Shares of creativity software company Adobe (NASDAQ:ADBE) have finally had a chance to ride on the AI wave, with ADBE stock now up an impressive 44% year-to-date. Undoubtedly, the rise of AI can either be a good thing or a bad one for Adobe. At this juncture, it’s evident that Adobe has taken AI seriously.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company has been working hard on incorporating AI features well before ChatGPT had its moment in the back half of last year. Adobe’s impressive AI tech has won the heart of Wall Street. That said, it’s still worth noting that there are competitors, and whether such competitors (think OpenAI) can erode Adobe’s time-tested moat surrounding creativity tools remains to be seen.

At this juncture, Adobe has more than enough AI talent to defend itself from rivals. If it can keep up in the AI race, it may be in a spot to claw some share away from some up-and-coming rival platforms. Adobe is a solid AI stock, just like the ones that led the charge in the first half. As such, I am bullish on ADBE stock.

Adobe’s Firefly AI Helps Lift ADBE Stock

Firefly (Adobe’s AI art generator) is an impressive platform, but it’s far from perfect, with a slew of AI art generators out there that may do a better job of giving prompters what they want. Though Adobe Firefly may be “commercially safe,” it needs to continue to invest heavily in AI capabilities because it’s likely just a matter of time before every AI pure-play joins forces with a licensed digital asset (think image and video) provider. And once that happens, there are bound to be many so-called “commercially safe” art-generating tools.

Adobe’s ambitious generative AI roadmap has also injected a wave of enthusiasm into the stock. As its tech advances, Adobe has one way of differentiating itself from AI peers: embedding AI tech alongside its existing platforms. Some folks may be content with getting a number of AI-generated results from a simple prompt. Others may require a greater deal of specificity.

In that regard, Illustrator or Photoshop with Firefly AI may be a match made in heaven. With such AI-enhanced tools, creators can change the finest details in a given work.

Just because AI art generation is improving doesn’t mean human-assisted work will become obsolete. As Adobe continues fine-tuning its AI, I believe it can make all its advanced platforms more user-friendly and capable than ever before.

Adobe’s Second-Quarter Beat and Raise May be Just the Start

Adobe’s surprising quarterly beat sent shares surging. With analysts revising to the upside over Firefly’s monetization potential, we could see Adobe have its very own “Nvidia (NASDAQ:NVDA) moment” as consumer demand outweighs original, likely overly-conservative estimates.

Indeed, it’s prudent to set conservative targets when dealing with the monetization of any new technology. However, I do think management is on the right side of innovation and could continue to serve up more beats and perhaps more guidance raises!

For the second quarter, Adobe sees adjusted EPS in the $15.65 to $15.75 range, up from $15.30 to $15.60 previously. ARR (average recurring revenue) from the digital media division is expected to be $1.75 billion for the year.

Indeed, analysts, management, and investors are upbeat on Adobe stock right now. At around 32.15 times forward price-to-earnings, Adobe isn’t all that expensive for an AI play. Shares are much cheaper than some of its AI-savvy big-tech rivals. As we gain a glimpse of the magnitude of the early AI monetization opportunities, I’d not want to bet against Adobe here. Its latest quarterly beat may be just the start.

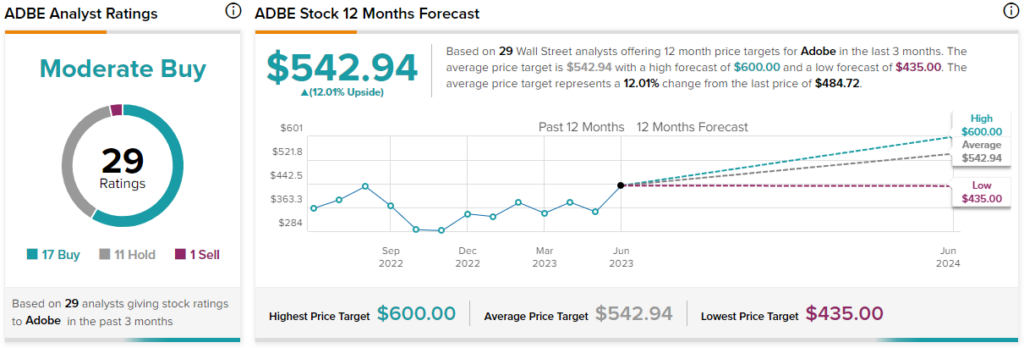

Is ADBE Stock a Buy, According to Analysts?

Turning to Wall Street, ADBE stock comes in as a Moderate Buy. Out of 29 analyst ratings, there are 17 Buys and 11 Holds, and one Sell rating. The average Adobe stock price target is $542.94, implying upside potential of 12%. Analyst price targets range from a low of $400.00 per share to a high of $600.00 per share.

The Bottom Line on Adobe Shares and the AI Momentum

Investors are starting to discover how truly capable Adobe is regarding AI. Still, more AI upside could be in the cards as the company continues to use AI tools to change the way we think about digital content creation.