The utility sector, which provides needs like water and electricity, is highly controlled by the government, making it less volatile, especially during economic turbulence. Thus, the price appreciation of these stocks is generally not impressive due to their lower risk. Nevertheless, investors may want to hold these stocks for stable income in the form of dividends.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

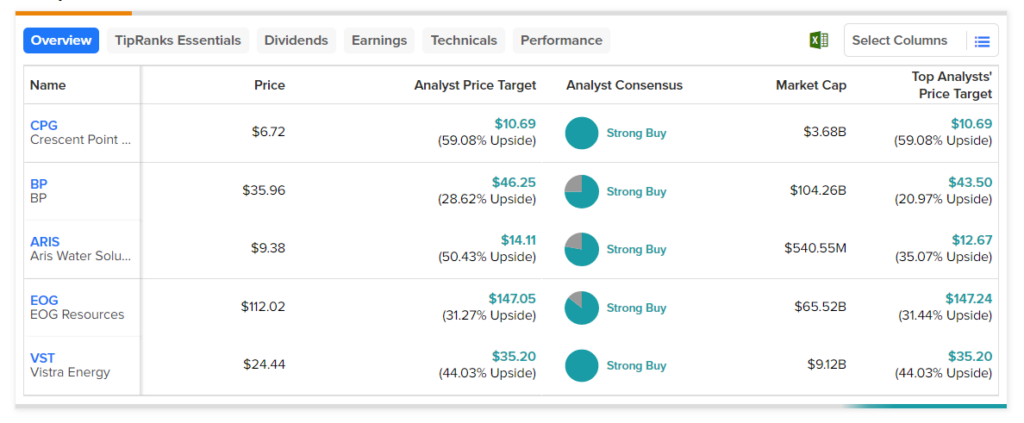

To help investors choose the best utility stocks, we have used the TipRanks Stock Screener tool. Using this tool, we shortlisted stocks that have a Strong Buy rating from analysts and a dividend yield of more than 2.5%. Also, analysts’ price targets reflect an upside potential of more than 20%.

Here are the five key stocks from the utility sector for investors to consider.

- Crescent Point Energy (NYSE:CPG) – Cresent is a North American light oil producer. Analysts currently see an upside potential of 58.9% in CPG stock. Also, it has a dividend yield of 3.61%.

- Aris Water Solutions (NYSE:ARIS) – The company provides full-cycle water handling and recycling solutions. ARIS stock has an analyst consensus upside of 53.9% and a dividend yield of 4.04%.

- EOG Resources (NYSE:EOG) – The stock has an average price target of $147.52, which implies a 31.7% upside potential from current levels. Also, its dividend yield of 8.1% is encouraging. EOG is an independent upstream oil and gas company.

- Vistra Energy (NASDAQ:VST)– The stock of an integrated retail electricity and power generation company, has an average price target of $35.20, which implies a 44% upside potential from current levels. Further, it has a dividend yield of 3.05%.

- BP Plc. (NYSE:BP) – Analysts currently see an upside potential of 28.6% in BP stock, which boasts a dividend yield of 3.96%. BP is a London-based integrated oil and gas company.