In volatile markets, dividend stocks make an appealing choice for long-term investors seeking reliable returns. By carefully selecting dividend stocks with strong fundamentals and a history of consistent payouts, investors can earn a stable income and potentially benefit from long-term capital appreciation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

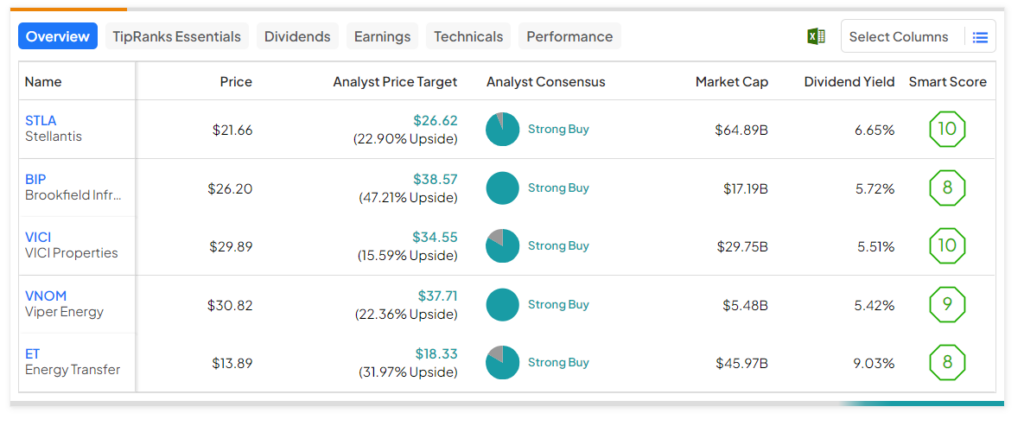

To help investors identify top dividend stocks, we’ve employed TipRanks’ Stock Screener tool. These stocks have garnered Strong Buy ratings from analysts and boast an Outperform Smart Score (8, 9, or 10) on TipRanks, indicating their potential to beat the broader market. Additionally, analysts’ price targets suggest an upside potential exceeding 15%. Finally, these stocks have a dividend yield of over 5%.

Here are the five best dividend stocks for investors to consider.

- Energy Transfer (NYSE:ET) – Energy Transfer is a provider of natural gas pipeline transportation and transmission services. Its price forecast of $18.33 implies a 32% upside. Also, the stock has a Smart Score of eight and boasts a dividend yield of 9.03%.

- Brookfield Infrastructure (NYSE:BIP) – The global infrastructure investment company’s stock has an analyst consensus upside of 47.2%. Also, BIP stock has a Smart Score of eight and offers a dividend yield of 5.72%.

- Stellantis (NYSE:STLA) – It is one of the leading automotive manufacturing companies in the world. STLA stock’s price forecast of $26.62 implies a 22.9% upside and has a “Perfect 10” Smart Score. The company offers a reliable dividend yield of 6.65%.

- Viper Energy (NASDAQ:VNOM) – This energy company’s core business is the acquisition and ownership of oil and natural gas properties in the U.S. VNOM’s average price target implies a consensus upside of 22.4% and carries a Smart Score of nine. Additionally, the stock has an impressive dividend yield of 5.42%.

- VICI Properties (NYSE:VICI) – VICI is a real estate investment trust specializing in casino properties. The stock’s average price target implies a 15.6% upside potential. Also, its Smart Score of ten and dividend yield of 5.51% are encouraging.