Growth stocks are enjoying huge gains in 2023 so far due to the hype surrounding artificial intelligence and expectations of a slowdown in interest rate hikes. Further, recent economic data reflects slowing inflation and a decrease in the yield on long-term government bonds. Interestingly, this makes for a favorable scenario for growth stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

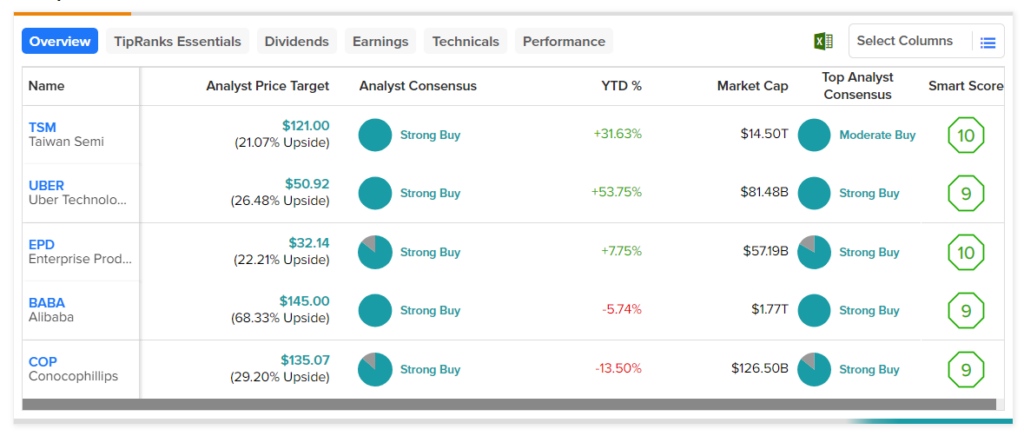

To help investors choose the best growth stocks from the entire universe, TipRanks offers a Stock Screener tool. Using this tool, we have shortlisted five stocks that have received a Strong Buy rating from analysts, and whose price targets reflect an upside potential of more than 20%. Also, they carry an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks. Lastly, these companies’ revenues have witnessed a strong compound annual growth rate over the past three years.

According to the screener, the following stocks have the potential to grow and are analysts’ favorites.

- Taiwan Semiconductor (NYSE:TSM) – The company engages in the manufacture and sale of integrated circuits and wafer semiconductor devices. TSM stock has an analyst consensus upside of 21.1%. The topline numbers have grown at a CAGR of 20.2%.

- Enterprise Products Partners (NYSE:EPD) – The midstream natural gas and crude oil pipeline company’s price forecast of $32.14 implies a nearly 22% upside from the current levels. The company’s revenue has grown at a CAGR of 28.9%.

- Alibaba (NYSE:BABA) – The Chinese multinational company offers e-commerce, retail, Internet, and technology services. The stock has an average price target of $145, which implies a 68.3% upside potential. BABA’s revenues have witnessed 18.8% CAGR.

- ConocoPhillips (NYSE:COP) – The stock’s average price target implies a consensus upside of 31.4%. ConocoPhillips is a global oil and gas company. Its revenues increased at a CAGR of 61%.

- Uber Technologies (NYSE:UBER) – Uber provides ride-hailing and food and package delivery services. UBER stock’s price forecast of $50.92 implies a nearly 26% upside. The company’s revenue has grown at a CAGR of 42%.