The easing of COVID-19 restrictions and pent-up travel demand helped several vacation rental companies recover last year. However, the Omicron outbreak impacted the pace of recovery.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While uncertainty associated with COVID-19 prevails, BTIG analyst Brad Erickson points out another concern – potential supply headwinds in the vacation rental market.

The analyst cited a recent Redfin report, which indicated that the pandemic-led second-home boom is coming to an end given the meaningful drop in March demand, and marked the second consecutive month of decline.

The demand for vacation homes skyrocketed in mid-2020 as many affluent Americans adopted remote working, and mortgage rates dropped to record lows. However, demand over the last two months was hit by rapidly rising mortgage rates, which reached 4.67% by March-end.

In addition to higher mortgage rates, Erickson feels that the hike in upfront fees for loans on second homes from 1% to 4% (effective April 1) could further impact future demand.

Consequently, the analyst feels that the vacation rental segment, which includes players like Airbnb and Expedia, will likely face supply issues over time “given the inherent lack of inventory in the most popular (and highest ADR [average daily rates]) locales.”

Meanwhile, thanks to easing COVID restrictions, airlines and other travel companies are gearing up for more business this spring and summer.

Against this backdrop, we used the TipRanks stock comparison tool to pit Airbnb, Expedia, and Booking Holdings against each other and discuss Wall Street analysts’ opinions on these stocks.

Airbnb (NASDAQ: ABNB)

Airbnb, a leading online vacation rental booking marketplace, boasts 4 million hosts and 6 million active listings as of year-end 2021. The company’s hosts span over 220 countries and regions, with 85% of hosts located outside the U.S.

Airbnb ended 2021 on a strong note, with stellar Q421 results driven by a robust recovery in travel. Q421 revenue grew 78.3% year-over-year to $1.5 billion and exceeded 2019 levels. The company swung to EPS of $0.08 from a loss per share of $11.24 in Q420.

Nights and Experiences Booked, a key measure of the scale of the Airbnb platform, came in at 300.6 million for full-year 2021, up 56% from 2020, but 8% below 2019 levels. Gross bookings of $46.9 billion reflected growth of 96% from 2020 and 23% from 2019.

Overall, 2021 revenue increased 77% to $6 billion and surpassed 2019 levels, buoyed by the improvement in Nights and Experiences Booked and higher ADRs. Airbnb’s loss per share came down considerably to $0.57 in 2021 from $16.12 in 2020.

Airbnb continues to invest in its platform and designed over 150 upgrades in 2021 to improve the user experience. It is also working on new offerings to address the changing dynamics since the pandemic, like remote working and an increase in the average trip length.

Notably, long-term stays of 28 nights or more remained Airbnb’s fastest-growing category by trip length and accounted for 22% of Q421 gross nights booked, rising 16% from Q419.

Recently, BTIG analyst Jake Fuller stated that his tracking data reflects a post-Omicron rebound in February and March bookings, which should put Airbnb on track to meet room nights booked guidance. However, the analyst pointed out that his Q122 room nights booked forecast of 95 million is below the buy-side’s expectation of over 100 million.

Fuller believes that the bull case on Airbnb isn’t about the room nights booked recovery relative to 2019 levels, it’s about “catching up to the pre-COVID growth rate,” and Q122 results might not offer much support to justify the bull case.

Fuller reiterated a Hold rating noting that Airbnb faces tougher comparables and has a high valuation multiple.

Meanwhile, the Street is cautiously optimistic about Airbnb, with a Moderate Buy consensus rating based on nine Buys, 18 Holds, and one Sell. The average Airbnb price target of $197.92 implies 23.62% upside potential from current levels.

Expedia Group (NASDAQ: EXPE)

Online travel company Expedia has an impressive portfolio of over 20 brands and more than 200 travel sites, including Expedia.com, Travelocity, Hotels.com, CheapTickets, CarRentals, and Orbitz. Its Vrbo online marketplace competes with the likes of Airbnb in the vacation rental space.

Expedia’s Q421 revenue rebounded 148% year-over-year to $2.3 billion but was lower than 2019 levels and slightly lagged the Street’s expectations. Disruptions caused by Omicron impacted Q4 top-line results.

However, adjusted EPS of $1.06 beat analysts’ estimates and marked a significant improvement from the adjusted loss per share of $2.64 in Q420, backed by higher revenue and cost efficiencies.

