Affirm Holdings (NASDAQ:AFRM) stock certainly hasn’t been a long-term winner, but it was on a rocket ride today, and the bulls were clearly in charge. I’m bullish on AFRM stock, not because it’s going up now, but because Affirm’s financials show that the company is successfully overcoming elevated inflation and high interest rates.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

California-headquartered Affirm Holdings provides point-of-sale payment solutions and operates in the financial space commonly known as buy-now, pay-later. Not long ago, JPMorgan (NYSE:JPM) analyst Reginald Smith raised his price target on AFRM stock from $16 to $18 but seemed to feel lukewarm about Affirm as he issued a Neutral rating on the shares.

Smith might end up lifting his price target and rating on Affirm Holdings stock soon, though, after its big move today. I certainly won’t claim that Affirm’s financial profile is perfect, but the company is demonstrating notable improvements in multiple areas.

Affirm Holdings Stock’s Bright Green Day

The long-term chart of Affirm Holdings stock doesn’t look great, I must admit. It seems that the company’s buy-now, pay-later business model got a boost during and immediately after the COVID-19 pandemic struck in 2020. That catalyst has subsided in 2023, though, and the market’s appetite for unprofitable businesses has faded during the past couple of years.

That’s the first thing to know about Affirm’s financial situation — the company isn’t income-positive, and this fact may be a deal-breaker for some investors. Another concern is that inflation in some areas is still elevated, which could be problematic for buy-now, pay-later businesses and their customers.

In addition, Federal Reserve Chairman Jerome Powell just acknowledged that the central bank is “prepared to raise [interest] rates further.” For these reasons, I’m certainly not recommending backing up the truck and overloading your portfolio with AFRM stock shares.

On the other hand, there’s clearly something positive going on with Affirm Holdings. Could the company be on the cusp of a turnaround? The market seems to think so, as AFRM stock finished almost 29% higher after the company released its second-quarter 2023 financial results. So, let’s see why investors apparently envision a comeback-in-progress for Affirm Holdings this year.

Affirm Holdings: One Metric to Watch Now

No doubt, today’s stock traders are enthused about Affirm Holdings’ improving sales and earnings for its fourth quarter of Fiscal Year (FY) 2023. I’ll definitely get to those stats in a moment, but there’s one data point that I feel is more important than the others.

Specifically, Affirm’s Q4-FY2023 gross merchandise volume (GMV) jumped 25% year-over-year to $5.5 billion, which exceeded the $5.3 billion modeled by analysts. For a financial platform like Affirm, GMV is a crucial metric, indicating the total value of transactions processed using Affirm over a specific timeframe.

Turning now to the more traditional metrics, Affirm Holdings generated quarterly revenue of $446 million, which beat Wall Street’s consensus estimate of $406 million. Furthermore, Affirm reported a per-share loss of $0.69, which is better than the $0.86 per-share loss that analysts had expected.

Moreover, we can’t ignore Affirm Holding’s current-quarter sales guidance. The company’s outlook calls for $430 million to $455 million in revenue, which is more optimistic than the analysts’ consensus forecast of $430 million. Speaking of analysts, let’s now take a look at their predictions for the future trajectory of AFRM stock.

Is AFRM Stock a Buy, According to Analysts?

On TipRanks, AFRM comes in as a Strong Buy based on three Buys, seven Holds, and four Sell ratings assigned by analysts in the past three months. The average Affirm Holdings stock price target is $15.71, implying 11.7% downside potential.

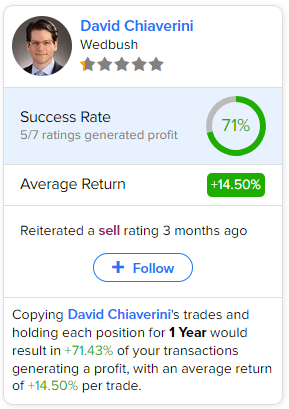

If you’re wondering which analyst you should follow if you want to buy and sell AFRM stock, the most accurate analyst covering the stock (on a one-year timeframe) is David Chiaverini of Wedbush, with an average return of 14.5% per rating and a 71% success rate. Click on the image below to learn more.

Conclusion: Should You Consider AFRM Stock?

Affirm Holdings will continue to face challenges, especially with high interest rates, since they tend to inhibit borrowing and lending activity. On the other hand, Affirm clearly demonstrated that it can prosper even when the macro-environment is difficult.

Consequently, I’m choosing to focus on Affirm Holdings’ improving GMV and other positive results rather than worry too much about the company’s obstacles in 2023. In the final analysis, I feel that AFRM stock is definitely worth considering for a very small but hopeful long-term position.