Value stocks are those shares that trade below their true worth, offering investors a unique opportunity to buy quality companies at discounted prices. These stocks can be a valuable addition to a diversified investment portfolio, offering the potential for long-term growth and income.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

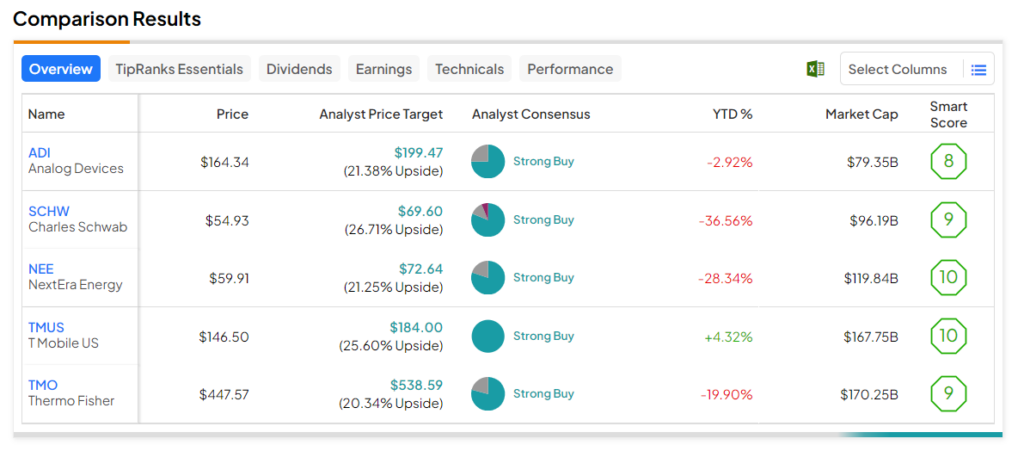

Using the TipRanks stock screener tool, we zeroed in on stocks with a Strong Buy rating from Wall Street analysts, and their price targets reflect an upside potential of more than 20%. Also, they carry an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks. Furthermore, these stocks seem to be undervalued, as the price-to-earnings (P/E) ratio is below their respective five-year averages.

According to these screeners, the following stocks are reasonably valued and are analysts’ favorites.

- T-Mobile US (NASDAQ:TMUS) – This company provides wireless communications services for postpaid and prepaid customers as well as wholesale customers. Analysts currently see an upside potential of 25.6% in TMUS stock. Also, the stock is trading at 22.5 times earnings, which reflects a discount of about 52% from the five-year average. Importantly, 11 Buy ratings were assigned to the stock following the release of third-quarter earnings on October 25.

- NextEra Energy (NYSE:NEE) – NextEra is an electric power and energy infrastructure company. The company’s average price target implies a consensus upside of 21.3%. Its P/E ratio of 15.5x is 56.9% lower than its five-year average. Five analysts rated the stock a Buy post-Q3 earnings release on October 24.

- Charles Schwab (NYSE:SCHW) – SCHW is the nation’s largest discount broker. The stock has an analyst consensus upside of 26.7%. The stock trades at 17.6 times trailing earnings, reflecting a 19% discount from the five-year average.

- Analog Devices (NASDAQ:ADI) – This company provides semiconductor solutions. Based on the ratings of the 16 analysts, the stock has an average price target of $199.47, which implies a 21.4% upside potential from current levels. ADI stock trades at 21.6x earnings, which is 40% below its five-year average.

- Thermo Fisher (NYSE:TMO) – TMO is a scientific services and products company that provides healthcare, life sciences, and research solutions. The stock has a 12-month price target of $538.59, which implies a nearly 20% upside. The stock trades at 28.9 times trailing earnings, reflecting a 33.3% discount from the five-year average.