Investing in food-related stocks has been an appealing choice for investors seeking stable returns, dividends, and even growth potential. The food industry tends to display resilience to economic downturns as consumers often prioritize essential food items. However, macroeconomic factors, such as interest rates and inflation, can influence the performance of some food stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

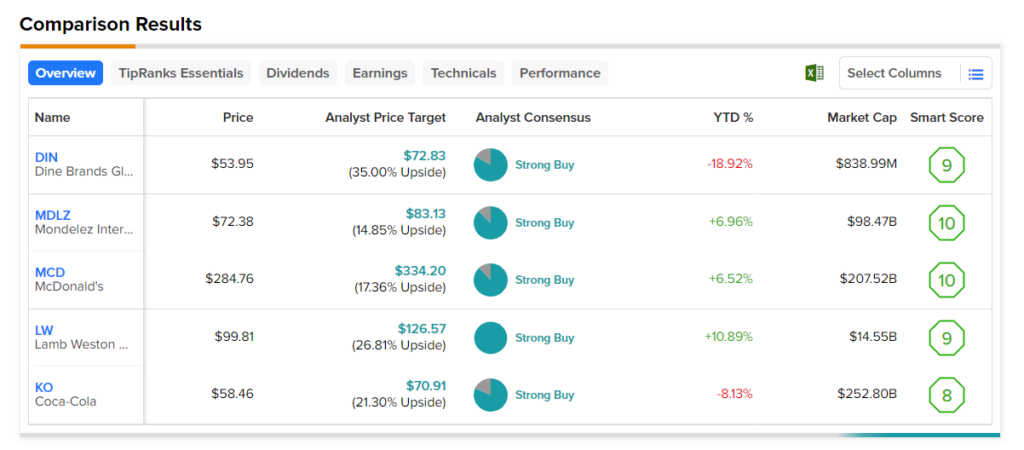

Thus, to support investors in finding the best stocks in the industry, we used TipRanks’ Stock Screener tool. We shortlisted five food stocks that have received Strong Buy ratings from analysts and whose price targets reflect upside potential of more than 10%. Also, these stocks carry Outperform Smart Scores (i.e., 8, 9, or 10) on TipRanks, meaning that they have high potential to outperform the market.

Here are the five key stocks that investors can consider.

- McDonald’s (NYSE:MCD) – McDonald’s is a global fast-food giant known for its diverse menu of burgers, fries, and more. Analysts currently see upside potential of 17.4% in MCD stock. Also, it has a ‘Perfect 10’ Smart Score.

- Mondelez International (NASDAQ:MDLZ) – This global food conglomerate is famous for its portfolio of beloved brands, including Oreo, Cadbury, and Trident. The stock’s price forecast of $83.13 implies 14.9% upside potential. MDLZ stock has a Smart Score of 10.

- Lamb Weston Holdings (NYSE:LW) – Lamb Weston is a supplier of frozen potato products. LW stock has upside potential of 26.8%, according to analysts, and a Smart Score of 9 out of 10.

- Coca-Cola (NYSE:KO) – This multinational beverage company is known for its iconic carbonated soft drink, Coca-Cola, and a wide range of other beverages. KO stock’s average price target implies upside potential of 21.3%. Moreover, it has a Smart Score of 8 out of 10.

- Dine Brands Global (NYSE:DIN) – DIN owns and operates popular chains like Applebee’s and IHOP, offering a diverse range of dining options. The stock has an average price target of $72.83, which implies 35% upside potential from current levels. Also, its Smart Score of 9 out of 10 is encouraging.