Investing in utility stocks is likely a prudent choice amid the current volatile stock market environment. These defensive investment options are considered safe due to the consistent demand for essential services, regardless of economic conditions. Moreover, their steady dividend distributions make them attractive to investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

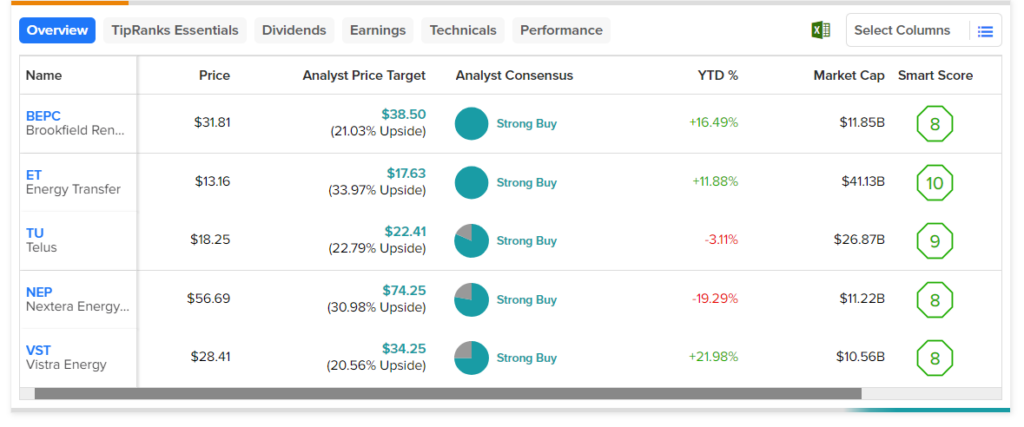

To help investors choose the best utility stocks, we have used the TipRanks Stock Screener tool. Using this tool, we shortlisted stocks that have Strong Buy ratings from analysts, a dividend yield of more than 2.5%, and price targets from analysts that reflect upside potential of more than 20%. Finally, these stocks have an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, indicating a relatively high chance to outperform the broader market.

Here are the five key stocks from the utility sector that investors can consider.

- NextEra Energy Partners (NYSE:NEP) – The company acquires, manages, and owns contracted clean energy projects. Analysts currently see upside potential of 31% in NEP stock. Also, it has a dividend yield of 5.43% and a Smart Score of 8 out of 10.

- Telus (NYSE:TU) – While not a true utility company, Telus provides a broad range of telecommunications products and services in Canada, making it as essential as a utility company. TU stock has upside potential of 22.8%, according to analysts, and a dividend yield of 5.59%. Also, the stock has a Smart Score of 9 out of 10.

- Energy Transfer (NYSE:ET) – The stock has an average price target of $17.63, which implies 34% upside potential from current levels. Also, its dividend yield of 8.42% and “Perfect 10” Smart Score are encouraging. Energy Transfer is a provider of natural gas pipeline transportation and transmission services.

- Vistra Energy (NASDAQ:VST) – This stock of an integrated retail electricity and power generation company has an average price target of $34.25, which implies 20.6% upside potential from current levels. Further, it has a dividend yield of 2.75% and a Smart Score of 8 out of 10.

- Brookfield Renewable (NYSE:BEPC) – Analysts currently see an upside potential of 21% in BEPC stock, which boasts a dividend yield of 4.1%. BEPC operates renewable power platforms. The stock has a Smart Score of 8 out of 10.