Wall Street is a cruel place at times, and Carnival (NYSE:CCL) stock bore the brunt in Monday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In its FQ3 (August quarter) earnings report, the world’s largest cruise line operator posted a record net income and raised its full-year outlook for the third time. Despite this, investors gave the thumbs down to the print, and shares fell in the aftermath.

Carnival posted revenue of $8.15 billion, up 3.2% year-over-year and $40 million ahead of the Street. On the bottom line, adj. EPS reached $1.43, beating expectations by $0.11. Net yields in constant currency rose about 5.3% versus 2024, 30 basis points above the June guide. The company also set a record in the quarter with customer deposits of $7.1 billion, surpassing the previous high recorded last August.

For the full fiscal year, the company anticipates adj. net income will climb roughly 55%, $235 million more than its June outlook, thereby reaching ~$2.14 per share. That is some distance above the initial estimate of $1.97 and $0.12 better than the analysts’ forecast.

So, with all that goodness, what was behind the downbeat reaction? Stifel analyst Steven Wieczynski attributes the sell-off to “fears that CCL’s yield/cost spread could go negative when CCL provides initial 2026 guidance.”

However, that is not a take Wieczynski agrees with. “We don’t see that right now and would argue even if you assume 3% all-in cost growth next year, CCL’s yield opportunity should be north of that when it’s all said and done,” Wieczynski said. “Our guess is forward estimates will be adjusted lower to account for these cost headwinds which to us makes the setup for 2026 even better, and we would be buyers at these current depressed levels.”

In fact, the analyst thinks the sell-off will turn out to be “short-lived.” Once investors recognize the strength of the results and fully appreciate how well the company is currently booked not just for 2026 but also for 2027, the stock will “rally from current levels given an underwhelming valuation.” Additionally, Wieczynski points out that CCL is expected to hold an analyst event in early 2026, where it will likely announce updated long-term targets. “We believe this will be another catalyst for the shares as we expect any type of long-range financial guidance will get priced into the shares relatively quickly,” the analyst opined. The key point is that booking trends remain strong, and Wieczynski sees no signs of any decline in CCL’s onboard customer spending patterns.

“Shares remain undervalued,” sums up the analyst, recommending investors make the most of a “tactical long-term buying opportunity.”

Accordingly, Wieczynski maintained a Buy rating on CCL shares, backed by a $38 price target. This suggests the stock will gain 38% over the next year. (To watch Wieczynski’s track record, click here)

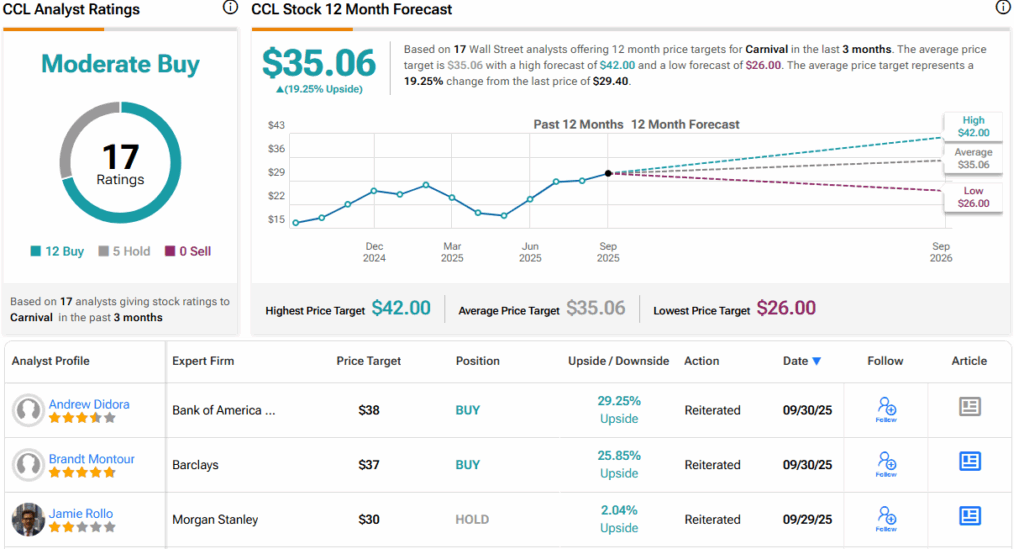

11 other analysts join Wieczynski in the bull camp and with an additional 5 Holds, the stock claims a Moderate Buy consensus rating. Going by the $35.06 average target, a year from now, shares will be changing hands for a 19% premium. (See CCL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.