Computer software company Adobe (NASDAQ:ADBE) is scheduled to announce its fourth-quarter Fiscal 2023 results after the market closes on December 13, 2023. Ahead of the Q4 earnings release, analysts maintain a bullish outlook for ADBE, as nine analysts reaffirmed their Buy recommendations on the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

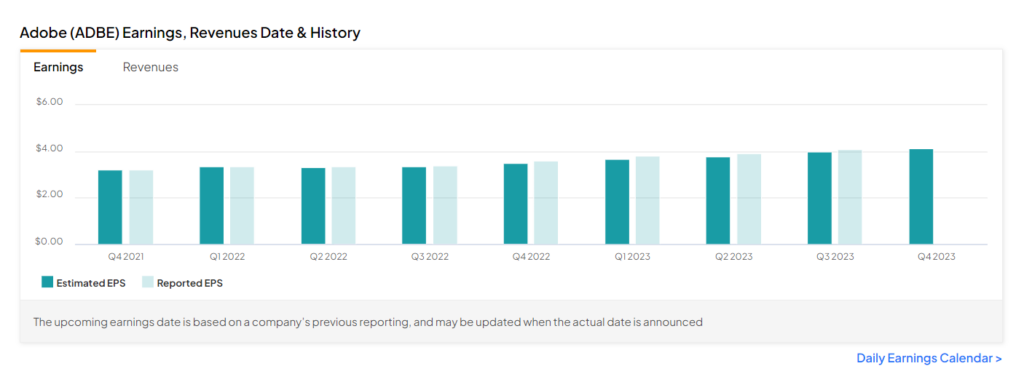

Interestingly, Adobe has a consistent history of delivering strong quarterly performances. The company surpassed earnings expectations for 15 consecutive quarters, indicating the potential for it to outperform estimates again in the to-be-reported quarter.

This time, Wall Street expects ADBE to post earnings of $4.13 per share in Q4 compared with $3.60 per share reported in the prior-year period. Meanwhile, revenue is expected to rise by 12.6% from the year-ago quarter to $5.01 billion.

Q4 Earnings: Here’s What Analysts Are Saying

Ahead of the Q4 earnings release, BMO Capital analyst Keith Bachman has maintained a Buy rating on ADBE stock. Bachman believes that Adobe’s Document Cloud sector will benefit from AI-related advancements. Additionally, he is encouraged by the company’s consistent track record of outperforming its Digital Media net new ARR (Annualized Recurring Revenue) guidance.

Moving on, Jefferies analyst Brent Hill reiterated a Buy rating on Adobe, fueled by optimism over the company’s potential to benefit from creative industry tailwinds and increased adoption of AI. These factors are expected to support revenue growth and bolster the company’s financials. Moreover, Thill considers the stock to be reasonably valued.

Is Adobe a Buy, Hold, or Sell?

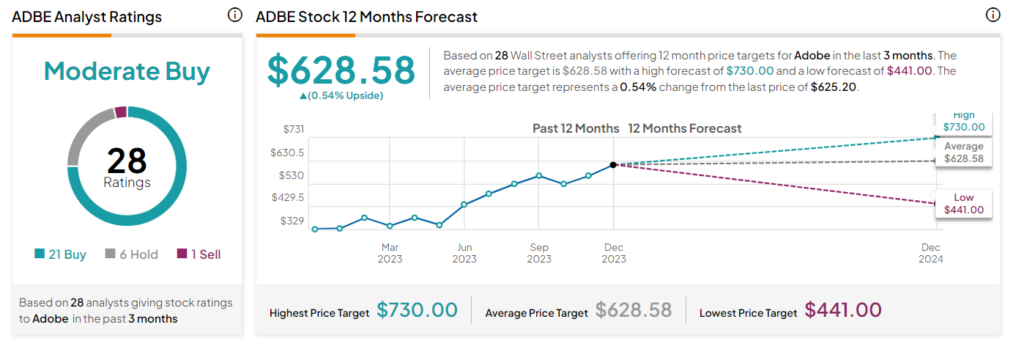

Wall Street is cautiously optimistic about Adobe. It has a Moderate Buy consensus rating based on 21 Buys, six Holds, and one Sell rating. The average Adobe stock price target of $628.58 implies 0.54% upside potential.

Insights from Options Trading Activity

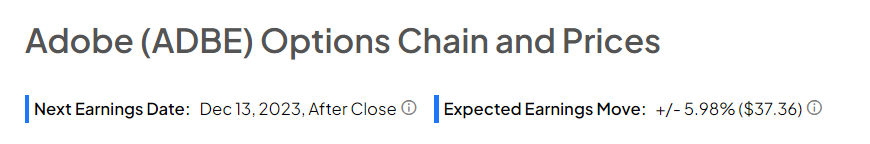

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 5.98% move on Adobe’s earnings, compared with the previous quarter’s earnings-related move of -4.21%.

Ending Note

With its innovative AI tool, Firefly, Adobe is poised to attract new customers, leading to substantial revenue growth. Furthermore, the company’s consistent track record of exceeding earnings expectations suggests it could easily surpass analyst predictions for the upcoming quarter.