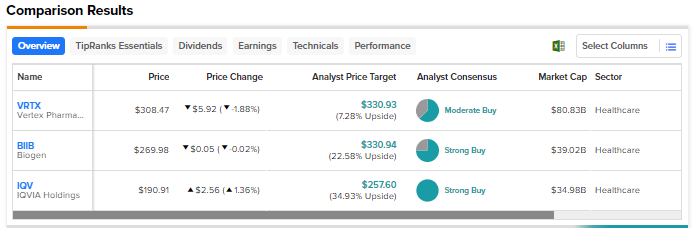

Several biotech companies developing treatments for unmet medical needs have rapidly emerged over recent years. Generally, investing in a biotech stock is a high-risk, high-reward proposition. Moderna (MRNA) is a good example of a biotech stock that delivered breakthrough innovation and boosted shareholder returns. Using TipRanks’ Stock Comparison Tool, we placed Vertex (NASDAQ:VRTX), Biogen (NASDAQ:BIIB), and IQVIA Holdings (NYSE:IQV) against each other to pick the biotech stock that could deliver the highest returns as per Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Vertex Pharmaceuticals (NASDAQ:VRTX)

Vertex Pharmaceuticals is a dominant player in the field of cystic fibrosis, an inherited life-threatening disorder that damages the lungs and digestive system. The company also has a solid pipeline of investigational small molecule, cell, and genetic therapies focusing on other serious diseases, including sickle cell disease, beta thalassemia, and Duchenne muscular dystrophy.

Last month, the company reported upbeat fourth-quarter earnings, with adjusted EPS up nearly 25% to $3.76. Revenue grew 11% to $2.3 billion. Results benefited from the continued strength in the company’s Trikafta drug in the U.S. and multiple countries (Trikafta is called Kaftrio abroad).

Vertex is now gearing up for the potential commercial launch of Exagamglogene autotemcel (Exa-cel) in severe sickle cell disease and transfusion-dependent beta thalassemia.

Is VRTX a Good Buy?

Last week, Bernstein analyst William Pickering initiated coverage of Vertex stock with a Buy rating and a price target of $344. Based on a survey of 30 hematologists specializing in sickle cell, Pickering is bullish about Vertex’s Exa-cel launch. He expects $2.7 billion in peak sales from the Exa-cel treatment.

Wall Street is cautiously optimistic about Vertex, with a Moderate Buy consensus rating based on 10 Buys and six Holds. At $330.93, the average VRTX price target suggests 7.3% upside potential. Shares have advanced about 7% year-to-date.

Biogen (NASDAQ:BIIB)

Biogen is focused on autoimmune diseases and neurology. The company has a solid pipeline of multiple sclerosis drugs, including Tecfidera and Vumerity. Its spinal muscular atrophy drug Spinraza is also a vital revenue source.

However, sales from the company’s key multiple sclerosis drug Tecfidera have declined over the past few quarters due to competition from generics. Spinraza’s sales have also been under pressure due to competition. Moreover, Biogen’s Alzheimer’s drug, Aduhelm, approved by the FDA in 2021, failed to generate the desired sales due to questions over its efficacy and the lack of Medicare coverage. The company decided to substantially wind down commercial operations of Aduhelm.

Biogen is now pinning its hopes on another Alzheimer’s drug Lecanemab or Leqembi (developed in collaboration with Eisai (ESALY)), which won the U.S. Food and Drug Administration’s (FDA) accelerated approval earlier this year. Biogen and Eisai are now awaiting the traditional approval of Lecanemab by the FDA.

Another drug that could boost Biogen’s prospects is Zuranolone (developed in collaboration with Sage Therapeutics (SAGE)) for depression. Zuranolone is under priority review in the United States and the FDA has assigned a Prescription Drug User Fee Act (PDUFA) action date of August 5, 2023.

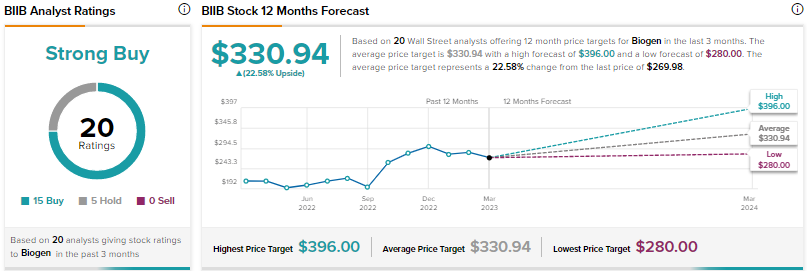

What is the Target Price for Biogen?

Wall Street’s Strong Buy consensus rating for Biogen is based on 15 Buys and five Holds. The average BIIB stock price target of $330.94 suggests 22.6% upside. Shares have declined 2.5% since the start of this year.

IQVIA Holdings (NYSE:IQV)

IQVIA Holdings provides analytics, technology solutions, and clinical research services to the life sciences industry. It helps healthcare companies accelerate the clinical development and commercialization of innovative medical treatments.

IQVIA’s revenue increased 4% to $14.4 billion in 2022. Better margins helped the company deliver about a 13% rise in adjusted EPS to $10.16. The company expects its 2023 revenue growth in the range of 5.1% to 6.9%, driven by sustained operating momentum across the portfolio. It projects adjusted EPS to increase in the range of 1% to 3.9%. Earnings this year are expected to be impacted by higher interest rates and a rise in the U.K. corporate tax rate.

Is IQVIA a Buy, Sell, or Hold?

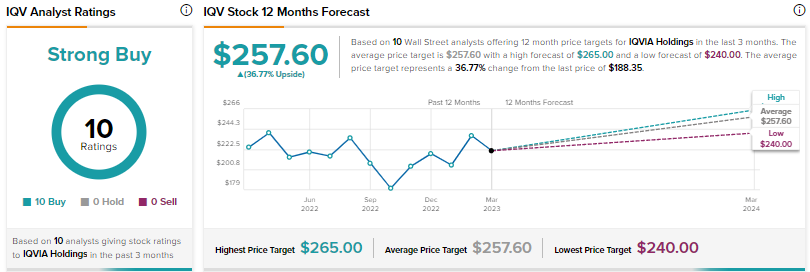

Recently, Truist Financial analyst Jailendra Singh initiated coverage of IQVIA Holdings with a Buy rating and a price target of $265, as he expects the company to further benefit from its “differentiated” contract research organization (CRO) division.

Singh explained that IQVIA’s CRO segment is differentiated, as “the depth of its data enables IQV to improve clinical trial design, site identification, and patient recruitment by combining therapeutic, scientific, and domain expertise with patient records and product-tracking insights.”

Singh also highlighted IQVIA’s strong backlog, which is backed by continued expansion of the breadth of the company’s offerings.

The rest of the Street is also bullish, with IQVIA having a Strong Buy consensus rating based on 10 Buys. The average IQV stock price target of $257.60 implies nearly 37% upside potential. Shares are down about 7% year-to-date.

Conclusion

Wall Street is more bullish about IQVIA compared to Vertex and Biogen and sees a higher upside in the stock. Aside from analysts, hedge funds are also bullish on IQVIA. As per Tipranks’ Hedge Fund Trading Activity tool, hedge funds have a Positive confidence signal on IQVIA and have purchased 126.9K shares in the past quarter.