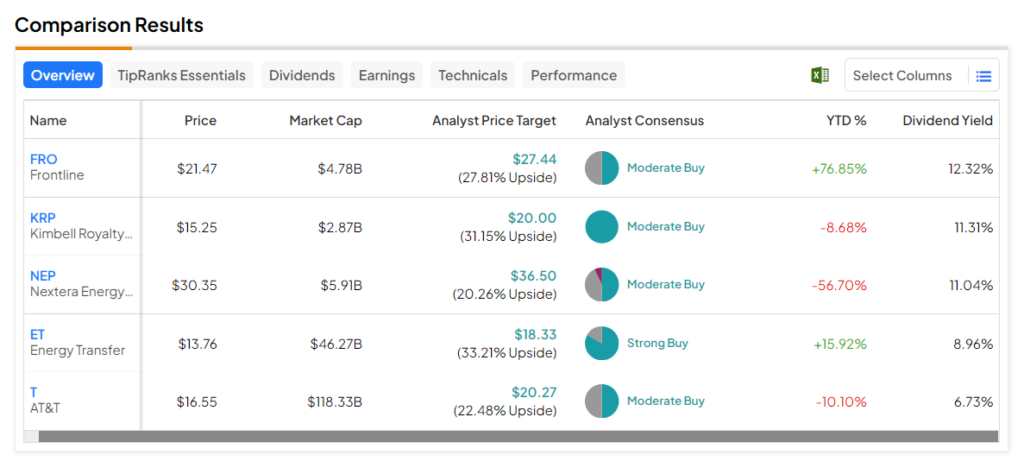

2023 witnessed U.S. stock market volatility due to geopolitical tensions, rising interest rates, and persistently high inflation. As we are about to enter 2024, the macroeconomic scenario seems to be improving, as reflected by easing inflation and rising consumer confidence levels. With this in mind, we have identified five stocks – AT&T (NYSE:T), Energy Transfer (NYSE:ET), NextEra Energy (NYSE:NEP), Kimbell Royalty Partners (NYSE:KRP), and Frontline (NYSE:FRO) – that boast a high dividend yield and upside potential of over 20%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Here are the top five picks for 2024.

Is AT&T Stock a Buy or a Hold?

AT&T is a multinational conglomerate known for telecommunications, media, and technology services. The company offers an impressive dividend yield of 6.7%, much above the sector’s average of 2.5%. The robust momentum in the company’s core segments, 5G and fiber, might keep supporting its strong cash position.

Overall, AT&T stock has a Moderate Buy consensus rating based on eight Buys and eight Holds. The average AT&T price target is $20.27, implying an upside potential of 22.5% from current levels. Year-to-date, shares of the company have declined about 4%.

Is ET Stock a Good Buy?

Energy Transfer is a midstream energy company with about 125,000 miles of pipeline and associated energy infrastructure. The company continues to attract investors with its lucrative dividend yield of 9%. ET’s acquisition of Crestwood Equity Partners LP, completed in November, strengthens the company’s position in the midstream sector. Also, its diversified fee-based earnings and strong asset base support long-term growth.

With five Buy and one Hold recommendations, Energy Transfer has a Strong Buy consensus rating. Further, analysts’ average ET stock price target of $18.33 implies a 33.2% upside potential from current levels. Energy Transfer stock is up about 28% year-to-date.

Is NEP a Good Stock to Buy?

NextEra Energy Partners purchases and owns wind, solar power, and natural gas pipeline projects in North America. Currently, NEP has a magnificent dividend yield of 11.1%, compared with the sector’s 3%. The company’s strong position in the renewable energy space, steady cash flows, and promising valuation keep NEE stock well poised for growth during an economic upturn.

Out of the 14 analysts covering NextEra stock, seven recommend a Buy, six recommend a Hold, and one recommends a Sell, giving it a Moderate Buy rating. The average NextEra stock price target is $36.50, implying 20.3% upside potential. NEP stock is down 53.4% year-to-date.

Is KRP a Good Stock to Buy?

This company owns lands, wells, and royalty rights – and allows third-party operators to conduct the extraction business. It has an impressive dividend yield of 11.3%, compared with 3.8% for the sector. KRP seems well poised to grow dividends in 2024, with support from its recently completed acquisition of mineral rights assets in the Permian.

Overall, Kimbell’s Moderate Buy consensus rating is backed up by two Buy ratings. The average price target of $20, points to a 31.2% potential upside in the next 12 months. KRP stock is up 2.1% in 2023 so far.

Is Frontline a Good Investment?

This international shipping company engages in the ownership and operation of oil and product tankers. The company has a stellar dividend yield of 12.3% above the 3.8% average for the Energy sector. FRO’s plans to acquire 24 Very Large Crude Carrier from Euronav (NYSE:EURN), announced in early October, keep it well poised to cater to growing demand in the crude oil industry.

Frontline stock has a Moderate Buy consensus rating based on three Buys and three Holds. The average FRO stock price target of $27.44 implies a 27.8% upside potential. Shares of the company have gained 110% so far in 2023.

Ending Note

All five above-mentioned stocks present an attractive opportunity for income-focused investors. Apart from impressive dividend yields, the recent strategic moves of these five companies keep them well poised for growth in the near term.