistics arm, seems to be paying off. The units witnessed solid growth in the last quarter, with the trend expected to have continued in the to-be-reported quarter as well.

Is BABA a Buy or Hold?

On TipRanks, BABA stock is a Strong Buy. It has nine unanimous Buy recommendations. Moreover, the analyst’s price target of $143 implies 50.4% upside potential.

Ending Thoughts

Alibaba’s performance in the to-be-reported quarter is less likely to be impressive owing to a slowing economy, tight Chinese government regulations, and the impact of COVID lockdowns.

On the other hand, investors are likely to keep a close watch on the management’s commentary about the benefits to the company from the reopening of China’s border. Also, Alibaba’s progress in the launch of its own version of ChatGPT is likely to attract attention.