Shares of Adobe (NASDAQ:ADBE) have been on a terrific run this year, potentially cut short by the recent post-earnings plunge. Despite shedding more than 7% after a round of underwhelming results, the stock is still up over 78% year-to-date. Indeed, anything that seems to be touching generative artificial intelligence (AI) has been rewarded this year, and Adobe has been no exception.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As the creative software behemoth walks away from its pursuit of Figma, questions linger as to how Adobe will cope in the new age that could see small and innovative tech firms leverage AI in a way to erode Adobe’s wide moat. Indeed, AI is make or break for many dominant tech juggernauts. Fortunately, I view Adobe as having enough of an AI edge to not only retain share but grab more of it as it looks to flex its AI muscles in other parallel markets. For this reason, I’m staying bullish on Adobe stock, just like most analysts covering the firm.

Adobe Disappoints with Its Latest Quarter. The Reaction Seems Shortsighted

Adobe may have failed to impress with its fourth-quarter results, but the numbers weren’t bad. Adjusted earnings per share (EPS) came in at $4.27, just slightly higher than the consensus estimate of $4.14. Given the stock’s hot run into the quarter, it should be no surprise that such a modest beat sparked a slight sell-off. Though Adobe stock has recovered just over 2% immediately following the 7% dip from 52-week highs, I view the dip as mostly exaggerated.

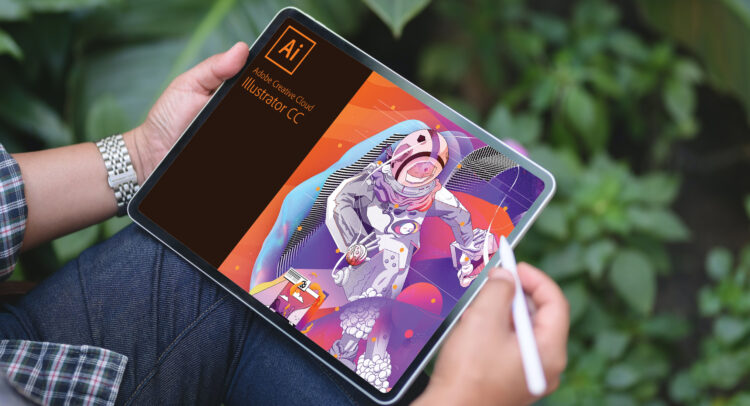

As other investors raised their hands over the slight bottom-line beat, there was a lot to get excited about on the front of generative AI. Adobe’s AI image generator, Firefly, is actually garnering quite a bit of attention. Though the image generation space has become quite crowded, with the likes of OpenAI’s Dall-E 3 and Midjourney, I view Firefly as a potential frontrunner.

At the end of the day, Adobe has the image assets and creative expertise to retain its dominance as we move from complex graphic design interfaces to simple prompts. Additionally, regarding the customizability of images, I view Firefly and Adobe Creative Suite with AI as having a considerable lead over peers in the AI image generation space. Does that mean Adobe can afford to be complacent? Definitely not. If Adobe can’t stay on the cutting edge of generative AI, the moat of its creative suite could wither. And it may not be able to “acquire” any potential disruptors given that anti-trust regulators already seem to be on the firm’s back.

Following the falling through of the Figma deal, Adobe now has more cash on the sidelines (around $6 billion) to put to work on other endeavors. Whether it uses the cash to pursue another takeout target remains to be seen. Either way, Adobe has the financial firepower to innovate on the AI front, even if rates stay stubbornly high (there’s always the possibility that less than three rate cuts are dealt in 2024) in the new year.

Beyond Figma, to Firefly AI and Beyond

Arguably, I think Adobe will have no issue moving on from Figma as it looks to put its capital to better use in the web interface design market. Perhaps Adobe could do a better job of creating an AI-based platform that can better compete with the likes of Figma.

With a wealth of subscribers to the Creative Suite, the company has many folks eager to try the latest and greatest AI offerings from the Adobe pipeline. In that regard, I view Adobe’s size as an advantage, as it looks to make the most of its economies of scale in the next few chapters of the so-called AI race.

As an early tester of Firefly, I must say I’m impressed with Adobe’s generative AI capabilities at this stage of the game, even if it doesn’t do certain things as well as the likes of Dall-E. Depending on the prompt, your mileage will vary across image generators.

In any case, I’ve found many images created by Firefly are nothing short of beautiful. They look professional, even if they aren’t exactly what I intended from my prompts.

Is ADBE Stock a Buy, According to Analysts?

On TipRanks, ADBE stock comes in as a Strong Buy. Out of 30 analyst ratings, there are 24 Buys, five Holds, and one Sell recommendation. The average ADBE stock price target is $650.93, implying an upside potential of 8.5%. Analyst price targets range from a low of $465.00 per share to a high of $730.00 per share.

Takeaway: Adobe’s Generative AI May Lower Barriers to Entry

At the end of the day, Adobe is an AI company that can put digital paint brushes in the hands of more than just seasoned graphic designers. In a way, you could view generative AI tech as coming for jobs or as lowering the barriers to entry in certain professions, such as graphic (and web) design. In the earlier innings of the AI race, I’d argue that the latter will come before the former.

As AI tools improve, who wouldn’t want to unleash their imagination without learning the ropes of complicated software platforms?

Firefly is bound to grow smarter and more capable over time, making it hard to bet against Adobe. The recent quarterly flop seems more like an opportunity to buy the dip than a sign that the creative software behemoth has lost its luster in the AI age. Adobe is very much an AI play, and I think more people will view it as such in 2024.