AbbVie (NYSE: ABBV) discovers, develops, manufactures, and sells pharmaceuticals worldwide. The company was spun off of Abbott Labs in 2013 with essentially one product to sell, Humira.

The company took the huge amounts of cash that was thrown off by Humira and invested more than $50 dollars into research and development to prepare for when Humira comes off patent in 2023.

Today AbbVie has 48,000 employees and operates in the immunology, oncology, neuroscience, eye care, virology, woman’s health, and aesthetics spaces. Three-quarters of the medicines in its pipeline are first-of-kind, meaning they are the first to treat a particular disease through that mechanism of action.

This is quite remarkable when considering this is a dividend stock that returns almost 4% of its value back to investors.

After reviewing AbbVie’s stock’s intrinsic value, the company’s plans to move past Humira, and what the Wall Street analysts and bloggers are saying, I am bullish on this stock.

This is a good investment for value investors looking for a payout of approximately 4% with significant upside potential as the market realizes that AbbVie is much more than the company that markets and produces Humira.

Recent Results and Dividend

AbbVie brought in revenues of $55.169 billion over the last 12 months, with a net income of $7.542 billion.

The company reported third-quarter earnings of $3.33 per share, beating analyst estimates of $3.21 per share. It has also reported $9.39 in earnings per share for the first nine months of 2021, beating analyst estimates of $9.10 for the first nine months of 2021.

It has declared a dividend payable on January 12, 2022, of $1.41 per share, with a dividend yield of 4%. This is an increase over the last quarterly dividend issued of $1.30 per share. This also marks the seventh straight year AbbVie has increased dividends.

This is the rare dividend-paying stock where the growth rate of the dividend is outpacing inflation, meaning investors are gaining real purchasing power. Most investments lose value during high inflation, and AbbVie is an exception.

The company shows strength on both the balance sheet and the income statement. The company has a current ratio of 1.015 which means that it has enough money and other current assets on hand to pay its bills over the next year.

When I calculated the stock’s intrinsic value by modeling discounted cash flows, I pegged it at $201.33.

Can The Stock Go Higher?

AbbVie has created a pipeline of pharmaceutical products that will act as a catalyst to drive the share price higher as investors realize that AbbVie is much more than the company that makes Humira.

In addition to carrying out research and development activities on its own, AbbVie has also done a great job using the cash flow from Humira to buy blockbuster drugs like Rivoq and the Botox brand of cosmetic botulinum toxin, used to reduce skin wrinkles and treat migraine headaches.

AbbVie has also partnered with over 220 companies, academic, and government institutions to strengthen its research and development pipeline.

Wall Street’s Take

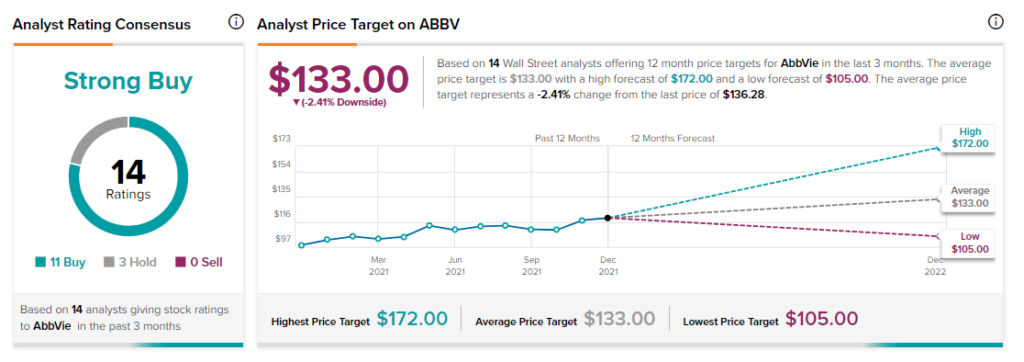

Fourteen Wall Street analysts currently cover AbbVie and have issued 12-month estimates for the price. Of the 14, 11 rate the stock as a Buy with a high forecast stock price of $172, an average stock price of $133, and a low stock price of $105. The average AbbVie price target represents 2.4% downside potential.

Conclusion

AbbVie has done a great job taking the vast amounts of free cash flows that Humira has generated and purchasing other blockbuster drugs. These will continue to throw off plenty of free cash flow to continue to pay the significant dividend increases that investors have become accustomed to.

Download the mobile app now, available on iOS and Android.

Disclosure: At the time of publication, Tim O’Rourke did not own shares of any stocks mentioned above.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >