The First Trust RBA American Industrial Renaissance ETF (NASDAQ:AIRR) is an under-the-radar ETF with a fairly unique investment theme. It has also put up some monster returns for its investors over the last few years. However, there is also one major caveat that investors need to consider before deciding if AIRR is the right ETF for their portfolios. Let’s take a look at AIRR.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What is AIRR’s Strategy?

As you can guess from its name, AIRR is focused on an “industrial renaissance” in the United States, but it adds an interesting twist that makes the ETF more than just a collection of large-cap industrial stocks. According to First Trust, AIRR invests at least 90% of its assets in an index designed to “measure the performance of small and mid cap U.S. companies in the industrial and community banking sectors.” The index’s initial investing universe consists of companies classified by the Global Industry Classification Standard (GICS) to be a part of the following industries — Commercial Services & Supplies, Construction & Engineering, Electrical Equipment, Machinery, and Banks.

Index provider Richard Bernstein Advisors (RBA) says that “there is increasing reason to expect that the United States may regain industrial market share, based on a number of factors, including: access to competitively-priced energy sources; the relative stability of the U.S. market compared to many emerging markets; and availability of bank financing for manufacturers.”

Why small and mid-cap industrials and community banks? Presumably, if there is an uptick in industrial and manufacturing activity in the United States, RBA believes that community banks will be providing much of the funding that enables companies to build new plants and purchase new equipment.

AIRR also has some other interesting criteria for the companies that it invests in. On the banking side, it screens out banks that don’t engage in commercial lending and those not domiciled in what many would call the U.S.’s traditional manufacturing hub, or the “rust belt,” specifically Pennsylvania, Wisconsin, Michigan, Ohio, Illinois, Indiana, and Iowa.

I’m not sure why the index wouldn’t want to consider including banks from some of the Sun Belt states where more manufacturing has been being going in recent years, such as Texas, Arizona, or the Carolinas, so that is one potential concern.

On the industrial side, AIRR screens out companies that derive more than 25% of their sales internationally to keep the focus on smaller and medium-sized U.S. companies as opposed to giant conglomerates, which typically have more global customer bases.

Lastly, the stocks need to be profitable in that they must have a positive forward 12-month earnings consensus estimate, which is a sensible criterion, in my view.

A Unique Group of Holdings

This is certainly among the more interesting and specific ETFs out there that I’ve come across in terms of its investing criteria. So, what does it look like in practice? Let’s take a look at AIRR’s portfolio to find out.

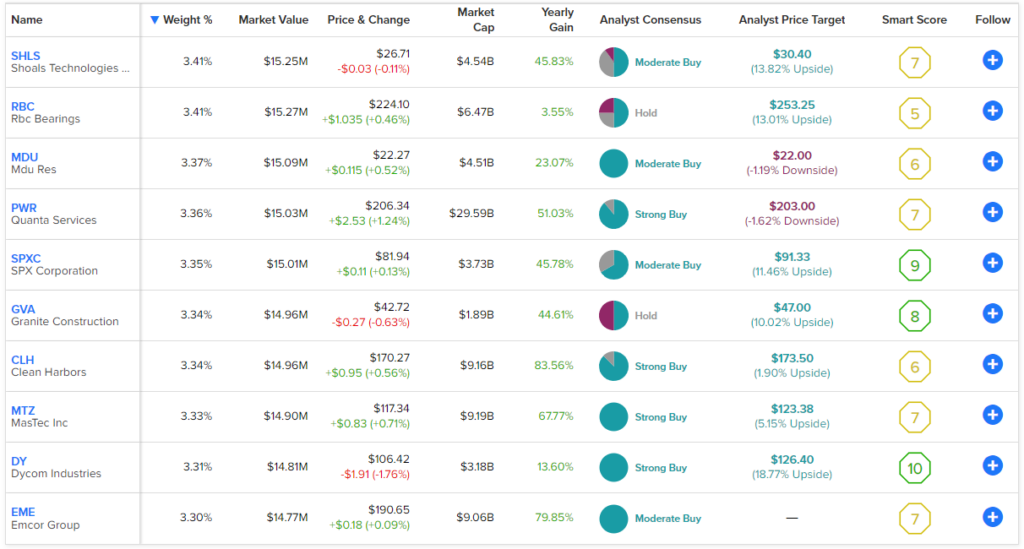

In total, AIRR has 50 positions, and its top 10 holdings account for 33.5% of the fund. Because AIRR rebalances its index periodically to ensure that no position makes up more than 4% of the fund after rebalancing, the fund isn’t dominated by just one or a handful of positions.

As you can see, while AIRR invests in industrials and community banks, all of AIRR’s top 10 holdings are industrial stocks. Given the fund’s focus on small and mid-cap companies, AIRR’s top holdings likely aren’t household names for most investors.

When it comes to Smart Scores, AIRR’s holdings are a bit of a mixed bag, with some strong Smart Scores offset by some lower ones. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Dycom Industries (NYSE:DY), which provides specialty contracting services to the telecom industry, scores a ‘Perfect 10.’ However, seven of AIRR’s top 10 holdings feature neutral Smart Scores. AIRR itself features a neutral ETF Smart Score of 7.

Is AIRR Stock a Buy, According to Analysts?

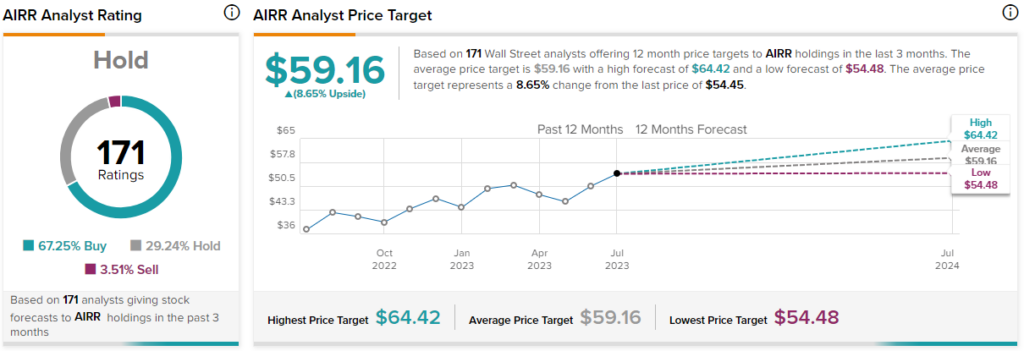

Turning to Wall Street, AIRR has a Hold consensus rating, as 67.25% of analyst ratings are Buys, 29.24% are Holds, and 3.51% are Sells. At $59.16, the average AIRR stock price target implies 8.65% upside potential.

An Amazing Performance

AIRR has put up a monster performance in recent years. As of the end of the most recent quarter in June, AIRR has an incredible one-year total return of 45.4%. Over the past three years, AIRR has had an impressive annualized return of 30.9%. Going out to five years, AIRR’s annualized return of 15.4% is still impressive. Lastly, while AIRR hasn’t yet been around for a decade to post a 10-year return, it has a solid 11.6% total annualized return since its inception in 2014.

These returns put AIRR in good company as an ETF that can say it has beaten the market over time. For comparison, as of the end of June, the Vanguard S&P 500 ETF (NYSEARCA:VOO) has a three-year annualized total return of 14.6% and a five-year annualized total return of 12.3%.

AIRR has even outperformed the hard-charging Nasdaq (NDX) — the popular Invesco QQQ Trust (NASDAQ:QQQ) has a three-year annualized total return of 15% and a five-year annualized total return of 17.4% over the same time frame.

Hefty Fees

Overall, AIRR sounds like a promising investment so far, but here’s the one downside that investors need to keep in mind: AIRR is expensive. With an expense ratio of 0.70%, AIRR is among the more expensive equity ETFs that you’ll find.

This expense ratio means that an investor putting $10,000 into AIRR will have to pay $70 in fees. But these fees also compound over time. After 10 years, assuming the expense ratio remains 0.70% and that the fund returns 5% per annum, the same AIRR investor will have paid a whopping $871 in fees.

Investor Takeaway

Overall, I like AIRR. It has an interesting and unique investment theme and gives investors exposure to a lot of holdings that you won’t find in many other ETFs. It has proven itself as a strong performer that has beaten the broader market over time.

On the downside, sell-side analysts and TipRanks’ Smart Score seem a bit less enthusiastic about AIRR, with neutral ratings. However, the main downside investors need to keep in mind is its high expense ratio. If investors feel confident in the belief that AIRR will continue to soundly outperform the market over time, then they will likely feel comfortable paying this high fee.

Still, if AIRR reverts to the mean and performs similarly to the broader market or even underperforms it at some point in the future, then this fee could become painful quickly. Overall, I view AIRR as a very interesting ETF, and it’s one that I’ve added to the top of my watchlist, but investors will need to decide if they are comfortable with AIRR’s fee before investing.