The cannabis sector looks promising heading into 2024 due to the rising expectations of marijuana being decriminalized in the U.S. This is expected to lower the tax burden on these companies and help boost their cash positions. In addition to this, more states are legalizing marijuana for recreational or medical use, thereby expanding the market size and potential customer base.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

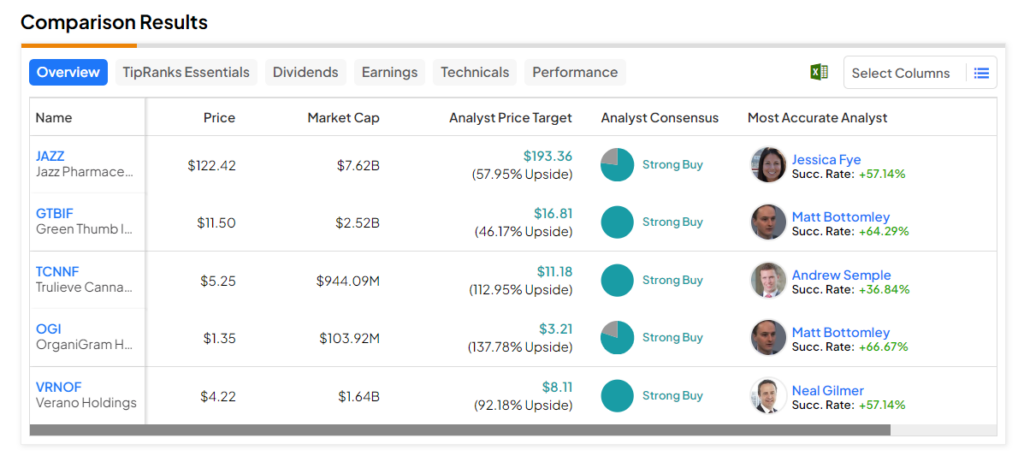

With this positive background, we have shortlisted the five best stocks using the TipRanks Stock Screener tool. These stocks have received a Strong buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 40%.

According to the screener, the following stocks have the potential to grow and are analysts’ favorites.

- Jazz Pharmaceuticals (NASDAQ:JAZZ) – The biopharmaceutical company’s price forecast of $193.36 implies a nearly 58% upside from the current levels.

- Verano Holdings (VRNOF) – Verano operates licensed cannabis cultivation, processing, and retail facilities. The stock has an analyst consensus upside of 92.2%.

- Green Thumb Industries (GTBIF) – GTBIF stock’s average price target implies a consensus upside of 46.2%. The company produces and sells medicinal and recreational cannabis through wholesale and retail channels in the United States.

- Trulieve Cannabis (TCNNF) – The company provides medical cannabis products. The stock has an average price target of $11.18, which implies an impressive 113% upside potential from current levels.

- OrganiGram (NASDAQ:OGI) – The company engages in the production and sale of medical marijuana. OGI stock’s price forecast of $3.21 implies a nearly 138% upside.