Two analysts, David Rescott and Jeff Johnson from Robert W. Baird, expressed their optimism about the MedTech sector in 2024 and named ALC, SYK, COO, AXNX, and BSX as their top picks in a report dated December 21.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite acknowledging potential obstacles such as macro uncertainties and the impact of weight loss drugs (glucagon-like peptide 1) on the adoption of MedTech devices in the upcoming year, analysts believe these challenges have already been factored into the current valuations of companies within the industry. Consequently, they advise investors to concentrate on “high-quality names with strong new product cycles and (rarely seen in MedTech) pricing power.”

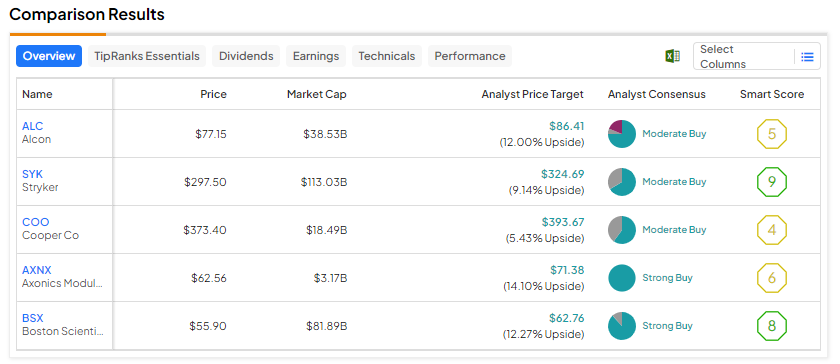

With this backdrop, let’s look at the Street’s consensus rating for these five MedTech stocks.

- Alcon (NYSE:ALC) – Alcon provides surgical and vision care products. Johnson expects ALC to benefit from margin improvement. Moreover, he expects the favorable pricing trends for contact lenses tol persist into 2024. The analyst maintained a Buy rating on ALC stock and increased the price target to $94 from $87. While Johnson is bullish about ALC, the stock has a Moderate Buy consensus rating. Further, analysts’ average price target of $86.41 implies 12% upside potential from current levels.

- Stryker (NYSE:SYK) – Stryker is a leading MedTech company. Johnson expects Stryker to benefit from solid orthopedic end-market demand and strong pricing. The analyst reiterated a Buy rating on SYK stock with a price target of $319. Overall, SYK stock has a Moderate Buy consensus rating. Further, analysts’ average price target of $324.69 implies 9.14% upside potential from current levels.

- CooperCompanies (NASDAQ:COO) – Medical device company CooperCompanies focuses on contact lenses and fertility and women’s health through its CooperVision and CooperSurgical units. Industry-wide pricing tailwinds in contact lens and margin expansion keep Johnson bullish about COO stock. The analyst increased his price target to $430 from $410 on December 21 and maintained a Buy. Overall, CO stock has a Moderate Buy consensus rating. Analysts’ average price target of $393.67 implies 5.43% upside potential.

- Axonics Modulation Technologies (NASDAQ:AXNX) – Axonics is developing and commercializing products for adults with bladder and bowel dysfunction. Analyst Rescott believes AXNX has the best and most sustainable positive profit outlook in coming years. He increased the price target to $79 from $70 and retained a Buy rating on December 21. AXNX has a Strong Buy consensus rating. Analysts’ average price target of $71.38 implies 14.10% upside potential.

- Boston Scientific (NYSE:BSX) – Boston Scientific offers a wide range of high-performance medical device solutions. Rescott’s bullish view on BSX stock is supported by the company’s solid earnings growth and new product launches. The analyst increased the price target on BSX to $64 from $59. Besides for Rescott, most analysts recommend buying Boston Scientific stock. With 15 Buy and two Hold recommendations, BSX has a Strong Buy consensus rating. Moreover, analysts’ average price target of $62.76 implies 12.27% upside potential.