AbbVie (ABBV) is an international, research-driven biopharmaceutical company specializing in developing and marketing comprehensive therapies that aim to remedy some of the world’s most complicated and severe diseases.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following AbbVie’s acquisition of Allergan plc last year, the company has formed a diversified biopharmaceutical product portfolio. It is positioned in key therapeutic areas such as immunology, hematologic oncology, aesthetics, neuroscience, eye care, and women’s health.

In fact, the combination of AbbVie’s original product portfolio and its enhanced pipeline following acquiring Allergan’s assets should benefit the merged company’s commercial strength and international infrastructure substantially, in my view.

AbbVie’s shares have significantly rallied over the past year, hovering near all-time high levels. However, the stock’s valuation remains rather attractive, while its 4.65% yield makes for a strong capital return component. For this reason, I am bullish on the stock. (See Analysts’ Top Stocks on TipRanks)

Q3 Results: Another Steady Quarter

AbbVie’s Q3 results came in quite strong, with the company generating revenues of $14.3 billion during the period, an 11.3% increase year-over-year. Growth was driven by higher sales in several of its drugs, including Skyrizi and Rinvoq. Amid scaling economics, Abvvie’s EPS came in at $3.33, 17.7% higher compared to Q3 2020.

Following a stronger-than-expected quarter, management hiked its Fiscal Year 2021 guidance. The company now anticipates delivering EPS between $12.63 – $12.67, suggesting a considerable improvement compared to last year.

Back in October, the company also declared a dividend hike by 8.5%, raising the quarterly dividend per share (DPS) to $1.41 per share. In my view, this suggests robust confidence from management when it comes to AbbVie’s short and medium-term profitability growth prospects.

The Dividend and Valuation

Combined with its dividend increases from before its spin-off from Abbot Laboratories, AbbVie has “unofficially” grown its dividend annually for 49 consecutive years.

Despite such a prolonged track record implying a very mature business, AbbVie’s five-year DPS CAGR stands at an impressive 17.9%. Following equally strong EPS growth during this period, the payout ratio is quite comfortable as well. Based on this year’s expected EPS, the payout ratio should remain just under 45%.

Regarding future profitability growth, note that AbbVie’s management believes that despite Humira’s revenues weakening in the mid-2020s amid the patent’s expiry, company-wide revenues in 2025 will be higher than last year. This displays AbbVie’s robust performance and strong diversification prospects going forward, in my view.

Despite its above-average yield of 4.65%, which is quite substantial in the current environment of ultra-low yields, AbbVie’s shares are very reasonably valued.

At the midpoint of management’s guidance, the stock is trading at a P/E of 9.6x. Hence, investors should be enjoying a relatively broad margin of safety at the stock’s current levels, hardly facing any risk of a potential valuation multiple compression, in my view. If anything, a valuation expansion towards a more reasonable multiple in the low teens is likely to add on total returns.

Wall Street’s Take

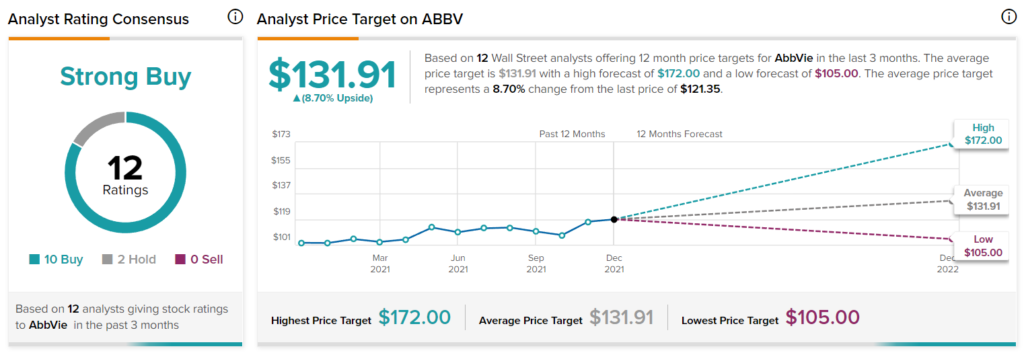

Turning to Wall Street, AbbVie has a Strong Buy consensus rating, based on ten Buys and two Holds assigned in the past three months. At $131.91, the average AbbVie price target implies 8.7% upside potential.

Disclosure: At the time of publication, Nikolaos Sismanis did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >