Mid-cap stocks are companies with a market capitalization in the range of $2 to $10 billion. Mid-cap companies fall between the purview of fast-growing small-cap businesses and well-established large-cap businesses. Mid-cap stocks are also usually profitable businesses and are considered relatively less risky than small-cap companies. At the same time, they have better growth opportunities than the larger cap companies.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

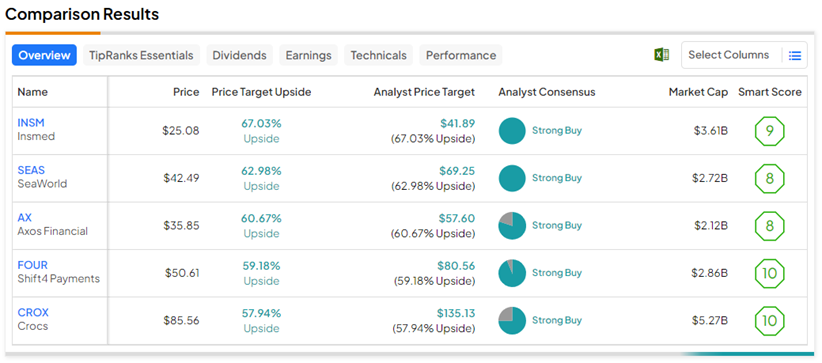

To help simplify your investment decision, we used the TipRanks Stock Screener tool to scan the mid-cap stocks with a Strong Buy consensus rating from analysts and an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 50%.

With this background in mind, let us look at the five best mid-cap stocks for investors, according to analysts.

- Insmed (NASDAQ:INSM) – Insmed is a biopharmaceutical company focused on transforming the lives of patients with serious and rare diseases. Its average price forecast of $41.89 implies a 67.03% upside. Also, the stock has a Smart Score of nine.

- SeaWorld Entertainment (NYSE:SEAS) – SeaWorld Parks & Entertainment is an American theme park and entertainment company headquartered in Orlando, Florida. The stock’s average price target of $69.25 implies an upside of nearly 63%. It carries a Smart Score of eight.

- Axos Financial (NYSE:AX) – Axos Financial is a holding company that provides banking and financing services. The stock has an analyst consensus upside of 60.7% based on the average price target of $57.60. On TipRanks, AX has a Smart Score of eight.

- Shift4 Payments (NYSE:FOUR) – Shift4 Payments is a provider of integrated payment processing and technology solutions. FOUR stock’s price forecast of $80.56 implies a 59.18% upside. Also, the stock boasts a “Perfect 10” Smart Score.

- Crocs Inc. (NASDAQ:CROX) – Crocs is an American designer footwear company. CROX stock has an analyst consensus upside of 57.9% based on the average price target of $135.13. On TipRanks, CROX earns a “Perfect 10” Smart Score.