Overall, Expedia’s revenue grew 65% to $8.6 billion in 2021, with Stayed Room Nights rising 35% and gross bookings increasing 97% to $72.4 billion. However, revenue and gross bookings were down relative to 2019.

Given the improved business conditions, adjusted EPS jumped to $1.65 in 2021 from a loss per share of $8.78 in 2020.

Expedia’s CEO Peter Kern expects a solid recovery in 2022 as he feels that the travel industry and travelers are becoming more resilient with each passing COVID-19 wave.

Deutsche Bank analyst Lee Horowitz feels that the market is under-appreciating the power of the post-COVID travel recovery and Expedia’s share of this “incredibly robust” demand backdrop.

Horowitz adds that if global leisure accommodation bookings are conservatively up in the high-single digits in FY22 versus FY19, he has a “high degree of confidence” that Expedia will beat the Street’s bookings and revenue estimates.

In line with his optimism, Horowitz initiated coverage of Expedia with a Buy rating and a price target of $218.

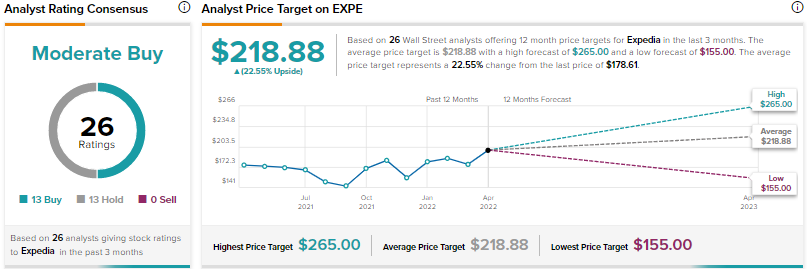

Meanwhile, the Street is divided on Expedia, with a Moderate Buy consensus rating based on 13 Buys and 13 Holds. At $218.88, the average Expedia price target implies 22.55% upside potential from current levels.

Booking Holdings (NASDAQ: BKNG)

Booking Holdings offers online travel and related services in over 220 countries through six primary brands: Booking.com, Priceline, Agoda, Rentalcars.com, KAYAK, and OpenTable.

Travel rebound helped Booking generate better-than-anticipated Q421 revenue and earnings. Q4 revenue grew 141% year-over-year to $3 billion. The company experienced a 100% rise in room nights booked and a 160% surge in gross bookings to $19 billion. Adjusted EPS reached $15.83, a staggering rise from an adjusted loss per share of $0.57 in Q420.

For 2021, revenue increased 61% to $11 billion. Gross travel bookings surged 116% to $76.6 billion and room nights booked were up 66.4% to 591 million. Adjusted EPS increased to $45.77 from $4.71 in 2020.

Despite persistent uncertainty associated with COVID-19 and geopolitical tensions, the company expressed optimism about a continued recovery in travel demand given the encouraging summer bookings in Western Europe and North America.

In an early-March SEC filing, Booking highlighted the suspension of its Russia and Belarus operations and outlined room night trends for February and the first week of March. Russia and Ukraine combined on a destination basis represent a very low single-digit percentage of the company’s total gross bookings.

Booking disclosed that February room nights booked were almost in line with 2019 levels. However, in the week through March 6, room nights booked were down about 10% relative to 2019 levels. The company stated that the recent softening of room nights booked trend was caused by exposure to Eastern Europe, primarily Russia, and to a lesser extent, by Western Europe, which remains modestly above 2019 levels.

In reaction to this update, Fuller lowered his room nights, bookings, and EBITDA estimates for Q122. However, the analyst pointed out that his tracking data indicates that declines in gross bookings have narrowed since the company’s update.

Fuller added that trends have stabilized since early March, and concerns around risk to full-year numbers have eased. Despite lower Q122 estimates, Fuller maintained his 2022 EBITDA estimate at $4.9 billion on a 30% margin.

Fuller reiterated a Hold rating on BKNG but didn’t provide a specific price target.

On TipRanks, Booking scores a Moderate Buy consensus rating backed by 15 Buys and seven Holds. The average Booking Holdings price target of $2,711 suggests 24.28% upside potential over the next 12 months.

Conclusion

Despite near-term headwinds like geopolitical tensions, continued recovery in travel bodes well for Airbnb, Expedia, and Booking Holdings. The average price targets of Wall Street analysts indicate similar upside potential in these three stocks. While analysts are treading cautiously with regard to all three stocks, the proportion of analysts with a bullish sentiment is greater for Booking Holdings.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure.