The entertainment industry has proven to be resilient despite economic uncertainty. Further, demand for entertainment is likely to persist and continue to push companies to expand offerings, thus driving the value of their stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

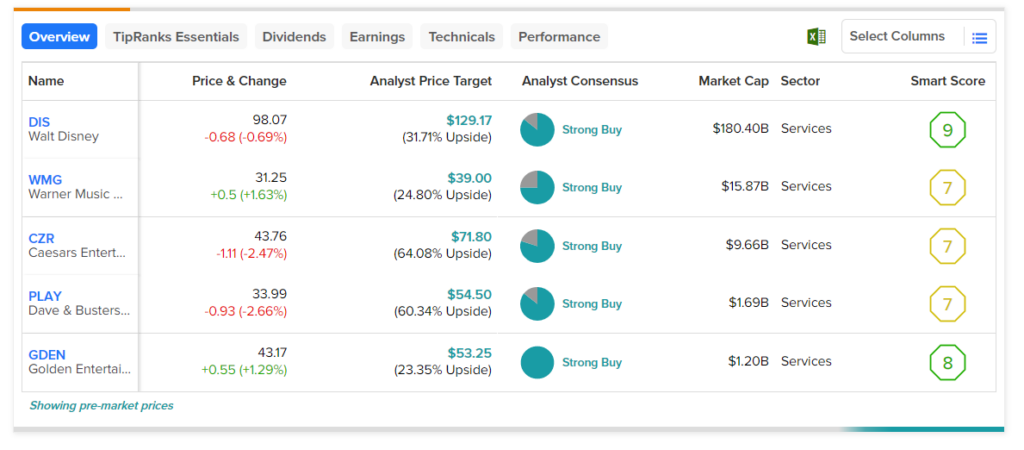

To help investors choose the best entertainment stocks from the entire universe, TipRanks offers a Stock Screener tool. Using this tool, we have shortlisted five stocks that have received a Strong Buy rating from analysts, and their price targets reflect an upside potential of more than 20%.

Here are the five key stocks in the entertainment sector that investors can consider.

- Walt Disney (NYSE:DIS) – The mass media and entertainment conglomerate’s price forecast of $129.17 implies a nearly 32% upside from the current levels.

- Caesars Entertainment (NASDAQ:CZR) – The American hotel and casino entertainment company’s stock has an analyst consensus upside of 64.1%.

- Warner Music Group (NASDAQ:WMG) – WMG stock’s average price target implies a consensus upside of 24.8%. Warner is a multinational entertainment and record label conglomerate.

- Dave & Busters (NASDAQ:PLAY) – The company has a full-service restaurant, a full bar, and a video arcade. The stock has an average price target of $54.50, which implies a 60.3% upside potential from current levels.

- Golden Entertainment (NASDAQ:GDEN) – The gaming company operates casinos, taverns, and slot machines. GDEN stock’s price forecast of $53.25 implies a nearly 23% upside.