Value investing is one of the numerous methods employed in stock market investing. It involves considering a stock undervalued when it trades at a lower price relative to its fundamentals, including dividends, earnings, or sales. This makes it appealing to value investors seeking stocks with the potential for long-term gains. Moreover, value stocks are perceived as a prudent investment choice amid the current market uncertainty.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

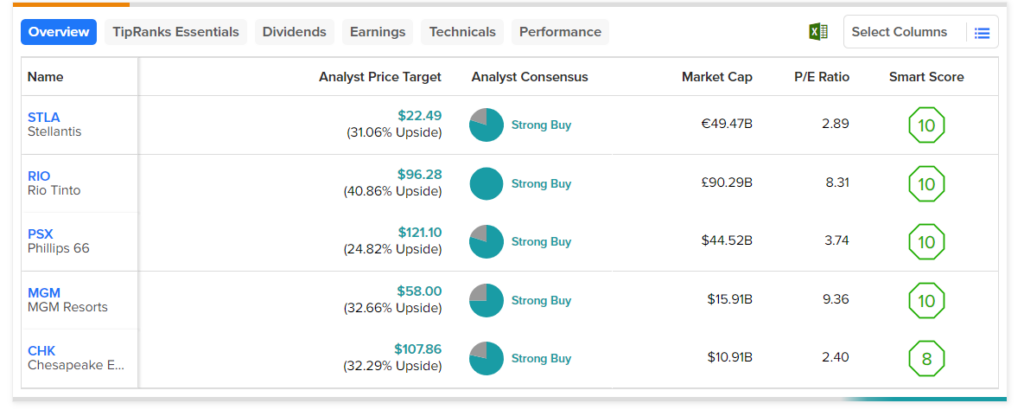

Using the TipRanks stock screener tool, we zeroed in on stocks with a Strong Buy rating from the top Wall Street analysts, and their price targets reflect an upside potential of more than 20%. Also, they carry an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks. Furthermore, these stocks seem to be undervalued, as they are currently trading at a considerable discount from their respective sector averages.

According to these screeners, the following stocks are reasonably valued and are analysts’ favorites.

- MGM Resorts (NYSE:MGM) – Top analysts currently see an upside potential of 37.5% in the global casino operator’s stock. Also, the stock is trading at 9.4 times earnings, which reflects a discount of about 47% from the sector’s average.

- Rio Tinto (NYSE:RIO) – Rio Tinto is a mining group that processes mineral resources like iron ore, copper, lithium, and diamonds. Based on the ratings of the three top analysts, the stock has an average price target of $96.28, which implies a 40.9% upside potential from current levels. RIO shares trade at 8.8x earnings, which is below its sector average of 13.67x.

- Phillips 66 (NYSE:PSX) – The downstream energy giant’s average price target, assigned by top analysts, implies a consensus upside of 24.8%. Its price-to-earnings (P/E) ratio is 3.7x, which is below the sector average of 7.16x.

- Stellantis (NYSE:STLA) – Stellantis is one of the largest automakers in the world. The stock has a top analyst consensus upside of 30.9%. The stock trades at 3 times trailing earnings, reflecting an 82.1% discount from the sector average.

- Chesapeake Energy (NASDAQ:CHK) – Chesapeake is an independent exploration and production company. The top analysts have set a 12-month price target of $111.89 for CHK stock, which implies a nearly 37% upside. It’s trading at 1.7 times earnings, 75.4% lower than its sector average of 7.16.