Is Advance Auto Parts (NYSE:AAP) an underdog or just a dog? Sorry to say, but I believe that Advance Auto Parts belongs in Wall Street’s scrap yard, as the company’s turnaround efforts are too little, too late. Overall, I am bearish on AAP stock and consider it to be a value trap.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Advance Auto Parts offers aftermarket parts for automobiles in the U.S. This might sound like a great business model during a time when new cars are expensive and many Americans are forced to maintain their current vehicles.

Sure, it’s been a great business model for more successful competitors, like AutoZone (NYSE:AZO) and O’Reilly Automotive (NYSE:ORLY). For Advance Auto Parts, however, there’s been no clear growth story, even with a highly-touted chief executive in charge.

New CEO Brought Turnaround Hopes for Advance Auto Parts

As you may recall, stock traders put Advance Auto Parts in the doghouse earlier this year after the company slashed its full-year EPS guidance in its Q1-2023 quarterly report. Around that same time, Advance Auto Parts chopped its quarterly dividend payments from $1.50 per share to just $0.25 per share.

Fast-forward to Advance Auto Parts’ Q2-2023 quarterly report, and the company reduced its 2023 EPS guidance again. At this point, Advance Auto Parts’ credibility was starting to fall apart. Could investors believe the company’s forward earnings guidance anymore?

Still, at least Advance Auto Parts was consistently profitable up to that point. Surely, the company would continue to stay “in the black,” as they say, right?

We’ll talk about that in a moment. Getting back to Advance Auto Parts’ second-quarter report, the company offered some hope of a turnaround. First, Advance Auto Parts brought in a new CEO, Shane O’Kelly, who has prior executive experience at Home Depot (NYSE:HD). Additionally, O’Kelly promised that Advance Auto Parts would “undertake an operational and strategic review of the business.”

This offered some hope to downtrodden AAP stockholders. Then, Advance Auto Parts’ shareholders waited and waited. Weeks turned into months with no update from Advance Auto Parts on the “strategic review.”

However, Advance Auto Parts released its third-quarter 2023 results this morning, and eager investors surely hoped that the company would provide decent results as well as an update on the “strategic review.” So, what did Advance Auto Parts actually deliver?

Advance Auto Parts Serves Up a Nothing Sandwich

In reality, Advance Auto Parts delivered much less than investors should have expected. For one thing, the company flipped from prior profitability to a loss of $0.82 per share. In contrast, Wall Street had called for Advance Auto Parts to report earnings of $1.44 per share.

Granted, Advance Auto Parts did meet the Q3-2023 consensus sales estimate of $2.68 billion, as the actual result was around $2.7 billion. On the other hand, Advance Auto Parts jeopardized its credibility again by reducing its full-year EPS outlook to $1.40-$1.80. That’s a huge cut compared to the prior guidance of $4.50-$5.10.

What about O’Kelly’s promised “strategic review,” though? There was an update to this, but it was just a couple of cost-cutting announcements. First, Advance Auto Parts will implement a cost reduction program that the company anticipates “will generate at least $150 million in savings on an annualized basis.” Yet, it really will be only $100 million of cost savings per year since O’Kelly expects Advance Auto Parts to “reinvest up to $50 million of these savings” in the company’s “team members.”

Also, Advance Auto Parts will divest its wholesale distributor business, known as Worldpac, as well as the company’s Canadian business, which mainly serves commercial customers. So, there’s your long-awaited update — some cost savings and business divestitures. Surely, investors should have hoped for more than this after the prolonged silence from Advance Auto Parts.

Is AAP Stock a Buy, According to Analysts?

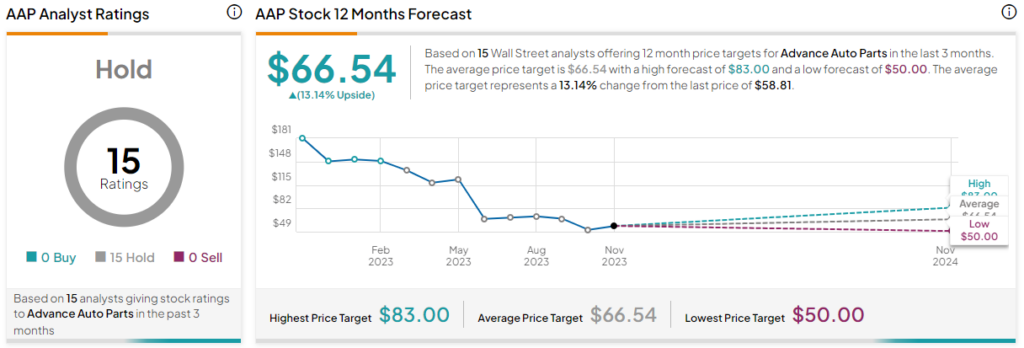

On TipRanks, AAP comes in as a Hold based on 15 unanimous Hold ratings assigned by analysts in the past three months. The average Advance Auto Parts stock price target is $66.54, implying 13.1% upside potential.

Conclusion: Should You Consider AAP Stock?

It’s possible that CEO O’Kelly will soon issue another, more meaningful update. However, it’s risky to invest in Advance Auto Parts now in hopes of better results and more details on the “strategic review.”

Meanwhile, Advance Auto Parts still has to compete against highly-favored rivals in the automotive components market. Therefore, I’m bearish on AAP stock, and it’s not on my list of investments to consider now.