China-based e-commerce and cloud services provider Alibaba (NYSE:BABA) will release its third quarter Fiscal 2024 earnings on February 7. The quarterly performance is expected to have benefitted from strong demand for the company’s artificial intelligence (AI) tools and cloud services. At the same time, a slowdown in the e-commerce business and China’s challenging macro conditions are expected to have weighed on BABA’s bottom line.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BABA – Q3 Expectations

Wall Street expects Alibaba to report revenue of $36.17 billion in Q3, higher than the prior-year quarter’s sales of $34.82 billion. The company’s strong position in China’s cloud computing market might have helped in attracting customers and supporting topline growth.

However, macro uncertainty in China and softer consumption trends will likely limit its bottom-line growth. Analysts expect Alibaba to post earnings of $2.66 per share, compared to an EPS of $2.68 in the prior-year quarter.

Analysts Lower Price Target Ahead of Q3 Earnings

Before the company’s Q3 earnings announcement, Loop Capital Markets analyst Rob Sanderson reduced his price target to $111 from $115. The analyst trimmed the price target to reflect challenging macroeconomic conditions in China and weak consumer sentiment. Nonetheless, Sanderson reiterated his Buy rating on BABA stock.

Echoing similar sentiments, Bernstein analyst Robin Zhu cut BABA’s price target to $85 from $93 on January 30 and maintained a Hold rating on the stock.

Is BABA a Buy or Hold?

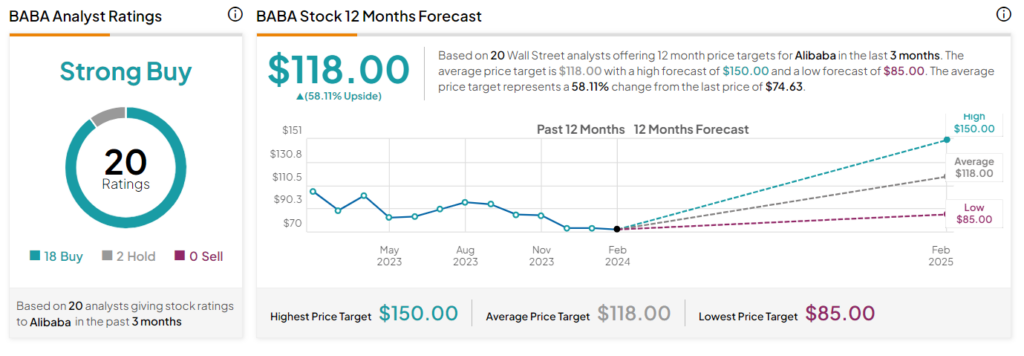

While heightened macro uncertainty remains a key headwind for Chinese stock, Wall Street analysts maintain a bullish outlook on Alibaba stock. With 18 Buy and two Hold recommendations, BABA stock sports a Strong Buy consensus rating.

After a 27.9% decline in its share price over the past year, the average BABA stock price target of $118 per share implies a 58.11% upside potential from current levels.

Insights from Options Trading Activity

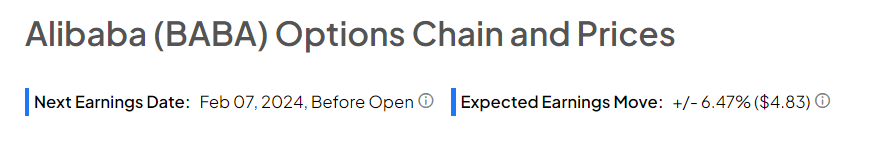

Options traders are pricing in a +/- 6.47% move on earnings, compared with the previous quarter’s earnings-related move of -9.15%.

Learn more about TipRanks’ Options tool here

Bottom Line

Alibaba’s stronghold in the growing cloud market and efforts to launch new AI tools keep it well poised for long-term growth. However, the weak macro backdrop remains a key headwind, leading analysts to cut the price target on BABA stock ahead of fiscal Q3 earnings.