U.S. financial stocks consist of banks, insurance companies, investment firms, real estate investment trusts (REITs), and various other financial institutions. This sector is poised to gain from multiple factors, including the Federal Reserve’s commitment to maintain higher interest rates to manage inflation, an improving job market, and resilient consumer spending.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

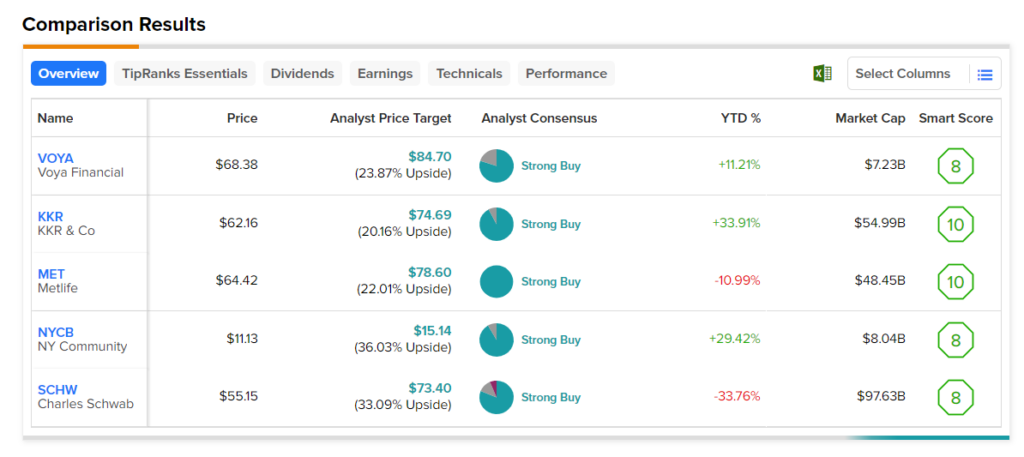

To support investors’ search for the best financial stock, we have leveraged the TipRanks Stock Screener tool. These stocks have received a Strong buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 20%.

Here are the five best financial stocks for investors to consider.

- Charles Schwab (NYSE:SCHW) – The company offers wealth management, securities brokerage, banking, asset management, custody, and financial advisory services. Its price forecast of $73.40 implies a 33.1% upside. Also, the stock has a Smart Score of eight.

- Metlife (NYSE:MET) – The global insurance company’s stock has an analyst consensus upside of 22%. Also, MET stock has a “Perfect 10” Smart Score.

- New York Community Bancorp (NYSE:NYCB) – The bank provides traditional and non-traditional products and services, and access to multiple service channels, including online banking and mobile banking. NYCB stock’s price forecast of $15.14 implies 36% upside and has a Smart Score of eight.

- KKR & Co. (NYSE:KKR) – The private equity giant’s average price target implies a consensus upside of 20.2% and carries a Smart Score of ten.

- Voya Financial (NYSE:VOYA) – The diversified financial services company offers retirement, investment, and insurance products. The stock’s average price target of $84.70 implies a 23.9% upside potential. Also, its Smart Score of eight is encouraging.