Real estate stocks, especially real estate investment trusts (REITs), are attractive for long-term investors due to their unique benefits. These stocks offer tax advantages, pay sizable dividends, and can be considered reliable sources of income. These characteristics, combined with the potential for capital appreciation over time, make real estate stocks a compelling choice for investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

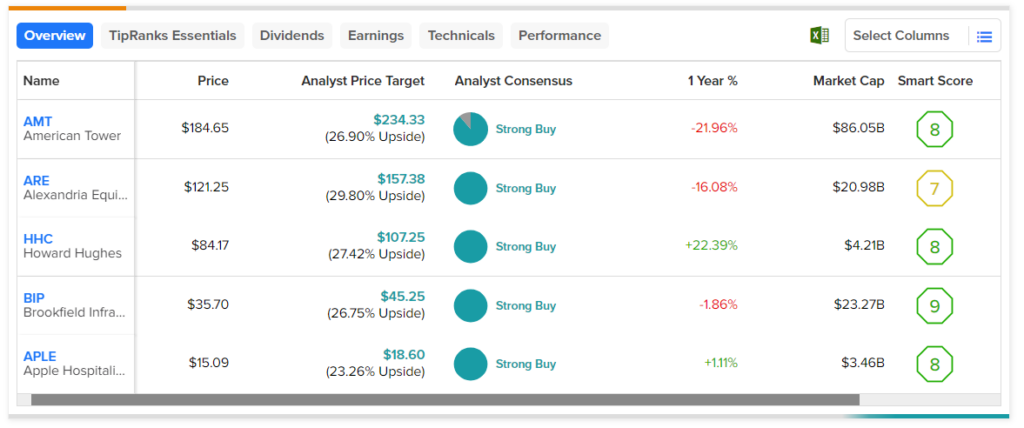

Using TipRanks’ Stock Screener tool, we have shortlisted five stocks with the potential to beat the market. Using this tool, we shortlisted stocks that have a Strong Buy rating from analysts. Moreover, the analysts’ price targets reflect upside potential of over 20%.

Here are the five key stocks from the real estate sector for investors to consider.

- American Tower (NYSE:AMT) – AMT stock’s average price target implies upside potential of 26.9%. The company owns and operates wireless and broadcast communications infrastructure.

- Alexandria Equities (NYSE:ARE) – ARE invests in office buildings and laboratories leased to tenants in the life science and technology industries. The stock has a consensus upside potential of 29.8%.

- Howard Hughes (NYSE:HHC) – The stock has an average price target of $107.25, which implies 27.4% upside potential from current levels. The company develops and manages commercial, residential, and mixed-use real estate.

- Brookfield Infrastructure (NYSE:BIP) – The stock has an average price target of $45.25, which implies 26.8% upside potential from current levels. The company owns and operates assets in the utilities, transport, energy, and data infrastructure sectors

- Apple Hospitality (NYSE:APLE) – Analysts currently see upside potential of 23.3% in APLE stock. The company invests in income-producing real estate, primarily in the lodging sector.