“Artificial intelligence is to trading what fire was to the cavemen,” – an unknown stock trader.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Artificial intelligence (AI) technology has been with us for a while and has made enormous strides in a number of industries, particularly in the financial markets. AI and finance are a perfect match: AI possesses this unique ability to quickly analyze massive amounts of data, spotting patterns that might often slip past humans. AI’s superiority to humans in many aspects, including analysis, speed, memory, and the absence of bias, have given way to many doomsday theories, including the end of investment as we know it.

Are we going to find ourselves in the world where the role of humans in financial markets is limited to shoveling money into funds run by robots trying to “out-algo” each other, as the only thing that counts is the number of nanoseconds needed to make a move?

Not so fast. We are now beginning to see that, as usual, not everything is predictable, even for machines.

When Robots Rule the Trading Game

What was once a theoretical idea – that of a robotic mastermind helping humans make rational decisions – has seemingly become the reality in many fields, particularly in the stock markets. Technology dictates a significant portion of global market operations: over 60% of today’s trading activity is managed by tech, and in some arenas, that number jumps to a staggering 90%.

The machine-mind is already present in almost all finance applications, from algo-trading and high-frequency trading strategies (HFT) to market forecasting based on vast historical datasets, to spotting trends or anomalies in market data that might indicate a trading opportunity, and to gauging market sentiment, supporting algorithmic trading decisions based on that sentiment. AI is also used to advise human investors, tailoring investment strategies based on individual preferences, risk tolerance, and financial goals.

The Big Bet and the Bumpy Ride

But it’s not only high-frequency trading strategies and robo-advisors that are capturing everyone’s attention. In the center of the discussion about AI’s role in finance now stands a question: can an AI-led investment strategy outperform humans?

According to the Wall Street Journal, there are now 13 ETFs managed by AI, although their combined assets-under-management (AUM), standing at $0.7 billion, is still just a small fraction of the $7 trillion ETF market. In 2022, these funds held over a trillion dollars, but have deflated as their underperformance has led to investor disillusionment.

