The travel industry is witnessing the busiest period of the year, the holiday season. Prior to the Thanksgiving holiday travel kicking off on November 17, the Transportation Security Administration (TSA) forecasted an all-time record 30 million passengers during the November 17 to November 28 period. An improving U.S. economy, marked by low unemployment rates and resilient consumer spending, is expected to have supported increased travel budgets. After witnessing volatility in recent years, Airline stocks are well-positioned to capitalize on this surge in travel demand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

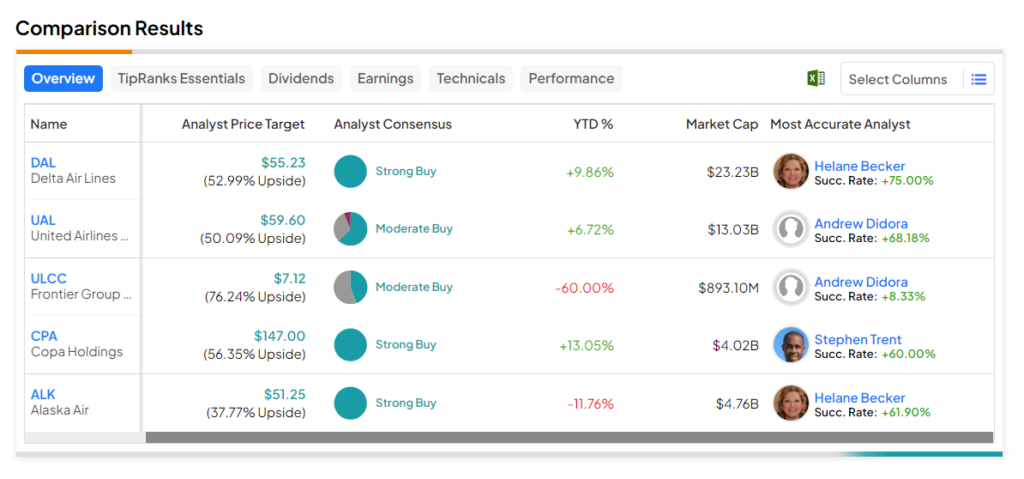

We have shortlisted the best airline stocks with the help of TipRanks’ Stock Screener tool. Analysts are optimistic about these stocks and their price targets reflect an upside potential of more than 35%. Now, let’s take a look at five airline stocks that match these criteria.

- Delta Air Lines (NYSE:DAL) – Analysts currently see an upside potential of 53% in the stock to $55.23 over the next 12 months.

- Alaska Air (NYSE:ALK) – ALK stock’s price forecast of $51.25 implies nearly 38% upside potential.

- Copa Holdings (NYSE:CPA) – CPA stock has an impressive consensus upside potential of 56.4%. Importantly, four Buy ratings have been assigned to the stock following the release of promising October traffic data on November 14.

- United Airlines Holdings (NASDAQ:UAL) – UAL stock’s average price target implies an upside potential of 50.1%.

- Frontier Group Holdings (NASDAQ:ULCC) – The stock has an average price target of $7.12, which implies 76.2% upside potential from current levels.