Ford (F) stock has waited years, if not decades, for a game-changing catalyst. Fortunately, it has one now, with the rise of electric vehicles (EVs).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A few years back, the sentiment was that EV-only carmakers like Tesla (TSLA) would leave incumbent automakers like Ford in the dust. That was mainly due to the assumption that legacy automakers would wait too long to electrify their fleets. In hindsight, it appears they were simply waiting for the right moment to make the move.

Now, more than making up for lost time, it’s clear that Ford, as well as Detroit rivals like General Motors (GM), as well as other major global automakers such as Volkswagen (VWAGY), won’t go extinct due to this trend. Instead, legacy automakers (especially Ford) stand to profit tremendously from the shift.

Yes, this catalyst has been highly priced into shares, as they’ve surged from around $6.25 per share last June, to $14.93 per share today. Yet even as the stock rises back to its 2015 price levels, there may be room for it to return to multi-decade highs. (See Ford Stock Charts on TipRanks)

F Stock, The Recovery, and its Long-Term EV Tailwinds

With EV stocks still a trendy investment area, one might initially assume that Ford’s share price today is built more on hype than on substance. However, looking under the hood, it makes sense that investors have pushed it back up near the $15 per share price level.

First, the post-pandemic recovery is projected to give both its 2021 and 2022 results a tremendous boost. Sales are expected to grow around 13.1% this year, and 18.1% next year. Profitability? Earnings per share are expected to zoom from $1.11 this year, to $1.79 next year (a 61.2% increase).

Admittedly, this increase in earnings alone may not be enough to send shares higher. Why? Given the cyclical nature of the business, historically auto stocks have traded at low price-to-earnings, or P/E ratios.

Nonetheless, with the rise of EVs, and related changes to Ford’s business model, the days of it sporting a low P/E (even at the top of its business cycle) might be coming to a close.

Ford is Just Starting to Climb Out of its Multi-Decade Rut

Shifting from building gasoline-powered vehicles to electrically-charged vehicles is just one major change on the horizon for Ford. Along with this shift, the company is diversifying into other segments of the electric vehicle economy.

For example, the company recently announced its purchase of Electriphi, which provides software that helps manage the charging of commercial EV fleets. This acquisition is part of the company’s overall plan to branch into higher-margin service businesses that complement its existing commercial vehicle unit.

This, coupled with other initiatives presented in its overall Ford+ restructuring plan, may result in substantially higher overall EBIT (earnings before interest and taxes) margins within the next two years.

With increased margins and a move into more service-oriented business lines, investors may have more reason to assign shares a higher valuation. This could result in shares getting back to above $20 per share. That’s a price level it hasn’t hit in 20 years.

What Analysts Are Saying About F Stock

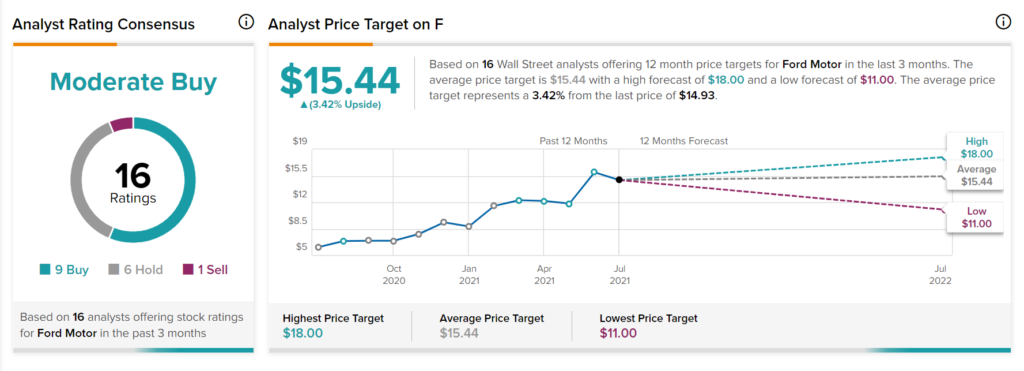

According to TipRanks, F stock has a consensus rating of Moderate Buy. Out of 16 analyst ratings, 9 rate it a Buy, 6 analysts rate it a Hold, and 1 analyst rates it a Sell.

As for price targets, the average Ford price target is $15.44 per share, implying around 3.4% in upside from today’s prices. Analyst price targets range from a low of $11 per share, to a high of $18 per share.

Bottom Line: Ford Shares Stand to Remain Hot Among Investors

The epic run of Ford shares over the past year might appear a bit overdone to some. Its post-virus recovery does help to justify its current share prices. Nevertheless, for shares to continue moving higher toward price levels not seen in decades, it has to deliver on its promises to capitalize on the EV phenomenon.

Until investors start seeing whether its plans translate into continued revenue and earnings growth, they’ll likely be satisfied with the company’s well-presented Ford+ gameplan. In short, investors should expect the enthusiasm for F stock to continue in the near-term.

Disclosure: Thomas Niel held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.