Travel company Airbnb (NASDAQ:ABNB) is scheduled to announce its fourth-quarter earnings after the market closes on February 14, Tuesday. In November 2022, Airbnb issued subdued Q4 guidance due to currency headwinds and macro pressures despite resilient travel demand. ABNB shares have advanced over 27% so far in 2023 and upbeat results could drive the stock higher.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street’s Q4 Expectations

Airbnb’s Q3 revenue grew 29% year-over-year to $2.9 billion due to continued strength in travel demand. Excluding the impact of currency fluctuations, revenue increased 36%. Moreover, the company called Q3 its “biggest and most profitable quarter ever.” Earnings per share (EPS) surged nearly 47% year-over-year to $1.79.

Airbnb projected Q4 2022 revenue in the range of $1.80 billion and $1.88 billion, reflecting growth of 17% to 23%. However, the company cautioned that the growth in Nights and Experiences Booked (indicates the number of nights booked for stays and the total number of seats booked for experiences, net of cancellations and alterations) will moderate slightly compared to Q3 2022.

Moreover, it stated that the average daily rates in Q4 will face some pressure due to forex headwinds and an unfavorable business mix.

Analysts expect Airbnb’s Q4 revenue to grow more than 21% to about $1.9 billion. They project EPS to jump considerably to $0.25 from $0.08 in the prior-year quarter.

Is Airbnb a Buy, Sell, or Hold?

Recently, Gordon Haskett analyst Robert Mollins downgraded his rating for Airbnb to Sell from Hold due to several trouble areas. The analyst believes that the Street’s consensus revenue expectations for 2023 and 2024 are “excessively optimistic and will likely require a big step up in either supply growth or occupancy rate expansion.”

The analyst also feels that Airbnb could see a delayed impact from the reopening of the economy in China due to airlines’ capacity constraints, COVID testing requirements, and affordability issues.

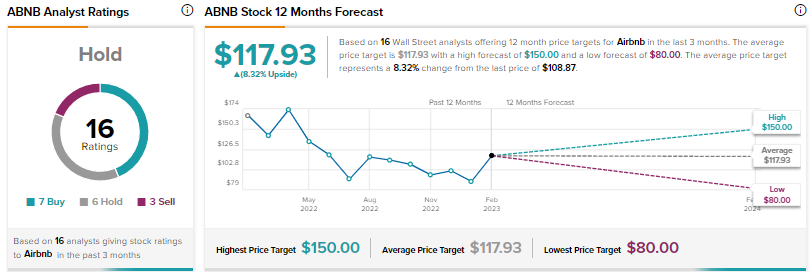

Wall Street is currently sidelined on Airbnb, with a Hold consensus rating based on seven Buys, six Holds, and three Sells. The average ABNB stock price target of $117.93 suggests 8.3% upside potential.

Conclusion

Airbnb is expected to gain from resilient travel demand. However, macro pressures could impact affordability. Currency headwinds are also expected to hit Q4 results. Improved sentiment for growth stocks has moved Airbnb shares higher. Better-than-anticipated results as well as solid guidance could provide more upside.