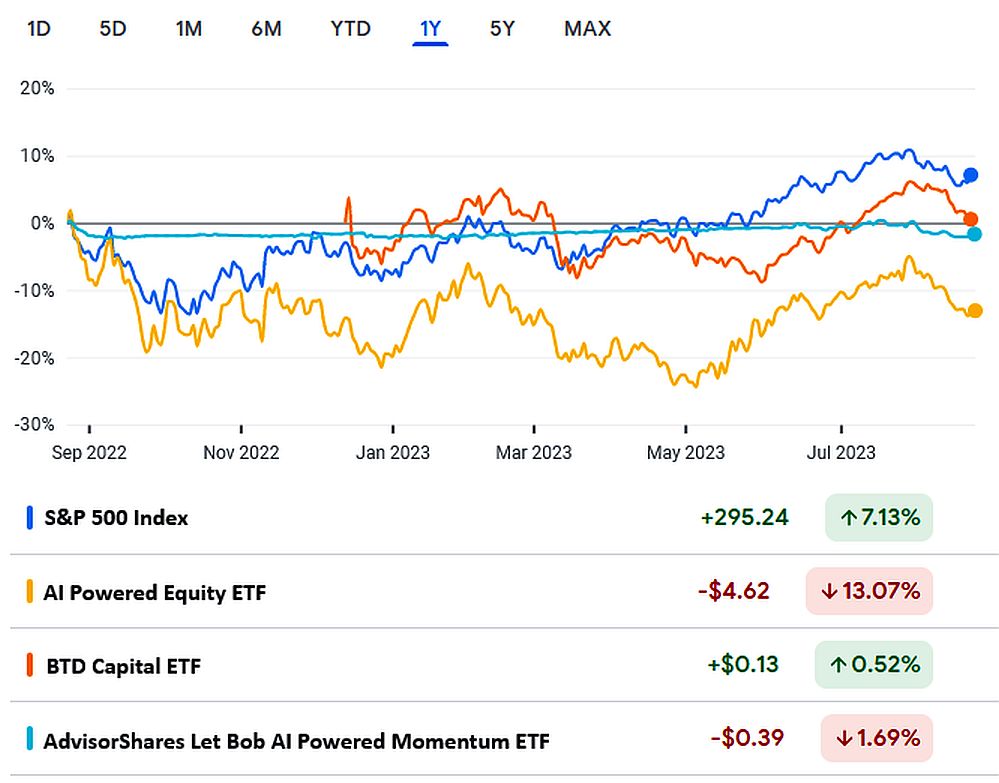

The veteran among AI-managed ETFs, AI Powered Equity ETF (AIEQ), powered by the IBM (IBM) Watson supercomputer, has underperformed the S&P 500 (SPX) year-to-date, in the past 12 months, and in the past five years. While it did outperform the benchmark index in a number of occurrences, it didn’t foresee the outsized negative impact on stocks from the Federal reserve’s “fast and furious” rate increases, and it also missed this year’s Tech rally, dismissing the rally champions like Meta (META) or Nvidia (NVDA) as too overvalued at a time when they had just started accelerating. The AI algorithms also failed to recognize the AI-craze – which many market participants have dubbed a bubble, a definition that hasn’t prevented them from rushing into AI-related stocks.

Another AI-run ETF, AdvisorShares Let Bob AI Powered Momentum ETF (LETB), has lost over 9% since its inception in February 2022; in the same period the SPX is up 0.5%. BTD Capital Fund ETF (DIP) didn’t do any better: it has risen by 4.5% since its inception in December last year, while SPX has added over 15% since that date.

Two additional machine-powered ETFs, the Merlyn.AI Bull-Rider Bear-Fighter ETF (WIZ) and the Merlyn AI SectorSurfer Momentum ETF (DUDE), are basically funds-of-funds, investing in a bunch of ETFs. They utilize an AI algorithm to analyze and ride the market momentum; however, they failed spectacularly so far, down 5% and 11.5% in the past 12 months.

Genuine Genius or Just Good Fortune?

The only bright star currently on the horizon of the AI-led investment management is the fund created by South Korean Qraft Technologies, Inc. (traded on NYSE), QRAFT AI-Enhanced US Large Cap Momentum ETF (AMOM). The fund, which invests in AI-selected stocks that exhibit higher price momentum, has risen 15% in the past year, more than twice the increase in SPX. Its outperformance is quite recent though, as since its inception in May 2019, it has brought its investors a gain of 26%, while the SPX surged by 57%. This could mean that Qraft’s AI algorithm has been learning from its mistakes, but, on the other hand, it could have been lucky, just like a human trader. We simply don’t have enough historical data to judge the matter.

Certainly, AI capabilities are evolving, and the algorithms that have been built with the ability to learn are, well, learning. It means that the next time the Fed hikes by 5% within little more than a year, or the next time a company surges by an additional 50% or 100% after it has reached a P/E over 100 (or any other monster number), the AI will recognize the pattern and probably make a correct investing decision. However, the technology still can’t extrapolate its experience to non-similar trends. Namely, AI cannot ask itself, “What if I’m wrong this time, like I was with Nvidia?”

Sharp Moves, But Humans Still Lead the Groove

AI has indeed made significant strides in the world of investments, but it isn’t primed to completely overshadow human involvement. AI can surely crunch numbers better than any humans, and it is certainly immune from a vast number of typically human mistakes, such as irrationality or home/knowledge bias. Sometimes, AI can even successfully time the market. However, it is not a god-like all-knowing creature, but just a set of algorithms learning from an enormous pool of past data. This “backward-looking” nature is the limitation inherent in the technology, at least the way it is built at the moment.

Learning from the past, when done efficiently, can help avoid similar mistakes in the future. However, it leaves AI unprepared for unforeseen “black swan” events, like the Covid-19 pandemic. It cannot “understand” basic human irrationality, including intangible market drivers like fear and greed – emotions that profoundly influence financial decisions. On the flip side, humans have the ability to imagine things that haven’t happened yet, letting us anticipate and plan for wild curveballs. Plus, when it comes to game-changers like AI itself, humans have a better sense of the broader picture and implications, since we can capture context, nuances, and the cultural shifts behind innovations. So, while the advent of AI can complement and augment human capabilities in the investment and trading arenas, the decision-making still needs a human touch – at least until the machines develop imagination.