Last week’s news cycle was dominated by the Twitter (TWTR) hack. Accounts of well-known public figures – including those of ex-President Obama, billionaires Elon Musk and Jeff Bezos and various other high-profile names – were breached.

It is not a good look for the micro-blogging platform, which will be hoping for a more positive slew of headlines after it reports Q2 earnings before market opens on Thursday, July 23.

However, Wedbush analyst Michael Pachter is not convinced there will be an abundance of those. Although the analyst thinks “sequential audience growth could surprise positively,” Pachter’s expectations are dampened ahead of the quarterly statement.

“While we believe some verticals (namely mobile gaming and ecommerce) have shown signs of moderation, and higher investment from DR advertisers could be offsetting some of the weakness associated with lower brand spending, we expect the overall dynamic in Q2 to reflect significantly weaker ad pricing, partially offset by continued robust engagement,” the analyst said.

As for the numbers – Pachter expects revenue to be down year-over-year by 18% to $694 million, and forecasts adjusted EBITDA of $100 million, and EPS of $0.00. The Street is expecting $695 million, $102 million, and $0.01, respectively.

The shifting economic climate and macro uncertainty has been cited by Twitter as the reason why no guidance for Q2 has been provided and Pachter doesn’t expect Twitter to provide any guidance for Q3 or FY20, either. If the overall advertising trends are anything to go by, they are not in Twitter’s favor. On the basis of a recent advisor call, Pachter believes that digital advertising spend and CPMs (cost per millie) are expected to decline by 30% and 15 to 20%, respectively.

On the other hand, Q1’s addition of 14 million mDAUs (monetizable daily active users) indicates Pachter’s estimate for 5 million new additions in the quarter “may prove to be conservative.” However, despite recent events which boosted engagement, these won’t be enough to offset the pandemic’s negative impact on Twitter’s main source of revenue.

As Pachter noted, “With Q2 representing a full quarter of coronavirus coverage and conversation, along with the widespread protests in the US around racial justice that began in May, we see meaningful room for upside to sequential audience growth, but ad pricing declines will likely pressure ARPU and temper revenue flow-through.”

Accordingly, Pachter thinks Twitter shares “appear fully valued at present,” and reiterates a Neutral rating, along with a $30 price target. This conveys Pachter’s belief shares will slide by 19% over the coming months. (To watch Pachter’s track record, click here)

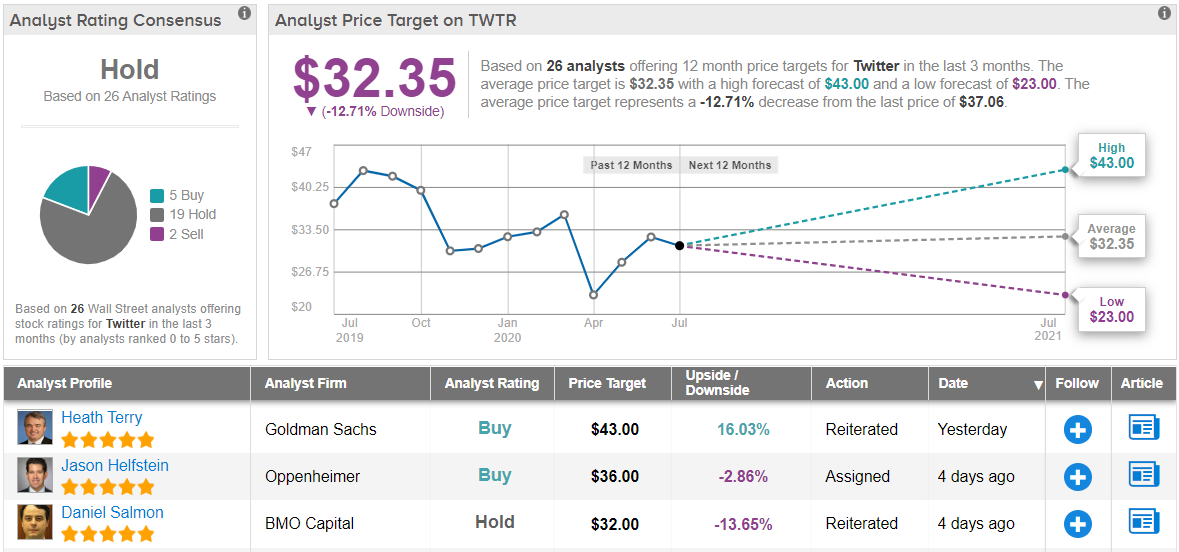

The Wedbush analyst’s colleagues outlook for Twitter stays pretty close to Pachter’s template. TWTR’s Hold consensus rating is backed by 5 Buys, 2 Sells and an overwhelming 19 Holds. The average price target hits $32.35 and implies potential downside of nearly 13% in the year ahead. (See Twitter stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.