After a brutal 2022, investors had lost hope in growth stocks that generally thrive in a low-interest rate environment. To help investors choose the best growth stocks from the entire universe, TipRanks offers a Stock Screener tool. Using this tool, we have shortlisted five stocks that have received a Strong Buy rating from analysts, whose price targets reflect an upside potential of more than 20%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

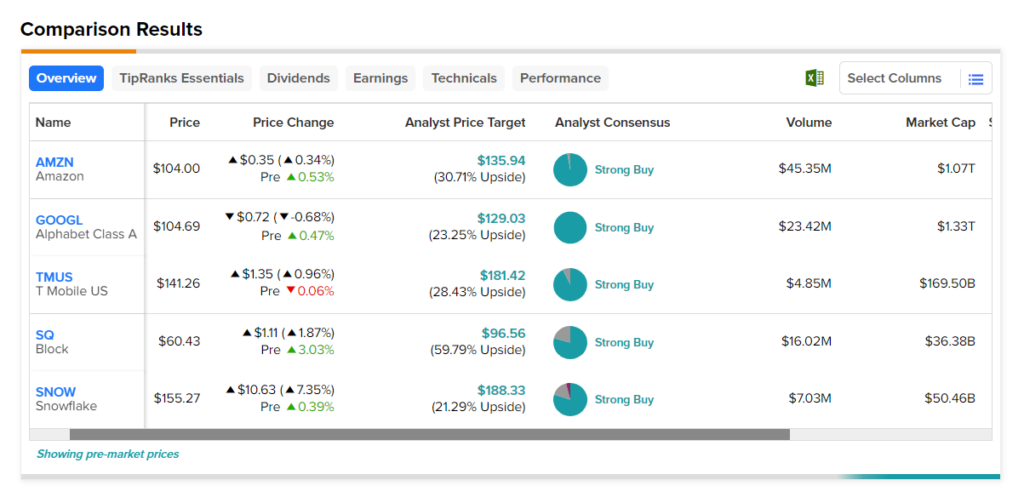

According to the screener, the following stocks have the potential to grow and are analysts’ favorites.

- Block (NYSE:SQ) – The company operates as a financial services and digital payments company. SQ stock has an analyst consensus upside of 58.8%. Following the better-than-expected Q1 results yesterday, SQ stock received Buy ratings from three analysts.

- Amazon (NASDAQ:AMZN) – The e-commerce giant’s price forecast of $135.94 implies a nearly 31% upside from the current levels. The company reported Q1 earnings on April 27, after which 28 analysts rated the stock a Buy.

- Alphabet (NASDAQ:GOOGL) – The multinational technology conglomerate is widely known for its search engine, Google. The stock has an average price target of $129.03, which implies a 23.3% upside potential. It reported strong Q1 results on April 25, following which the stock was assigned 23 Buy ratings.

- Snowflake (NYSE:SNOW) – SNOW stock’s average price target implies a consensus upside of 21.3%. The company’s platform enables customers to consolidate data into a single source to drive meaningful business insights.

- T-Mobile US (NASDAQ:TMUS) – T-Mobile provides wireless communications services for postpaid and prepaid customers as well as wholesale customers. TMUS stock’s price forecast of $181.42 implies a nearly 28% upside. Despite mixed Q1 results, which were released on April 27, the stock was assigned 11 Buy ratings.