In recent months, China has come under greater scrutiny from investors. Besides the Evergrande (EGRNF) crisis that has shaken markets around the world, many Chinese companies have also come under rising regulatory scrutiny as the Chinese government is bringing in new regulations for different sectors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To add to this, the relationship between the U.S. and China is quite strained. Recently, U.S. President Joe Biden addressed this issue while speaking at the United Nations General Assembly (UNGA). The President clarified that the U.S. is “not seeking a new Cold War.”

Last week, Cowen & Co. published a research report focused on U.S.-China relations, and their impact across different industries. According to the financial services company, it expects some “major policy decisions over the next three months,” and for Congress to pass legislation this year that would be tough on China.

Here are at some U.S. stocks across different sectors that are likely to feel the heat from strained U.S.-China relations.

FedEx (FDX)

FedEx provides a broad portfolio of transportation, e-commerce, and business services.

The company has established an Asia-Pacific hub at the Guangzhou Baiyun International Airport in southern China, and an International Express and Cargo Hub in Shanghai. (See FedEx stock charts on TipRanks)

The company’s management commented on its business in China, “Our growth in market is very strong and our operations in our hub in Guangzhou is going smoothly and we also just opened up new air operations from Beijing.

“So China remains a very important market for us and we are very committed to it.”

According to Cowen & Co. analyst Helane Becker, there are “no Chinese-based integrated carriers that offer main deck cargo capacity out of China. As a result, Chinese shippers rely on Atlas Air (AAWW), FedEx, UPS (UPS) and DHL (DPSGY) to move high value goods out of China.”

The analyst is also of the view that FedEx’s intercontinental business is growing at a faster clip than its business within China. Moreover, Becker cited industry sources saying that “operating to China continues to be challenging as quarantine measures imposed by the government make it difficult to rest crews in Guangzhou, Hong Kong or Shanghai.”

The analyst reiterated a Buy rating, and a price target of $297 (29.7% upside) on the stock following its fiscal Q1 results.

Turning to the rest of the Street, analysts are cautiously optimistic about FedEx, with a Moderate Buy consensus rating, based on 18 Buys, five Holds, and one Sell.

I am neutral about FedEx stock.

The average FedEx price target of $311.62 implies 36.1% upside potential from current levels.

Lululemon Athletica (LULU)

Lululemon is a designer, distributor, and retailer of athletic apparel and accessories. The company primarily conducts business through two channels: its company-operated stores, and its website.

By the end of Q2, the company operated 63 stores in China, including stores in Hong Kong, Macau, and Taiwan.

Cowen & Co. analyst John Kernan believes that LULU generates sales between $100 million to $150 million in China. The analyst also believes that Western brands like LULU are highly desired by people in China “though the trend has become much more volatile due to COVID and geopolitical tensions.”

The analyst has a Buy rating on the stock, and a price target of $520 (20.4% upside). (See Lululemon stock charts on TipRanks)

Interestingly, in 2020, LULU sourced 45% and 18% of its fabrics from Taiwan and Mainland China, respectively. The company has said in its filing that the company’s production could run into problems if it experiences a disruption in its supply chain.

According to the TipRanks Risk Factors tool, LULU is at a higher proportional production risk (23%) than its sector average (17.3%).

Moreover, Lululemon has also entered into an uncommitted and unsecured 130 million Yuan revolving credit facility that was later increased to 230 million Yuan last year. The company has to comply with certain covenants regarding this facility.

Wall Street analysts are bullish about Lululemon, with a Strong Buy consensus rating, based on 14 Buys and three Holds.

I am bullish about LULU as demand for the company’s products remains strong, though it remains to be seen how LULU will address supply chain disruptions, if any.

The average Lululemon price target of $469 implies 8.6% upside potential from current levels.

Vertiv Holdings Co. (VRT)

Vertiv Holdings is in the process of designing, manufacturing, and servicing of critical digital infrastructure technology that cools, powers, deploys, secures, and maintains electronics that process, store and transmit data.

