In today’s world, digital tech rules. And that means, artificial intelligence is vital. AI powers our apps, it makes our devices ‘smart,’ and it underpins our computing technology. For investors, this makes AI-related stocks a prime target.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

So, how to get in? Are we looking for robots, for thinking machines that can walk and talk? We’re not there yet, no matter what the science fiction movies show us on the big screen. But we do have a host of lower-key choices, applications of AI to the daily activities of our ordinary world. From paying our bills to parsing our data, there’s very little we do that doesn’t interact with an AI system, somewhere.

Bearing this in mind, we’ve used the TipRanks platform to pinpoint two stocks that are tied to AI – but in quite different ways. Moreover, both tickers earn Moderate or Strong Buy consensus ratings from the analyst community, and boast considerable upside potential. Here are the details.

Opportunity Financial (OPFI)

The first stock we’ll look at is Opportunity Financial, a fintech, or financial technology, company in the consumer credit sector. This company lives up to its name, providing credit access to ‘the median US consumer.’ This target market is employed, has a bank account, and earns approximately $50,000 annually – but lacks a strong credit score, and so has difficulty entering the traditional banking/credit system. OppFi fills that gap, using AI to quickly and accurately parse raw consumer data.

The company provides customers with easy access to credit applications, through a digital process via smartphone. The decision process is fair and transparent, and customer service is held to a high standard. OppFi’s services include loans, payroll-linked credit, and a same-day access credit card.

There is a strong market for OppFi credit access business. Approximately 58% of American consumers have less than $1,000 in savings, and some 115 million people are living ‘paycheck to paycheck.’ These problems are exacerbated by lack of access to liquidity; 51% of consumers reported being denied a loan in the last 12 months, while 72% were denied a line of credit.

OppFi uses AI tech to power its app, mitigating the inherent risks of providing credit to this target market.

OppFi’s numbers show up the need for its services in the US economy. The company reported a 25% year-over-year increase in net loan origination for 3Q21, to $165 million. Top line revenue came in at $92 million, for a 47% yoy gain. EPS was flat from Q2, at 21 cents per share. This was OppFi’s second quarterly report as a public company; the firm entered the stock markets last summer – through a SPAC merger.

ThinkEquity analyst Ashok Kumar sees OppFi unconventional approach as a key point, writing: “OppFi credit decisioning technology is differentiated and unique. The company’s dataset includes 8 billion data points. The company has received over 11 million applications and facilitated over 1.8 million loans. The company is continuously improving the platform through AI machine learning to facilitate more access while maintaining loss rates even during periods of high growth.”

“We are forecasting net revenues to grow from $219 million in fiscal 2020 to $318 million in fiscal year 2022. The company continues to make investments to support business growth, including developing new loan products, enhancing AI models, improving operating infrastructure, or acquiring complementary businesses and technologies,” the analyst added.

All of this has been factored into Kumar’s Buy rating on OPFI. The analyst gives the stock a $12 price target, suggesting ~90% growth over the next 12 months. (To watch Kumar’s track record, click here)

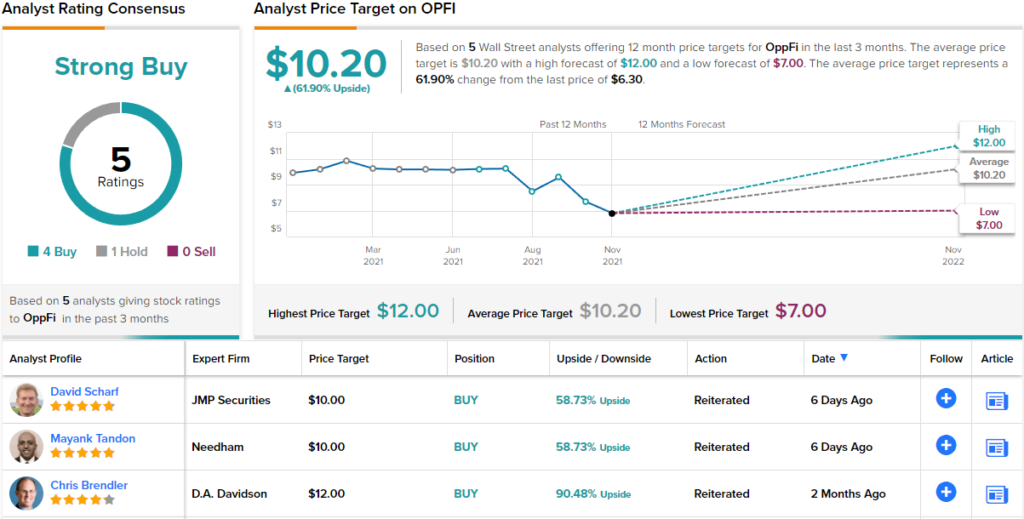

It’s clear that Wall Street agrees with Kumar’s views. The stock has 5 recent reviews, including 4 to Buy and 1 Hold. The shares are priced at $6.30 and their $10.20 average price target suggests a one-year upside potential of 62%. (See OPFI stock analysis on TipRanks)

GigCapital4 (GIG)

We’ll continue our look at AI with a SPAC. GigCapital4 was formed specifically to target a tech firm and it is currently moving to combine with Big Bear.ai. GigCapital4 filed earlier this month its proxy statement with the SEC confirming its intent to merge with BigBear.ai, and the company has a special stockholder meeting scheduled for December 3 to vote on the move.

Completion of the transaction will take BigBear.ai public on the New York Stock Exchange with the ticker BBAI. The move is expected to bring some $330 in new capital to the target company when it closes, and will create a combined entity with an estimated enterprise value of $1.57 billion.

As for BigBear.ai, GigCapital4’s prospective partner, that company is an AI tech firm with roots in the national security and defense industry. The company works in data-driven decision making and advanced analytics, making complex raw data into the base for human decision making. BigBear.ai offers an end-to-end data analytics platform that integrates both AI and machine learning (ML), and is scalable and fits into existing technologies used by both public and private sector customers.

BigBear.ai reported revenue of $40.2 million in 3Q21, and is projected to reach $182 million in total revenue by the end of this year. The company added new contract awards totally $150 million during Q3, and by the end of the quarter had a total backlog of $485 million.

5-star analyst Michael Latimore, covering this coming SPAC combo for Northland Securities, writes of BigBear.ai: “BigBear.ai has solidified a leading position in AI among government agencies and is expanding rapidly into the commercial sector. Core company expertise is improving data sources, thus producing better insights and predictions. This has helped the company achieve a 93% win rate.”

“AI is now maturing enough to be applicable to multiple use cases and industry verticals in our view. The overall AI software and services market is forecast to grow at a 40% CAGR and within the US government by 50% this year. AI is often core to digital transformation, which is accelerating,” Latimore continued.

Based on all of the above factors, Latimore rates GigCapital4 shares a Buy and set a $13 price target. Apparently, the analyst believes share prices could surge ~30% over the next twelve months. (See GIG stock analysis on TipRanks)

SPACs don’t always get a lot of analyst attention. Latimore is the only bull in the picture right now – with the stock displaying a Moderate Buy analyst consensus. (See GIG stock analysis on TipRanks)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.