Affirm Holdings (NASDAQ:AFRM) stock recovered swiftly after witnessing pressure from Apple’s (NASDAQ:AAPL) introduction of the Pay Later service earlier in March. Apple’s entry into the BNPL (Buy Now, Pay Later) space is a significant threat to AFRM’s business. However, Affirm CEO Max Levchin said that the company witnessed no impact from Apple Pay, while he believes that AFRM has “structural advantages” over the tech giant.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Affirm Stock Gains Significantly

After falling earlier this year, Affirm stock gained about 70% since the start of May. Affirm stock benefited significantly from its strong third-quarter results, where its credit performance improved, led by a decline in delinquencies.

Additionally, its Q3 gross merchandise volumes and revenue came in better than its guidance. Further, transactions from active customers increased by 34%. Overall, solid volumes, expense control, and operating leverage augur well for its plan to achieve profitability (on an adjusted operating income basis) by the end of this year and could support the uptrend in its stock price.

Affirm Has Upper Hand Over Apple in the BNPL Space

Speaking to Mizuho Securities analyst Dan Dolev, AFRM’s CEO Levchin said that the company did not witness any impact on its performance from Apple’s entry in the BNPL sector. Levchin added that AFRM has structural advantages over Apple due to its direct relationships with the merchants and underwriting expertise.

Levchin added that the company’s new products, like Debit+ (a BNPL debit card that consumers can link to their bank accounts), will likely expand its addressable market. Moreover, inventory management for merchants provides new growth opportunities.

Whether Apple Pay creates challenges for Affirm remains a wait-and-watch story. Nonetheless, Dolev reiterated a Buy rating on the stock following his discussion with the company’s CEO. In a note to investors dated June 13, Dolev said that AFRM stock is trading “roughly in line with the peer group,” which is “conservative given AFRM’s position as the market leader in BNPL.”

Dolev assigned a price target of $17 on AFRM stock.

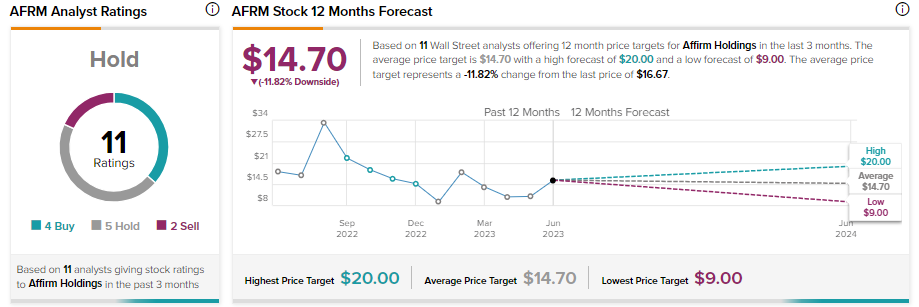

Is AFRM Stock a Buy, According to Analysts?

Despite the improvement in its credit performance and expense control, higher funding costs and pressure on consumer spending keep analysts sidelined. AFRM stock has received four Buy, five Hold, and two Sell recommendations for a Hold consensus rating. Moreover, as AFRM stock has gained quite a lot, the average AFRM stock price target of $14.70 implies 11.82% downside potential from current levels.