It wasn’t long ago that dividend investors were content with getting a dividend payment from their stocks or ETFs once a quarter. Now, the landscape is changing with the proliferation of ETFs that pay dividends on a monthly basis. Here are five ETFs that are monthly dividend payers — all of which feature high dividend yields of 10% or more.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

1. JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI)

You can’t really start an article like this with any ETF besides JEPI. In a short time, JEPI has become the king of monthly-dividend ETFs, racking up $29 billion in assets under management, making it the market’s largest actively-managed ETF, despite the fact that it launched just three years ago. JEPI currently yields just above 10%.

According to fund sponsor JPMorgan (NYSE:JPM), JEPI “generates income through a combination of selling options and investing in large-cap U.S. stocks, seeking to deliver a monthly income stream from associated option premiums and stock dividends.” JEPI also seeks to “deliver a significant portion of the returns” of the S&P 500 (SPX) with less volatility.

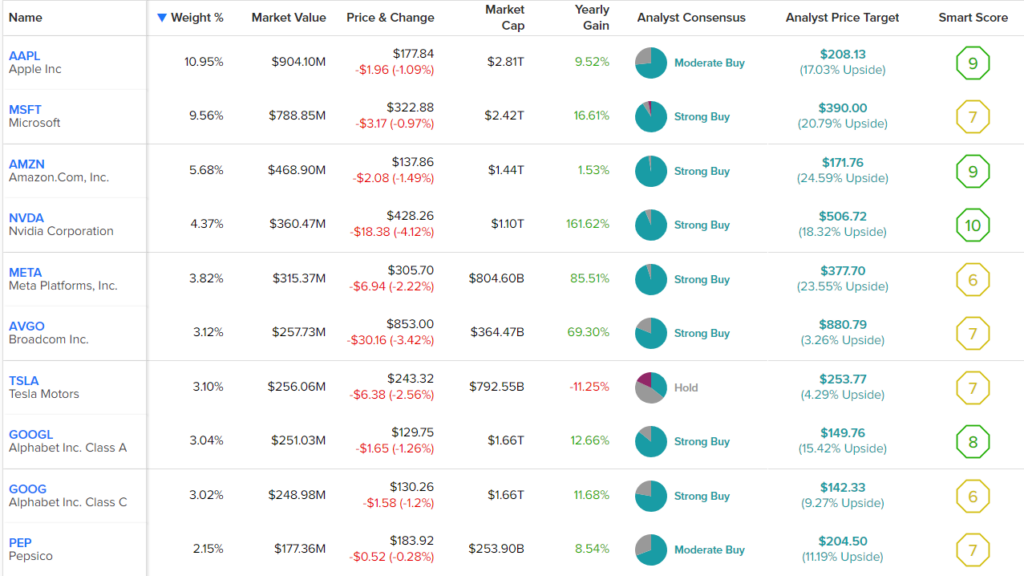

JEPI offers investors ample diversification. It holds 118 stocks, and its top 10 holdings make up just 17.5% of assets. Below, you can take a look at JEPI’s top 10 holdings using TipRanks’ holdings tool.

Note that, like many of the ETFs included here, which employ similar strategies to generate high yields, there is a tradeoff that investors should be aware of. By selling covered calls, JEPI runs the risk of leaving upside on the table as the market rises. Selling covered calls caps this upside at a certain point because if the price of the underlying stock rises beyond the strike price, JEPI investors forgo these additional gains.

To illustrate this point, we are back in a bull market this year, and while JEPI’s 7.3% total return (as of the end of July) is decent, it lags that of the broad market Vanguard S&P 500 ETF (NYSEARCA:VOO), which had a total return of 20.6% over the same time frame.

JEPI’s three-year annualized total return is more impressive at 11.5%, which is still less than VOO’s three-year total return of 13.7% but narrows the gap. For this reason, investors probably shouldn’t put their whole portfolios into JEPI (or any of the ETFs below). However, for dividend investors looking for steady, high-yield income, JEPI is a worthy option to consider as part of a balanced investment strategy.

Also, JEPI’s expense ratio of 0.35% is more expensive than some ETFs. However, it is actually more cost-effective than many of the other monthly dividend ETFs discussed below.

2. JPMorgan Nasdaq Equity Premium Income ETF (JEPQ)

JEPQ is another high-yield, monthly dividend fund from JPMorgan, and it packs even more of a dividend punch than its fund-mate, JEPI, as JEPQ’s dividend yield is 11.7%. JEPQ is very similar in approach to its JPMorgan counterpart, with one key difference — its underlying index is the Nasdaq 100 (NDX) rather than the S&P 500.

This results in a portfolio that skews more towards large-cap technology stocks, as you can see in the overview of JEPQ’s top 10 holdings below.

Like JEPI, JEPQ features an expense ratio of 0.35%.

