The Health Care Select Sector SPDR Fund ETF (XLV) has declined 4.6% so far in 2023 compared with the S&P 500 Index’s (SPX) gain of 10.4%. This decrease in share prices has made healthcare stocks more appealing in terms of valuation, presenting a favorable entry point for investors. It is noteworthy that healthcare is typically viewed as a defensive sector, as its spending patterns are largely independent of the broader economy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

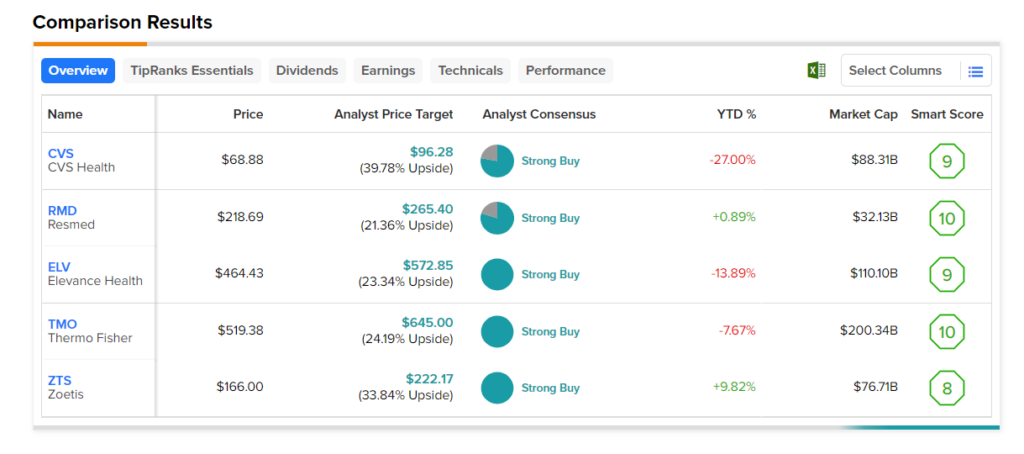

Using the TipRanks Stock Screener tool, we have shortlisted five stocks with the potential to beat the market averages. These stocks have received a Strong Buy rating from Wall Street analysts and have an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks. Moreover, the analysts’ price targets reflect an upside potential of over 20%.

Here are the five key healthcare stocks that investors can consider.

- CVS Health (NYSE:CVS) – The company’s price forecast of $96.28 implies a nearly 38% upside from the current levels. Moreover, it has an outperforming Smart Score of nine.

- Elevance Health (NYSE:ELV) – ELV stock has an analyst consensus upside of 23.3% and a Smart Score of nine.

- Thermo Fisher Scientific (NYSE:TMO) – The stock’s average price target implies a consensus upside of 24.2%. Also, it has a top-notch Smart Score of ten.

- Zoetis (NYSE:ZTS) – The stock has an average price target of $222.17, which implies a 33.8% upside potential from current levels. ZTS stock has a Smart Score of eight.

- Resmed (NYSE:RMD) – RMD stock’s price forecast of $265.40 implies a nearly 21% upside. Also, its Smart Score of eight is encouraging.