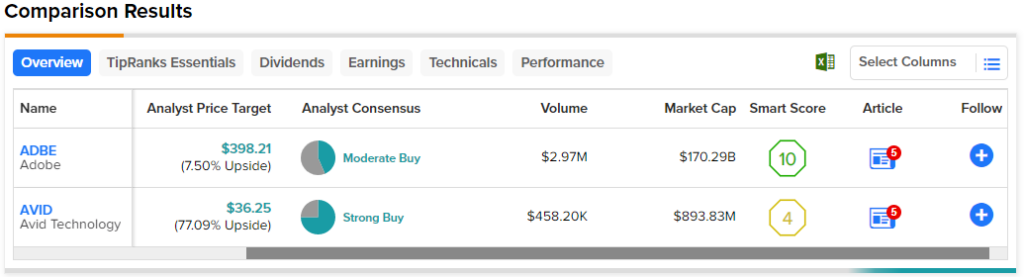

In this piece, I evaluated two software stocks, Adobe Inc. (NASDAQ:ADBE) and Avid Technology Inc. (NASDAQ:AVID), using TipRanks’ comparison tool to determine which is better. Adobe, famous for Adobe Photoshop, is up more than 10% year-to-date, while Avid, which provides technology services for the media and entertainment industry, is down 22%. Over the past year, Adobe is down 8.5%, and Avid is off by 20%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Importantly, while these companies are both in the application software industry, Adobe is exponentially larger than Avid in both annual revenue and market capitalization.

The U.S. software industry is trading at a price-to-earnings (P/E) multiple of 68.1 versus its three-year average of 58.4 and a price-to-sales (P/S) ratio of 10.3 compared to its three-year average of 9.1. The application software industry is trading at a P/S of 7.1 versus its three-year average of 10.2.

Adobe (NASDAQ:ADBE)

Adobe is trading at a P/E of 36.7 and a P/S of 9.2, notably lower than its five-year average P/E of 48.9 and five-year average P/S of 14.7. The company looks undervalued relative to the software industry and history, but there’s more to the story that’s caused a buy-the-dip opportunity. Thus, a bullish view looks appropriate.

There’s one major overhang for Adobe right now, which is its proposed acquisition of Figma. On the one hand, investors balked at the $20 billion cash-and-stock offer amounting to 40 times sales, but on the other, Figma was starting to eat into Adobe’s market share.

The deal has attracted regulatory scrutiny, so it might not go through. However, these concerns have triggered a buy-the-dip opportunity in a stock that hasn’t been this cheap since 2014, when it transitioned from a licensing model to a subscription-based model with recurring revenue.

Adobe has been growing steadily in both revenue and net income over the years, with stable net income margins that have been in the 26% to 30% range in five of the last six years. At a time when most tech companies are seeing their operating expenses skyrocket and net margins shrink dramatically, Adobe is holding its net income margin relatively stable.

The company also generates lots of free cash flow — $7.4 billion in 2022 — and has relatively little net debt, at $4.13 billion as of the last report. Adobe is undoubtedly here to stay with solid, growing fundamentals. Its stock price probably won’t jump dramatically in a short time, given that it’s up only 50% over the last five years. However, Adobe shares are up more than 175,000% since going public in 1986, making this seem like an attractive long-term stock that’s selling at a nice discount temporarily.

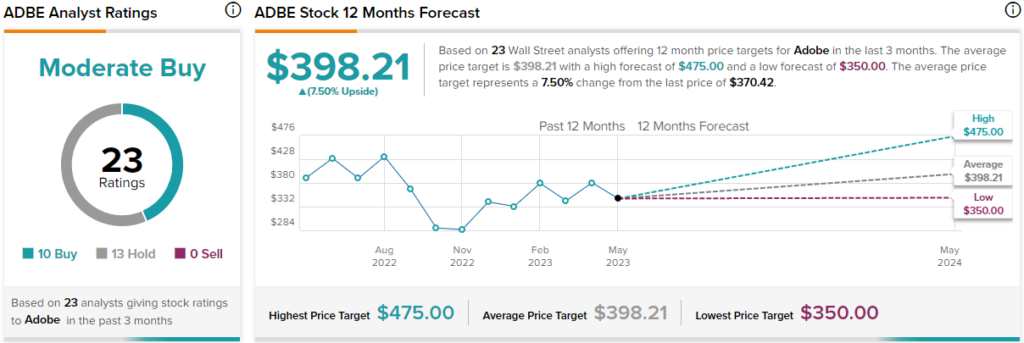

What is the Price Target for ADBE Stock?

Adobe has a Moderate Buy consensus rating based on 10 Buys, 13 Holds, and zero Sell ratings assigned over the last three months. At $398.21, the average Adobe stock price target implies upside potential of 7.5%.

Avid Technology (NYSE:AVID)

Avid Technology is trading at a P/E of 20.5 and a P/S of 2.2, suggesting a depressed valuation versus its industry. Avid’s five-year multiples are all over the place, making a comparison to its mean multiples of little value. Nonetheless, the company’s stable revenues, growing profits, and current transition to a subscription-based model suggest a bullish view may be appropriate.

Avid Technology is far smaller than Adobe, with a market capitalization of about $900 million. The company offers a unique opportunity following the steep sell-off triggered by the earnings and second-quarter guidance miss.

However, Avid reiterated its full-year guidance, and the transition to a software-as-a-service model with recurring revenue is going well. In fact, the company’s annual recurring subscription revenue jumped 30% year-over-year in its latest earnings report.

Importantly, Avid management said that much of the softness in its latest earnings report is due to supply-chain issues, which should ease over time. Additionally, the company’s significantly increased net income margin, from 3% in 2020 to between 10% and 13% in 2021 and 2022, indicates that it’s on the right track. Thus, the sell-off looks significantly overblown, creating a unique opportunity for investors.

What is the Price Target for AVID Stock?

Avid Technology has a Strong Buy consensus rating based on three Buys, one Hold, and zero Sell ratings assigned over the last three months. At $36.25, the average Avid Technology stock price target implies upside potential of 77.1%.

Conclusion: Bullish on ADBE and AVID

Trends look excellent for both Adobe and Avid Technology, so a bullish view looks appropriate for both, although for different reasons. Adobe looks like a long-term buy-and-hold stock trading at a significant discount, but its stock price might not explode quickly.

However, with Avid, there’s the possibility of significant near-term gains in its stock price as it transitions to a recurring-revenue model. Thus, both companies look attractive.