2023 has challenged financial companies so far, with several banks experiencing bankruptcies and others grappling with significant unrealized losses, increased deposit costs, and sluggish loan growth. However, higher interest rates have provided some support by expanding net interest margins, which is a crucial measure of a bank’s profitability and growth. Thus, if the Federal Reserve opts to raise rates, it is anticipated that bank stocks will experience positive effects.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

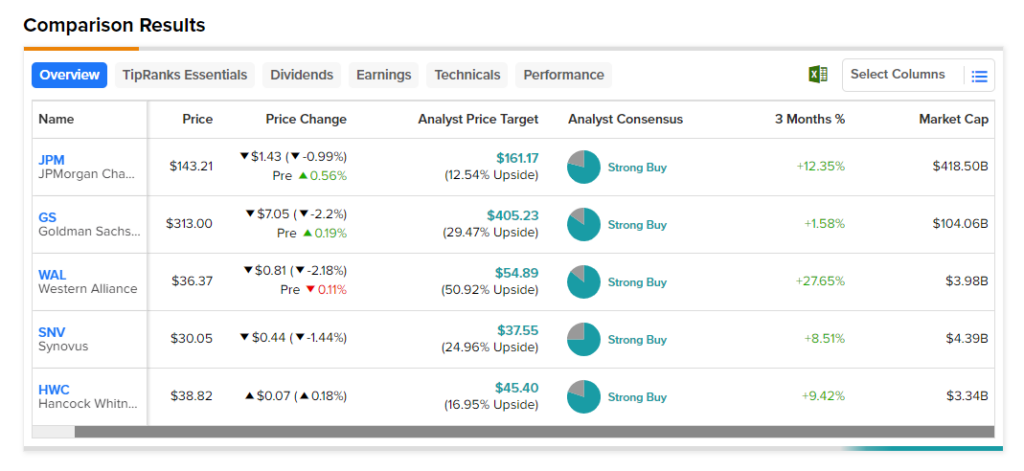

To help identify what could be the best bank stocks for your portfolio, we have leveraged the TipRanks Stock Screener tool. These stocks have received a Strong Buy consensus rating from analysts. Further, analysts’ price targets reflect upside potential of more than 10%.

According to the screener, the following stocks have the potential to grow and are analysts’ favorites.

- JPMorgan Chase (NYSE:JPM) – Analysts currently see upside potential of 12.5% in the stock. It is noteworthy that following the bank’s successful clearance of the Fed’s stress test on June 29, two analysts rated JPM a Buy.

- Hancock Whitney (NASDAQ:HWC) – The stock’s price forecast of $45.40 implies nearly 17% upside potential.

- Goldman Sachs (NYSE:GS) – GS stock has an impressive consensus upside potential of 29.5%. Following the release of annual stress-test results, one analyst has given a Buy rating while another gave a Hold rating.

- Western Alliance (NYSE:WAL) – WAL stock’s average price target implies upside potential of 50.9%. The stock has received two Buy ratings in the past eight days.

- Synovus (NYSE:SNV) – The stock has an average price target of $37.55, which implies 25% upside potential from current levels. In the past eight days, two analysts have reaffirmed their Buy rating on SNV stock.