A slew of weak economic data raised concerns about the U.S. economy tipping into recession. The latest data from the Labor Department indicated that job openings fell to a 21-month low of 9.9 million this February. Thus, value stocks seem to be a wise investment option now. These stocks tend to be well-established and less volatile, and they generally trade at prices lower than the value suggested by their fundamentals.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

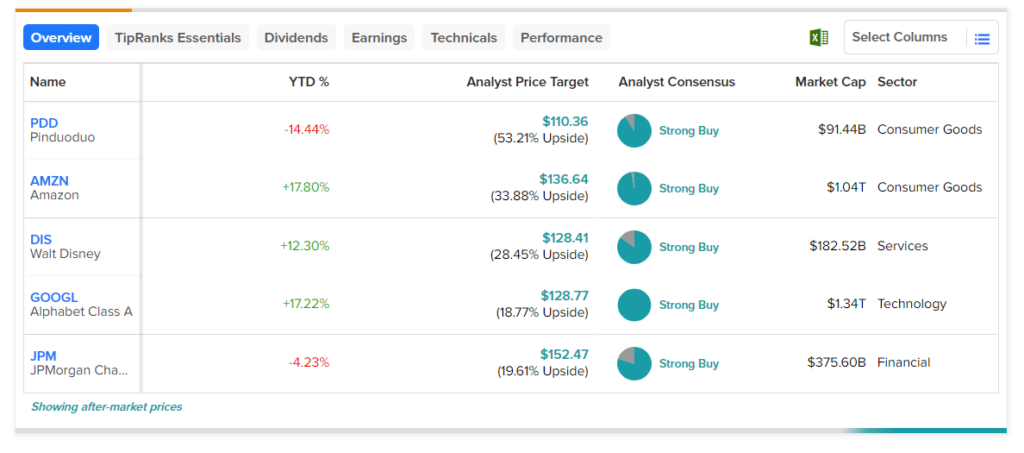

For value investing, TipRanks offers a perfect comparison tool: Value Stocks. Using the tool, value investors can also compare and contrast the different parameters. Further, we zeroed in on stocks with a Strong Buy rating from analysts, and their price targets reflect an upside potential of more than 15%.

According to these screeners, the following stocks are reasonably valued and are analysts’ favorites.

- Amazon (NASDAQ:AMZN) – Analysts currently see an upside potential of 33.9% in AMZN stock. Also, the stock is trading at 1.93 times sales, which reflects a discount of about 47% from the five-year average.

- Walt Disney (NYSE:DIS) – The stock has an average price target of $128.41, which implies a 28.5% upside potential from current levels. DIS shares trade at 2.05x sales, which is below its five-year average of 3.39x.

- JPMorgan Chase (NYSE:JPM) – JPM stock’s average price target implies a consensus upside of 19.6%. Its price-to-earnings (P/E) ratio is 10.6x, which is below the five-year average of 12.1x.

- Alphabet (NASDAQ:GOOGL) – GOOGL stock has an analyst consensus upside of 19.6%. The stock trades at 23.3 times trailing earnings, below the five-year average of 26.74 times.

- PDD Holdings (NASDAQ:PDD) – The stock’s price forecast of $110.36 implies a nearly 53.2% upside. It’s trading at 4.79 times sales, 58% lower than its five-year average of 11.44.