With everyone having gone doolally recently about AI stocks, Big Short luminary Steve Eisman has likened the latest craze to “Amazon (NASDAQ:AMZN) disease.” Explaining the term, following Amazon’s mega-success, research analysts became obsessed with finding the “next Amazon” and that is what is happening right now in the hunt for a new AI giant.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

One analyst, though, has a much simpler idea: instead of looking for the next Amazon, just buy shares of… Amazon.

Highlighting why he remains a big fan of the e-commerce giant, Tigress analyst Ivan Feinseth lays out the bull-case: “Strong retail results offset the near-term AWS pressure, and its powerful Prime Membership momentum, increasing traction with third-party sellers, new initiatives, and rapidly growing advertising revenue will continue to drive further growth and future share price gains. We continue to view the pullback in the stock as a major buying opportunity,” the 5-star analyst explained.

Yes, it’s true, like other Big tech luminaries, Amazon reported “difficult” Q4 results, but while it is still faced with multiple headwinds, Feinseth notes that advertising continues to grow and holiday retail sales were robust. In fact, with customers buying nearly half a billion items from small businesses in the U.S. between Thanksgiving and Cyber Monday (with U.S. small businesses raking in sales over $1 billion over the five-day period), the company reported a record-breaking holiday season.

Amazon has also improved its same-day delivery speed in major U.S. metropolitan hubs and having delivered the ten millionth package using electric delivery vehicles from Rivian, “continues to enhance its logistics and delivery capabilities.” The move over to an EV fleet should also result in a big reduction in operating costs.

Elsewhere, with the recent launch of Amazon Clinic, the company keeps on growing its healthcare services; the latest push into healthcare offers convenient and affordable care for more than 20 common conditions. Last month also saw the launch of Amazon Pharmacy’s RxPass, a new Prime membership benefit that provides unlimited eligible prescription medicines for just $5 a month with free shipping included.

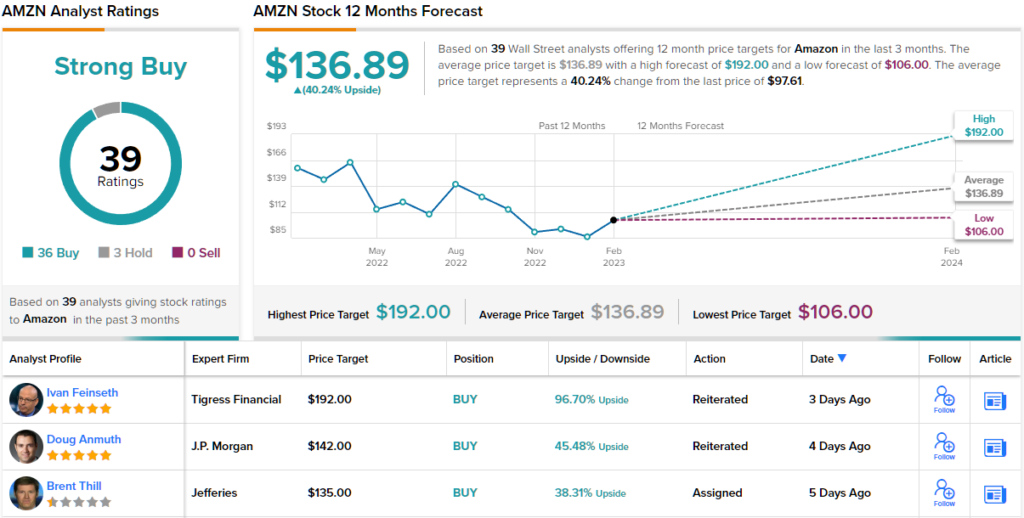

All of the above makes it clear why Feinseth is standing with the bulls. The 5-star analyst rates AMZN a Buy while his $192 price target implies an upside of ~97% for the year ahead. (To watch Feinseth’s track record, click here)

The Street’s average target is a more modest $136.89, yet that figure could still generate 12-month returns of 40%. All told, with the ratings skewing 36 to 3 in favor of Buys over Holds, the analyst consensus rates AMZN stock a Strong Buy. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.