The same caveat about JEPI’s returns applies to JEPQ as well. JEPQ’s year-to-date total return of 28.2% is excellent, but it slightly lags that of the Nasdaq, which is up 32.0% year-to-date. JEPQ launched in 2022, so it doesn’t have much of a long-term track record to evaluate yet. Still, these are good returns, and I’m intrigued by what JEPQ offers — exposure to the large-cap growth stocks that have powered the market’s rally over the past year plus a double-digit dividend yield.

3. NEOS S&P 500 High Income ETF (BATS:SPYI)

SPYI launched in August of 2022, and it is much smaller than JEPI and JEPQ, with just $220.5 million in AUM. SPYI uses a similar approach to JEPI and JEPQ, investing in the S&P 500 and using a data-driven call option strategy, so the same notes apply to this ETF. SPYI’s dividend yield is 10.7%, and its total return year-to-date is 17%. Therefore, it’s outperforming JEPI so far in 2023.

SPYI is incredibly diversified, with 505 holdings. SPYI’s top 10 holdings account for 30.7% of the fund. See below for SPYI’s top 10 holdings.

As you can see, SPYI shares quite a few of the same top holdings as JEPQ.

SPYI has a lot in common with both JEPI and JEPQ. Unfortunately, one thing that makes it different from these two is its expense ratio of 0.68%, which is nearly double what they charge. These expenses can add up. After three years, an investor putting $10,000 into JEPI or JEPQ would pay $113 in fees, while an SPYI investor would pay $218 in fees.

SPYI’s higher fees are a negative, but its high yield and its relative outperformance against JEPI so far this year make it an interesting option that is at least worthy of consideration for dividend investors.

4. Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD)

While JEPI, JEPQ, and SPYI are all fairly new ETFs, QYLD has been around for a long time, predating them all with a 2013 launch. QYLD’s dividend yield is 11.5%, similar to that of JEPQ and higher than that of JEPI and SPYI. As you can guess from the name, QYLD uses a similar strategy to its peers to achieve this double-digit yield.

QYLD has a longer track record as a consistent dividend payer than the aforementioned ETFs, as it has paid a dividend each month for nine years in a row.

One downside of QYLD is that while it has posted positive returns over time, they haven’t been great, and the fund has lagged the broader market over the years. For example, as of the end of July, QYLD has a three-year annualized return of 6.5%, and over the past five years, it has returned 5.7% on an annualized basis. This lags the Nasdaq, its underlying index, by a considerable margin.

Also, QYLD’s expense ratio of 0.60% is higher than those of JEPI or JEPQ but slightly better than SPYI’s.

As you can see below, QYLD’s top 10 holdings are fairly similar to those of JEPQ and SPYI. The fund offers decent diversification — it holds 102 stocks, and its top 10 holdings make up 48.8% of the fund.

QYLD isn’t a bad ETF per se, but due to its mediocre long-term performance and expense ratio, it looks like a pass.

5. Global X SuperDividend ETF (NYSEARCA:SDIV)

Lastly, we have another fund from Global X, the Global X SuperDividend ETF. SDIV’s dividend yield of 12.8% is the largest of these five ETFs.

Unlike the four other ETFs discussed here, SDIV doesn’t use a covered call strategy to boost its yield. Instead, SDIV invests in “100 of the highest dividend paying equities around the world,” according to Global X.

What are these equities? Below, you’ll find SDIV’s top 10 holdings. As you can see, there aren’t many well-known or blue-chip holdings here.

While the idea of investing in 100 of the highest-yielding equities in the world sounds good in practice, unfortunately, it hasn’t translated into good results over time. SDIV has lost money on a total-return basis over the past year, three years, five years, and 10 years.

Keep in mind that these annualized total returns take SDIV’s dividend into account, so SDIV investors are still down over the past decade despite its large dividend payouts. Sometimes, stocks have high yields for a reason — they are low-quality companies or in a long-term decline, which seems to be the case with some of these holdings. For this reason, I would consider SDIV a pass despite its high yield.

SDIV also charges a fairly high expense ratio of 0.58%.

The Takeaway

It’s a great time to be an investor interested in high-yielding ETFs and monthly payouts, with many options that fit these criteria now available.

For the first four ETFs listed here, investors should understand the tradeoffs discussed above. As long as they are comfortable with these, then these types of ETFs can be a useful part of a well-balanced portfolio.

Of these, I like JEPI and JEPQ the best given their returns thus far and their lower expense ratios. SPYI looks interesting based on its nascent performance, but its fees are quite a bit higher than those of JEPI and JEPQ. Meanwhile, QYLD is also more expensive than the two JPMorgan ETFs, and its long-term track record is underwhelming (although it remains to be seen if the returns of JEPI, JEPQ, and SPYI will eventually look more like those of QYLD after they have been around for longer).

SDIV is the least attractive option of these five despite having the highest yield based on the fact that it has lost money over the years.

In conclusion, JEPI and JEPQ look like the two strongest options for high-yield, monthly-dividend ETFs, SPYI is worth watching, and QYLD and SDIV look less compelling right now.