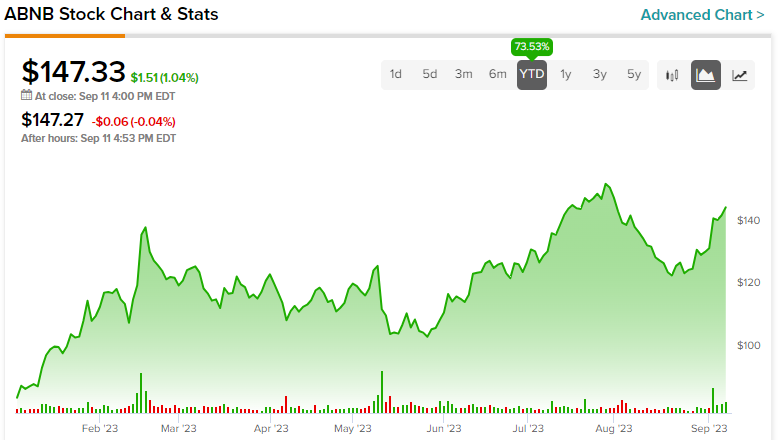

Airbnb, Inc. (NASDAQ:ABNB), a leading global travel marketplace that connects hosts and guests, has seen its market value increase by over 70% this year, aided by the strong demand for travel in the post-pandemic world. The company still has a long runway for growth, as evidenced by its potential to gain market share in the fast-growing online travel agency market.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Positively, on September 1, S&P Dow Jones Indices announced that Airbnb will be added to the S&P 500 Index (SPX) on September 18, which would mark an important milestone in the company’s history as it joins a group of elite, widely recognized companies. I am bullish on the prospects for Airbnb, as the company is well-positioned to enjoy durable competitive advantages.

The S&P 500 Inclusion is a Big Win

Companies that are part of the S&P 500 Index usually attract a higher level of institutional investors compared to companies that represent other indexes, such as the S&P SmallCap 600. In addition, inclusion in the S&P 500 is likely to increase Wall Street’s coverage of Airbnb, which, in return, will boost the interest in the company among investors of every scale and size. Another major benefit of S&P 500 inclusion is the potential share purchases by index funds that track the broad market.

Although Airbnb and its business practices will be scrutinized widely by analysts, fund managers, and investors when the company becomes part of the S&P 500, a higher level of transparency should be welcomed by long-term-oriented Airbnb investors.

Airbnb Enjoys Multiple Growth Drivers

Airbnb is benefiting from the pent-up demand for travel in the post-pandemic era. There are several reasons to believe Airbnb will continue to see strong demand for lodgings listed on its marketplace.

First, Airbnb will benefit from the strong growth in remote working trends, which opens up new opportunities for professionals to work while they travel. According to data from Forbes Advisor, 12.7% of full-time employees in the U.S. currently work from home, which is expected to increase to 22% by 2025.

Survey results published by Forbes reveal that 98% of full-time employees in the U.S. prefer to work remotely at least some of the time, a strong indication of the ongoing transformation of the work model.

This business transformation is likely to boost the demand for long-term stays, and Airbnb is prudently incentivizing hosts to offer discounts to long-term accommodation seekers. In the second quarter, long-term stays accounted for 18% of total bookings, and the contribution from long-term stays is likely to accelerate in the coming quarters. To make the most of the favorable landscape for monthly stays, Airbnb substantially reduced guest service fees for bookings of more than three months as well.

Second, Airbnb has a massive global presence, with the International segment accounting for approximately 50% of total revenue. Given that international travel is expected to remain resilient in the post-pandemic era, Airbnb’s global presence is likely to help the company thrive even if demand in the domestic market saturates in the coming months. The company is aggressively expanding its presence in key markets such as Germany, South Korea, Japan, and Brazil to keep up pace with the increasing demand for lodgings.

Third, Airbnb will benefit from the growing demand for urban stays in the post-pandemic era as people move back into the cities once again. The company offers unparalleled urban stays, making it the clear leader in this listing category.

A Business Conducive to Competitive Advantages

Airbnb faces competition from established travel booking platforms such as Booking Holdings, Inc. (NASDAQ:BKNG) and Expedia Group, Inc. (NASDAQ:EXPE), which are venturing into the vacation rental industry. In addition, big tech giants such as Alphabet Inc. (NASDAQ:GOOGL) and Amazon.com, Inc. (NASDAQ:AMZN) are exploring the possibilities of penetrating this sector, which is a potential risk Airbnb investors need to closely monitor.

Despite the intensifying competition in the industry, Airbnb seems well-positioned to enjoy long-lasting competitive advantages. Several factors help the company build competitive advantages.

First, Airbnb has scaled aggressively in the last few years to emerge as the go-to short-term vacation rental platform in the world. The company now connects more than 4 million hosts with hundreds of millions of guests. For context, in 2022, Airbnb reported 393.7 million nights stayed, which goes on to highlight the massive scale of the company. This scale, in return, has created a network effect where both hosts and guests consider Airbnb as their preferred choice.

Second, Airbnb is home to various types of accommodation options ranging from luxury getaways to shared apartments, which helps attract a diverse customer base. This diversified offering is helping the company gain an edge over its competitors as the platform has emerged as a one-stop shop for accommodation hunting.

Third, Airbnb’s online marketplace offers a seamless experience to both guests and hosts, which has been enabled by strategic investments spanning over a decade. Flexible location search tools, advanced pricing tools for hosts, and AI-driven customer experience management tools are some of the unique features offered by Airbnb to improve the user experience for both parties. It would take years for a competitor to replicate these features, which gives Airbnb a first-mover advantage.

What is the Prediction for ABNB Stock?

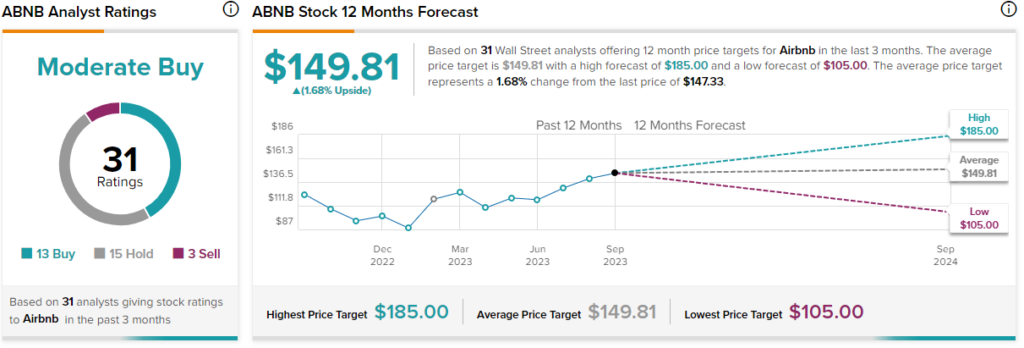

Based on the ratings of 31 Wall Street analysts, the average Airbnb stock price target is $149.81, which implies upside potential of just 1.7%. Although Airbnb may not be cheaply valued today, the company still has a long runway to grow, which makes it look attractive for long-term growth investors.

The Takeaway: Airbnb’s Growth is Far From Over

Airbnb still has room to grow and the company is capitalizing on the opportunities available in the post-pandemic era. The company seems fairly valued today, and investing in a fairly-valued growth company is likely not a bad proposition for investors with an extensive investment time horizon.