Shares of Adobe (NASDAQ:ADBE) have seen selling pressure recently, with the stock now down about 9% over the past month. Undoubtedly, generative AI may enhance the company’s slate of creativity software offerings. However, as new AI-savvy competitors push into the AI art-generation space, Adobe must demonstrate that it has what it takes to stay ahead of the pack. To do so, the company will need to really go big on AI, as so many other big-tech firms have been doing of late.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With UK competition watchdogs keeping a close eye on Adobe’s $20 billion buyout deal for Figma, Adobe may need to prove that it can accelerate growth organically to win back the heart of investors. Indeed, antitrust regulators have really been a thorn in the sides of big-tech companies looking to make multi-billion-dollar deals.

Personally, I believe Adobe doesn’t need to make a big splash in M&A to stay competitive with its creative suite in the AI era. Though it would certainly make things easier for the more than $160 billion software giant, deal-making may not be necessary for Adobe to overcome its recent growth woes.

Thus far, Adobe’s AI products (think AI-based art generator Firefly) have been pretty impressive. However, whether Adobe’s take on AI will be impressive enough to maintain the width of its moat remains a bit of a question mark at this juncture. In any case, I’m staying bullish on shares of Adobe, even as the negative momentum picks up again.

If Adobe Gets AI Right, the Upside Could be Considerable

As generative AI innovation continues to improve, the technical barriers to entry into creative fields could fall rapidly. Adobe’s creative suite can be quite tricky for untrained users to grasp. Nevertheless, as Adobe unlocks the power of AI, the firm could put the creative power in the hands of everyday users, including those who may never have used something like Adobe Photoshop or Illustrator.

Although I’m a fan of Adobe’s Firefly, the AI art generation space has become crowded lately. OpenAI’s Dall-E, Stable Diffusion, and other text-to-image AI models stand out as worthy rivals to Firefly.

Indeed, Adobe has a lot at stake as we move further into the AI era, and it needs to find a way to top the numerous offerings that seem to be popping up from all directions.

Partnering with the search giant and AI kingpin Alphabet’s (NASDAQ:GOOGL) Google, which Adobe did last week, could help put Firefly move (and stay) ahead of the pack. Google Bard users will be able to unlock the power of Adobe Firefly and Adobe Express as the two software firms look to compete against OpenAI and AI frontrunner Microsoft (NASDAQ:MSFT).

Indeed, the Adobe-Google partnership could really help Adobe pull ahead in the creative AI race. Convenient access to Bard’s users could allow Firefly a treasure trove of data that could help drive continuous improvements.

Adobe Stock is Getting Cheaper

At writing, Adobe stock is trading at just north of 34 times trailing price-to-earnings (P/E). That’s on the low side of the stock’s historical range. Over the past five years, shares of ADBE have averaged a P/E multiple of around 49.2 times. Though there’s significant competition that’s brewing in the creative AI space, I still view Adobe as one of the better AI innovators.

As Firefly moves out of beta and onto Bard, we could witness a rapid pace of improvement. For now, there’s a bit of uncertainty as to what to expect next from AI-driven creativity tools. As the AI war heats up, I wouldn’t be surprised if Adobe pursues smaller bite-sized AI deals to help accelerate its efforts. In any case, Adobe is on the right side of AI innovation, making recent punishment in the stock less than warranted.

Is ADBE Stock a Buy, According to Analysts?

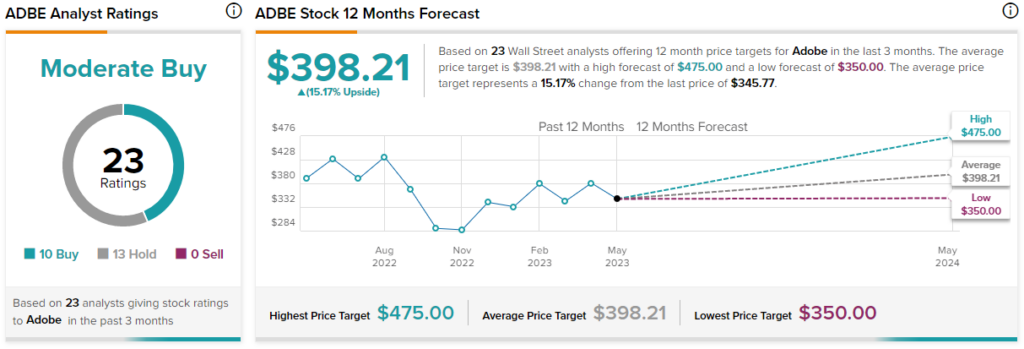

Turning to Wall Street, ADBE stock comes in as a Moderate Buy. Out of 23 analyst ratings, there are 10 Buys and 13 Holds.

The average Adobe stock price target is $398.21, implying upside potential of 15.2%. Analyst price targets range from a low of $350.00 per share to a high of $475.00 per share.

The Bottom Line on Adobe Stock

Adobe can’t catch a break this year. Even with all the exciting innovations and the partnership with Google, the stock continues to flop. Sure, competition is a concern, but Adobe has all the tools and talent to stay ahead of the curve.