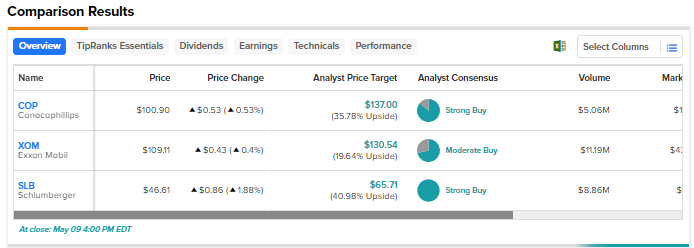

Energy prices have declined from the elevated levels seen last year due to fears of a potential recession. A healthy U.S. jobs report eased concerns about an imminent recession and drove energy prices higher on Monday. Nonetheless, prices have been volatile due to mixed supply and demand factors and persistent macro pressures. With an uncertain backdrop in mind, we used TipRanks’ Stock Comparison Tool to place ConocoPhillips (NYSE:COP), Exxon (NYSE:XOM), and SLB (NYSE:SLB) against each other to pick the most attractive energy stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ConocoPhillips (NYSE:COP)

Exploration and production company ConocoPhillips has operations in 13 countries. The company recently reported Q1 2023 adjusted EPS of $2.38, which surpassed analysts’ expectations but reflected a year-over-year decline of 27%.

The bottom line was impacted by a 21% decline in average realized price, even as production increased by 45 thousand barrels of oil equivalent per day in Q1.

Meanwhile, the company distributed $3.2 billion to shareholders in Q1, including $1.5 through regular dividends and variable return of cash and $1.7 billion via share repurchases. It expects to return $11 billion to shareholders in 2023.

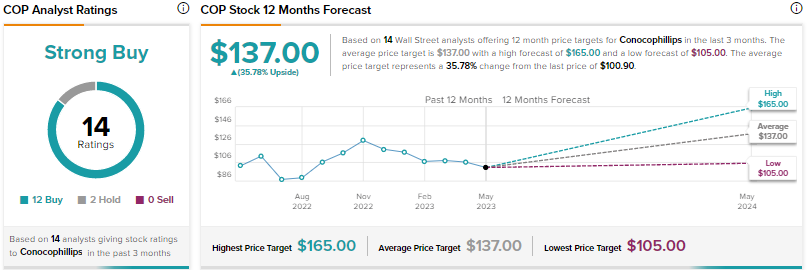

Is COP Stock a Buy?

In reaction to last week’s Q1 results, Goldman Sachs analyst Neil Mehta slightly raised the price target for ConocoPhillips stock to $122 from $121 and reaffirmed a Buy rating. Mehta highlighted that the company offers about a 22% average return on capital employed (2024-2026 timeframe) at $80/bbl WTI, which is higher than the average of about 16% among U.S. oil majors.

Further, the analyst remains “constructive” on the company’s shareholder returns commitment of $11 billion for 2023, which indicates a potential 9% capital returns yield.

With 12 Buys and two Holds, ConocoPhillips earns Wall Street’s Strong Buy consensus rating. At $137, the average price target implies nearly 36% upside potential.

Exxon Mobil (NYSE:XOM)

Integrated oil and gas giant Exxon Mobil’s Q1 2023 adjusted EPS increased to $2.83 from $2.07 in the prior-year quarter, as increased output and cost efficiencies helped offset the impact of a pullback in crude prices.

Exxon generated free cash flow of $11.4 billion, up 5.3% year-over-year. The company’s robust cash flows supported shareholder distributions of $8.1 billion in Q1 2023, including $3.7 billion in dividends.

Exxon has achieved cumulative structural cost savings of $7.2 billion to date and is on track to deliver cost savings of $9 billion by the end of 2023 compared to 2019.

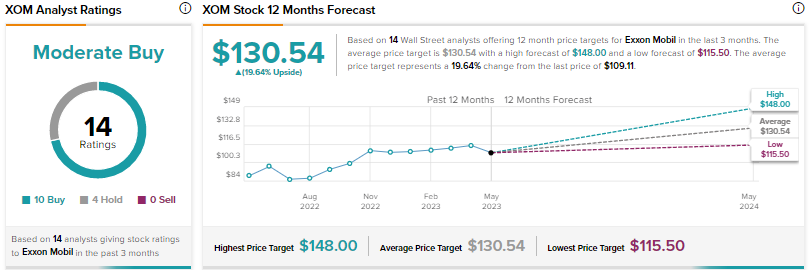

Is Exxon a Buy, Sell, or Hold?

On May 1, RBC Capital analyst Biraj Borkhataria lowered his price target for Exxon to $125 from $135 and reiterated a Buy rating. The analyst believes that the company should benefit from its downstream expansion at Beaumont in the second quarter. However, he reduced his full-year refining margin estimate to reflect weaker cracks.

Moreover, Borkhataria lowered his price target as he thinks that XOM stock is trading at all-time highs, earnings momentum is stalling, and valuation has expanded compared to the sector.

Wall Street is cautiously optimistic about Exxon, with a Moderate Buy consensus rating based on 10 Buys and four Holds. The average price target of $130.54 suggests about 20% upside potential.

SLB (NYSE:SLB)

Oil-field services company SLB, formerly known as Schlumberger, delivered better-than-expected first-quarter results. Adjusted EPS surged 85% year-to-year to $0.63, driven by a 30% rise in revenue to $7.7 billion and margin expansion. The company attributed its performance to solid activity offshore and in the broader international basins.

However, investors were disappointed with the lower-than-expected operating cash flow of $330 million. Also, the company cautioned that North American onshore activity could plateau this year due to lower natural gas prices and spending restraints by exploration and production companies. Nevertheless, SLB is optimistic about offshore activity.

What is the price target of SLB Stock?

Following the Q1 print, Goldman Sachs’ Mehta reaffirmed a Buy rating on SLB stock and a price target of $65. The analyst opined that the first-quarter performance was “somewhat mixed” in terms of margins and free cash flow despite solid revenue beat. He expects margins and free cash flow to recover in Q2 2023 due to the absence of the one-time items recorded in the first quarter.

That said, Mehta’s constructive view of the stock beyond 2023 remains intact, as he expects the company to be a leading beneficiary of strength in international markets, mainly in offshore.

Mehta expects SLB to deliver revenue growth of 15% CAGR in 2021-2025. His outlook is fueled by capacity expansion projects in the Middle East and multiple long-cycle projects in Latin America. He also expects SLB’s margins to benefit from the company’s expertise in offshore and its market-leading digital offering.

Wall Street has a Strong Buy consensus rating on SLB based on seven unanimous Buys. The average price target of $65.71 suggests about 41% upside.

Conclusion

Exxon shares have declined 1% year-to-date compared to about a 15% and 13% decline in COP and SLB. However, Wall Street is more bullish on ConocoPhillips and SLB than Exxon. Currently, analysts see higher upside potential in oil-field services company SLB than the other two energy stocks, backed by solid opportunities in offshore and international markets.