Boeing (NYSE:BA) may start issuing airworthiness certificates for some 737 MAX and 787 models as early as today (September 29), following a ruling by the FAA on Friday. The agency stated that it is confident the process can be carried out safely at Boeing, and moving forward, the FAA will keep monitoring Boeing’s production quality, with inspectors having increased access to oversee the company’s manufacturing, initially on a biweekly basis.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While the FAA hasn’t officially authorized Boeing to raise MAX production above 38 units per month, RBC’s Kenneth Herbert, an analyst ranked amongst top 1% of Wall Street stock experts, sees this as the “positive catalyst that investors were hoping for,” as it represents a concrete step toward the anticipated increase to 42 units a month. “We were initially surprised that the FAA would cede some of this authority back to Boeing,” the 5-star analyst went on to say, “but we do believe it reflects a broader push for regulatory oversight, and capacity constraints at the FAA.”

According to Cirium, as of September 28, Boeing has delivered a total of 42 aircraft. This includes 31 MAXs, 4 767s, 3 777s, and 4 787s. For Q3 overall, cumulative deliveries stand at 147 aircraft. As such, Herbert has now slightly raised his 3Q25 delivery estimate to 151, given Boeing has exceeded the previous forecast of 147. “We anticipate the OEMs to be able to push through additional deliveries on the last few days of the month, as they normally do,” Herbert further said.

Herbert has also increased his MAX deliveries by 15 aircraft in 2026 and 25 aircraft in 2027, the increase due to having a less conservative stance regarding the MAX, as the analyst was previously below the Street’s average (Visible Alpha). Additionally, Herbert removed any 777X deliveries from 2026 and 1H27.

In fact, regarding the777X, Herbert thinks that confirmation of the expected 777X charge – whether with the 3Q25 results or beforehand – will serve as a “clearing event for the stock.”

“While the strong order activity no longer materially impacts sentiment (considering the long backlog) we believe confidence in 787 and 737 production rate increases, and the impact on FCF, is the most important for sentiment,” the analyst added. Herbert doesn’t anticipate Boeing will update its midterm financial targets with the 3Q25 results, but greater visibility on the path toward generating around $10 billion (or more) in FCF would likely be a “positive for sentiment.”

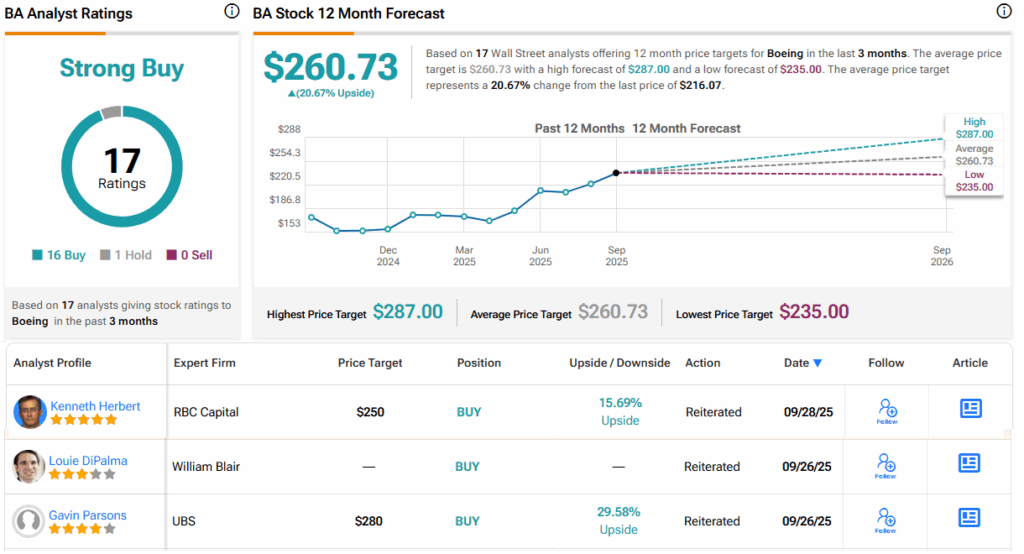

To this end, Hebert maintained an Outperform (i.e., Buy) rating on BA, backed by a $250 price target, implying shares will gain 16% in the months ahead. (To watch Hebert’s track record, click here)

Most analysts are thinking along the same lines. Based on a mix of 16 Buys vs. 1 Hold, the analyst consensus rates the stock a Strong Buy. The forecast calls for 12-month returns of 21%, considering the average target clocks in at $260.73. (See Boeing stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.