The company sources raw material and other components from countries like China, and posted adjusted diluted earnings of $0.31 per share in its recent Q2 filings, an increase of $0.15 per share from the same quarter last year. (See Vertiv Holdings stock charts on TipRanks)

Rob Johnson, Vertiv CEO, commented, “We decided in the second quarter to increase spot buys of key electronic components and use expedited freight to best meet the customer requirements of an incredibly strong demand environment.”

However, following the Q2 results, J.P. Morgan analyst Stephen Tusa downgraded the stock from a Buy to a Hold, and has a price target of $25 (3.7% upside) on the stock.

The analyst pointed out that Vertiv has strong demand for its products, but “lower near-term sales” point to “supply chain issues, unmasking the negative price/cost situation.”

Even Cowen & Co. analyst Lance Vitanza expects “negative long-term supply chain challenges” for VRT due to strained U.S.- China relations.

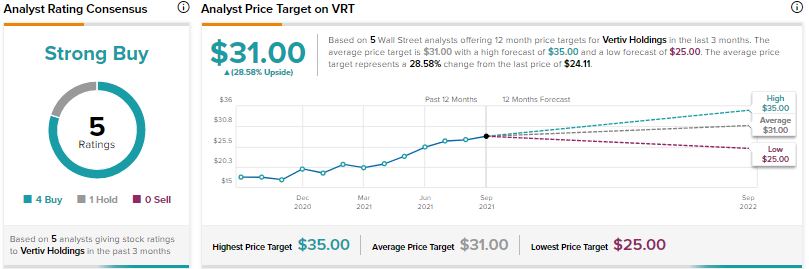

However, Wall Street analysts are bullish about Vertiv, with a Strong Buy consensus rating, based on four Buys and one Hold.

I am neutral about Vertiv.

The average Vertiv Holdings price target of $31 implies 28.6% upside potential from current levels.

Boeing (BA)

China has been a key market for aerospace company Boeing, but BA’s 737 Max is still banned in China.

The company’s 737 Max aircraft had run into regulatory trouble in different countries after a string of accidents. Seventeen regulators in various countries have lifted the ban, with China still yet to budge.

According to Cowen & Co. analyst Cai Rumohr, while Boeing expects that China will approve the 737 Max aircraft by end of the year, the analyst feels that the “question is whether near term deterioration in the U.S.-China relationship will encourage Chinese regulators to withhold approval of MAX for fear of crossing President Xi.”

Rumohr expects that Chinese regulators may withhold their approval, and that this may result in a “ripple effect” on Boeing’s suppliers. Moreover, according to the analyst, China comprises around 17% of Boeing’s narrowbody fleet on a global basis, and has been a key customer for the 737 and 787 airplane fleets.

The analyst has a Buy rating, and a price target of $290 (32.6% upside) on the stock.

Indeed, Boeing has stated in its company filing that failure to resume deliveries in China and a deterioration in U.S-China trade relations could result in unanticipated delays in airplane deliveries, and adversely impact its operating results. (See Boeing stock charts on TipRanks)

The company’s management stated on its Q2 earnings call that Boeing continues to monitor “U.S.-China trade relations given the importance of the China market to our economy and our industry’s recovery” and remains in “in active discussions with our Chinese customers on their fleet planning needs.”

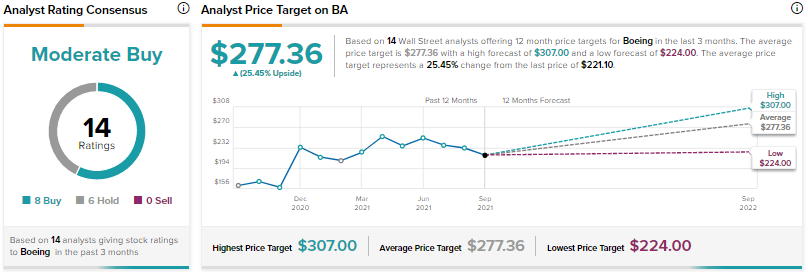

Wall Street analysts are cautiously optimistic about Boeing, with a Moderate Buy consensus rating, based on eight Buys and six Holds.

I am bearish on Boeing as the company is still facing uncertainties regarding its airplanes, and travel is still not back to pre-pandemic levels.

The average Boeing price target of $277.36 implies 25.5% upside potential from current levels.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.