The macro-uncertainty is keeping the stock market choppy. However, shares of big tech companies have defied the general economic trend and significantly outperformed the broader markets. For instance, Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Meta (NASDAQ:META) stocks have gained over 20%, 26%, and 75%, respectively, on a year-to-date basis. However, Morgan Stanley sees the rally in U.S. tech stocks as “overdone.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Thanks to the rally in large tech stocks, the NASDAQ 100 Index (NDX) has gained over 19% year-to-date. However, according to Mike Wilson, Morgan Stanley’s chief U.S. equity strategist, tech stocks that have increased over 20% this year will not be able to sustain the gains, and the tech sector could see new lows.

Notably, the economy remains weak. However, it hasn’t turned out as bad as many had expected. Meanwhile, expectations of easing monetary policy amid the bank funding program have led investors towards high-growth stocks.

Wilson doesn’t view the bank funding program as a form of quantitative easing. He advises investors to wait for a “durable low” in the broader market before going long on tech stocks.

While Wilson has a bearish view of tech stocks, let’s check what analysts recommend for AAPL, AMZN, and META stocks.

What’s the Prediction for AAPL Stock?

Apple’s dominant positioning in the smartphone market and the ongoing strength in the Services segment, with a growing base of over 2 billion active devices, continue to cushion its financials and stock price.

Analysts maintain a bullish outlook on AAPL stock. It has received 23 Buy, five Hold, and one Sell recommendations for a Strong Buy consensus rating. However, analysts’ price target of $170.73 implies a limited upside potential of 4.26%.

Nonetheless, the stock has received positive signals from hedge fund managers, who increased their holdings in the last quarter. AAPL sports an Outperform Smart Score of “Perfect 10.”

Is Amazon Stock Expected to Rise?

Amazon’s leading position in online retail and cloud computing and its growing digital ad business continue to support its financials and analysts’ bull case.

Analysts continue to maintain a bullish outlook on AMZN stock. It has a Strong Buy consensus, reflecting 36 Buy and one Hold recommendations. Analysts’ average price target of $136.92 implies 35.43% upside potential.

Along with analysts, hedge funds are also bullish about AMZN stock. Furthermore, AMZN stock commands an Outperform Smart Score of “Perfect 10” on TipRanks.

Is META Stock a Buy, Sell, or Hold?

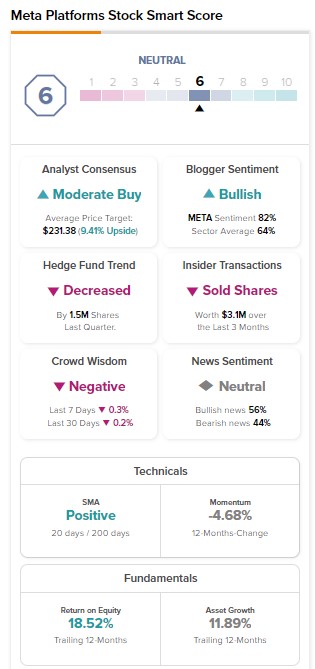

The surge in META stock is supported by its deep cost-cutting initiatives aimed at driving profitability. Further, the competitive headwinds are easing. However, given the pressure on ad spending, analysts remain cautiously optimistic about META stock.

It has received 38 Buy, seven Hold, and three Sell recommendations for a Moderate Buy consensus rating. Further, analysts’ average price target of $231.38 implies an upside potential of 9.41%.

While analysts are cautiously optimistic, hedge funds and insiders sold META stock in the last quarter. Overall, the stock has a Neutral Smart Score of six.

Bottom Line

Macro headwinds and valuation concerns could restrict the upside in these large tech stocks. Our data shows that AAPL and AMZN are more likely to beat the broader market average than the META stock thanks to their “Perfect 10” Smart Score and Strong Buy consensus rating. Meanwhile, AMZN stock offers a higher upside potential than META and AAPL stock from the current levels.